All eyes will be on the Bank of England at 12pm GMT today.

The likelihood is that the central bank will hold rates at 4%, but it;s the forward guidance we will need to look out for.

Recent BoE Communications

In its latest communications, the BoE has adopted a neutral tone, emphasizing that inflation “remains not out of the woods” while growth concerns are mounting.

Inflation in the UK remained at 3.8% in September, well above the 2% target.

The Autumn Budget (scheduled 26 November) will play a role: reports suggest fiscal tightening (tax increases) could reduce demand, which eases rate-cut pressure.

Future Guidance

If the BoE emphasises “more slack required”, “weak growth” or “ready to ease” that would be a dovish signal.

If the BoE emphasises “inflation risk”, “real-term rates still restrictive”, or “waiting for data” that could be a hawkish/neutral signal.

It is also important to keep an eye on the MPC vote. If more members lean towards cuts it could highlight what is to come.

Trading Takeaway for Retail Traders

If you’re trading this meeting I would be very cautious.

In my opinion I will be looking to sell GBP on any significant rallies, as I believe the BoE will have to cut soon.

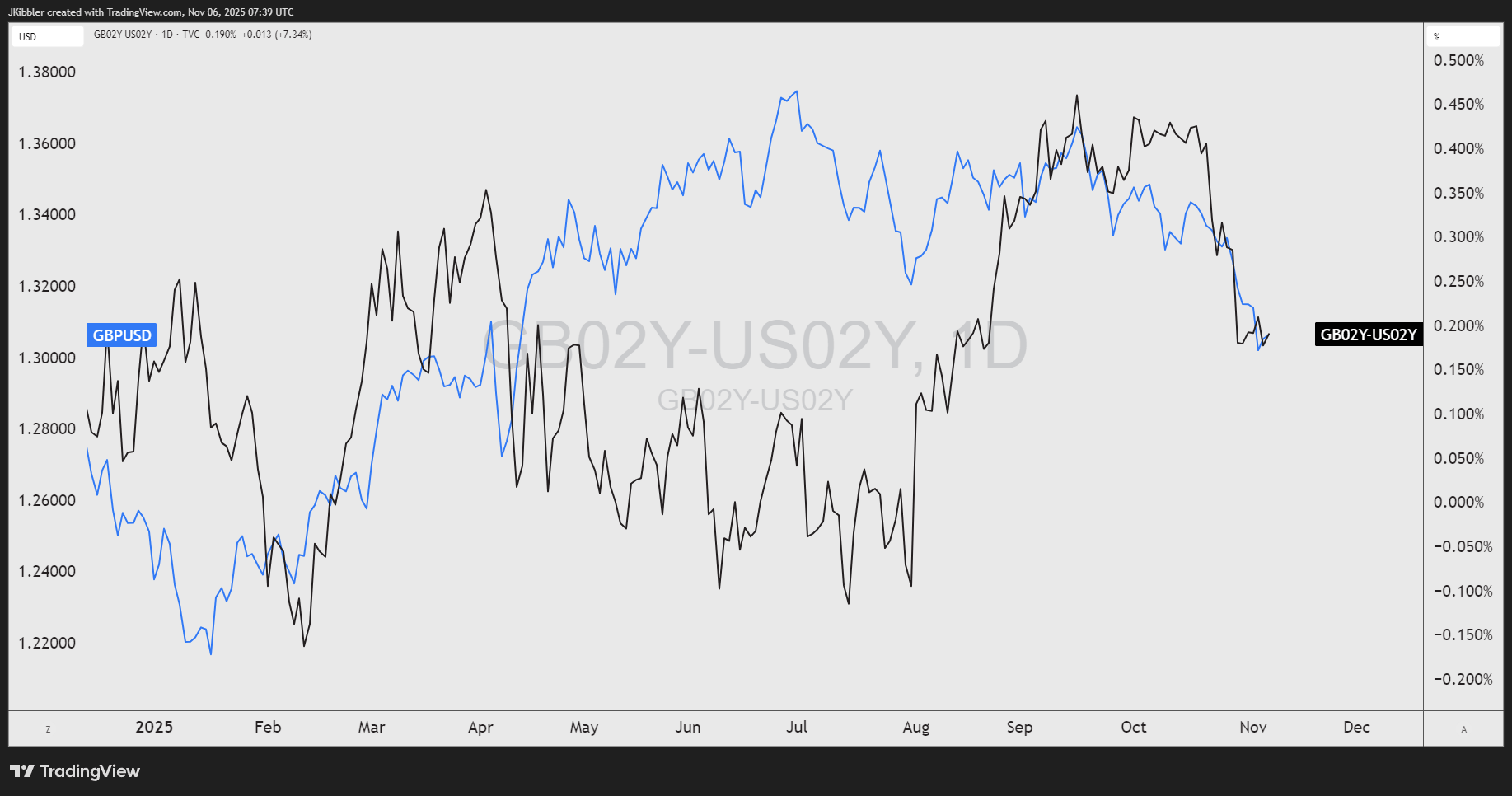

Looking into the interest rate differentials between the 2yr Gilts and US bond yields we can see it has a strong correlation with price at the moment. This will be something to watch out for.

There will be some unknown this meeting and it will be likely that the central bank looks at the risks of the upcoming budget as an excuse to hold and wait.