This week isn’t starting slow, it’s loaded. We’ve got inflation numbers from Canada, wage data from Australia, UK CPI mid-week, and a big U.S. lineup that includes FOMC minutes, jobs data, and PMI prints.

If last week was filled with uncertainty, this week is all about clarity. The market finally gets the data it’s been waiting for, and that means price action should start making more sense.

Here’s What You Need to Know:

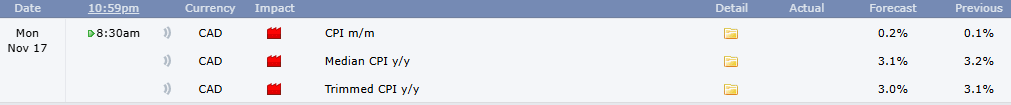

1. Canada Kicks Things Off With CPI (Monday)

CAD is in the spotlight early with three inflation prints, headline, median, and trimmed CPI. Forecasts point to steady or slightly stronger inflation. If CPI holds firm, it supports the idea that the Bank of Canada won’t rush into cuts. We can expect volatility on CAD pairs around the release.

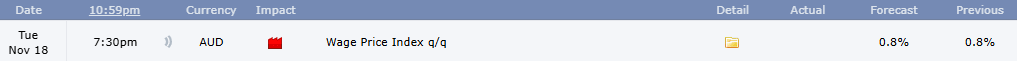

2. Australia Brings Wage Data (Tuesday)

AUD gets tested with the Wage Price Index. Strong wages = sticky inflation = RBA staying tight. A weak number, though, opens the door for rate-cut talk. AUD has been fragile lately, so this print matters.

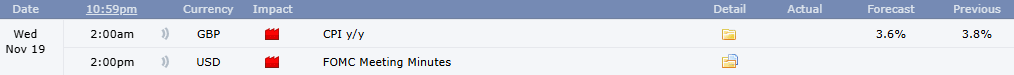

3. UK CPI Takes Center Stage (Wednesday)

GBP reacts strongly to inflation data, and this week will be no different. CPI is expected to cool a bit from 3.8% to 3.6%. If the drop is bigger, rate-cut expectations for the Bank of England will jump and GBP could slip quickly.

4. The U.S. Brings the Heat (Thursday–Friday)

This is where the real momentum comes in.

– Thursday: Average hourly earnings, Non-Farm Employment Change, and the unemployment rate.

– Friday: Flash Manufacturing and Services PMIs.

After weeks of delayed data, markets finally get a clearer look at the U.S. economy. If jobs stay soft and PMIs weaken, rate-cut bets for early 2026 grow.

My Takeaway

This week will reveal what the market really thinks.

Last week was about waiting, this one is about reacting, at least for me.

If you’re trading today, keep your expectations grounded. Monday sets the mood, but the real moves come mid-week once the big data drops.

You guys already know it, the best setups arrive when the numbers start talking.