As the world sits and watches the two heavyweight economies go toe to toe, traders are asking themselves, where is the trade? Is it direct USD/CHN or USD/CNY or is it another currency or asset that will be directly impacted by this trade war.

The U.S. is the world’s largest economy with a GDP (Gross Domestic Product) of $30.34 trillion, GDP Per Capita is $89.68 thousand. China comes in second with a GDP of $19.53 trillion, and a GDP per capita of $13.87 thousand. So when it comes to the two going twelve rounds in the metaphorical tariff boxing ring, the U.S. is the clear favourite, but you can never count out your opponent, especially in the heavyweight division.

It is clear from the language both sides are using right now, that a resolution is not on the horizon. This tit for tat approach is going to hurt some markets more than others, one market I am looking at in particular is the Australian dollar.

On the Truth Social platform the President Donald Trump stated the following:

“Yesterday, China issued Retaliatory Tariffs of 34%, on top of their already record setting Tariffs, Non-Monetary Tariffs, Illegal Subsidization of companies, and massive long term Currency Manipulation, despite my warning that any country that Retaliates against the U.S. by issuing additional Tariffs, above and beyond their already existing long term Tariff abuse of our Nation, will be immediately met with new and substantially higher Tariffs, over and above those initially set. Therefore, if China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th. Additionally, all talks with China concerning their requested meetings with us will be terminated! Negotiations with other countries, which have also requested meetings, will begin taking place immediately. Thank you for your attention to this matter!”

Following this China responded by saying it will “fight to the end” if the United States continues to escalate the trade war. Comments out of Beijing didn’t end there, China’s commerce ministry accused the United States of “blackmail”, adding to the already strong use of very strong language.

What it tells us is that the bell has just rung for the first round in the trade war, and that many implications are still to come from this. Can the market survive 12 rounds of this? That is something we really have to try and grasp.

Tariffs aren't a new tool to get countries to the negotiating table and Trump claims that this has been successful on Liberation Day, as he says they are backlogged with countries waiting to open negotiations. That’s great and all, but my problem is the fact that the top 5 economies might not want a seat at the table. They include China, Germany, Japan, Canada and the United Kingdom. Trump’s use of aggressive tariffs may force other nations to work closely together and abandon America all together. That will ensure that the American market is competitive within itself, but do Americans even want that? Maybe not. BUT how does this impact wider markets?

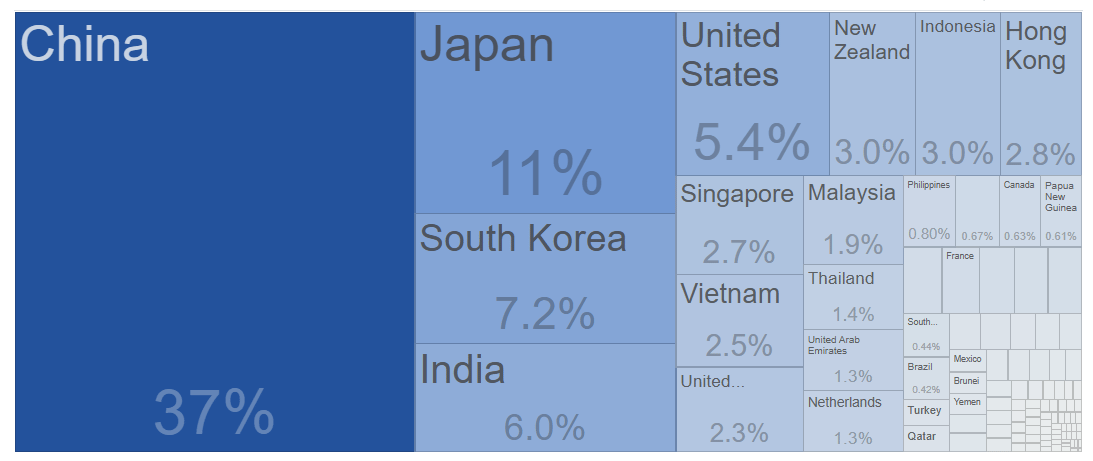

Like I said earlier, some markets may be impacted heavily by being associated with both parties. ONE of those economies is Australia. Due to its position on the map, Australia naturally has a strong trading relationship with China. As of 2024, Australia exports $102.63 billion and imports $75.70 billion to China, creating a trading surplus. So it’s safe to say that Australia relies heavily on trade with China.

Australia Exports by Country

If China continues to fight back in the trade war with Donald Trump, this will have an impact on global trade, and Australia may be hit hard. We have already seen this happening, AUD/USD on the announcement of trade tariffs on China fell 450 pips.

And how likely is it for China to not respond? Not likely considering they export $501.22 billion and import just $165.16 billion. Why would they want to decrease their trade surplus? They wouldn’t.

A similar situation happened in 2018, in June, Trump announced his intention to impose tariffs on China, in which they retaliated, leading to Trump's first trade war with China. Over a two year period the AUD/USD price fell from 0.8050 down to 0.6700.

AUD/USD 2018 performance

Could the same happen again?

It is now being reported by forexlive that the White House is saying that Trump would be ‘gracious’ if China makes a deal.

That seems to be the way out of this for Trump, he wants to make a deal with China, but will China want to make a deal with him? This chess battle will continue I feel.

The Australian dollar also seems to suffer in times of risk, a weaker CNH can signal economic weakness of outflows in China, which in turn is bearish for AUD. In times of uncertainty AUD can highlight risk appetite, if it sells off it’s a sign of fear.

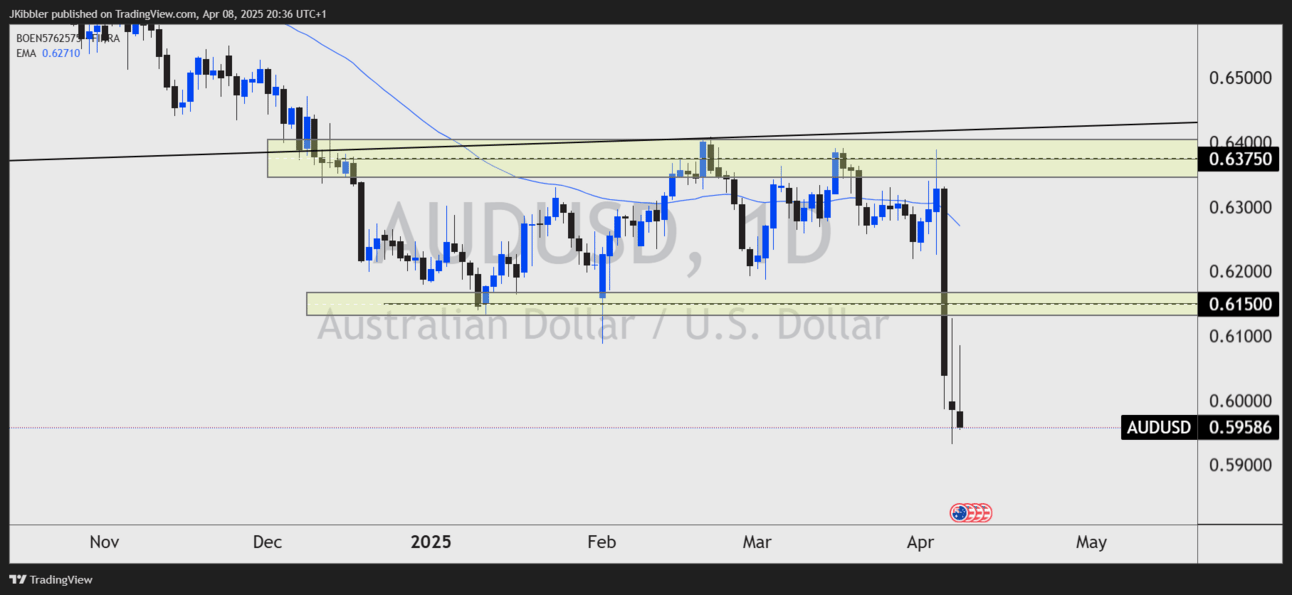

Let’s Look at AUD/USD Key Levels

The price of AUD/USD shows the sentiment of the market currently, breaking through the supporting lows of 0.6150. If the sentiment in the market doesn’t change and we see the trade war between China and the United States escalate further, then the upside for this forex pair looks limited.

AUD/USD Daily Chart

If the price trades back to the resistance of 0.6150, I will be looking for the downward trend to continue. If I get some price action that aligns with my trading strategy then I think adding risk here makes sense for me personally.

That could obviously change, if we see a huge shift in sentiment, but until then, we have to trade what we see and keep an eye open to the current market narrative.