Currency strength and weakness is a major part of my trading process. Let’s be real here, a trend forms one when currency is stronger than another. So my job is to find this out.

There are multiple ways to do this, we can analyse the fundamentals, which is something I do to find earlier opportunities, or we can use a currency strength meter.

To confirm:

Fundamentals: Identify global economies macroeconomic data points to see how a central bank may react. This is usually an early indicator of what may happen in the forex market.

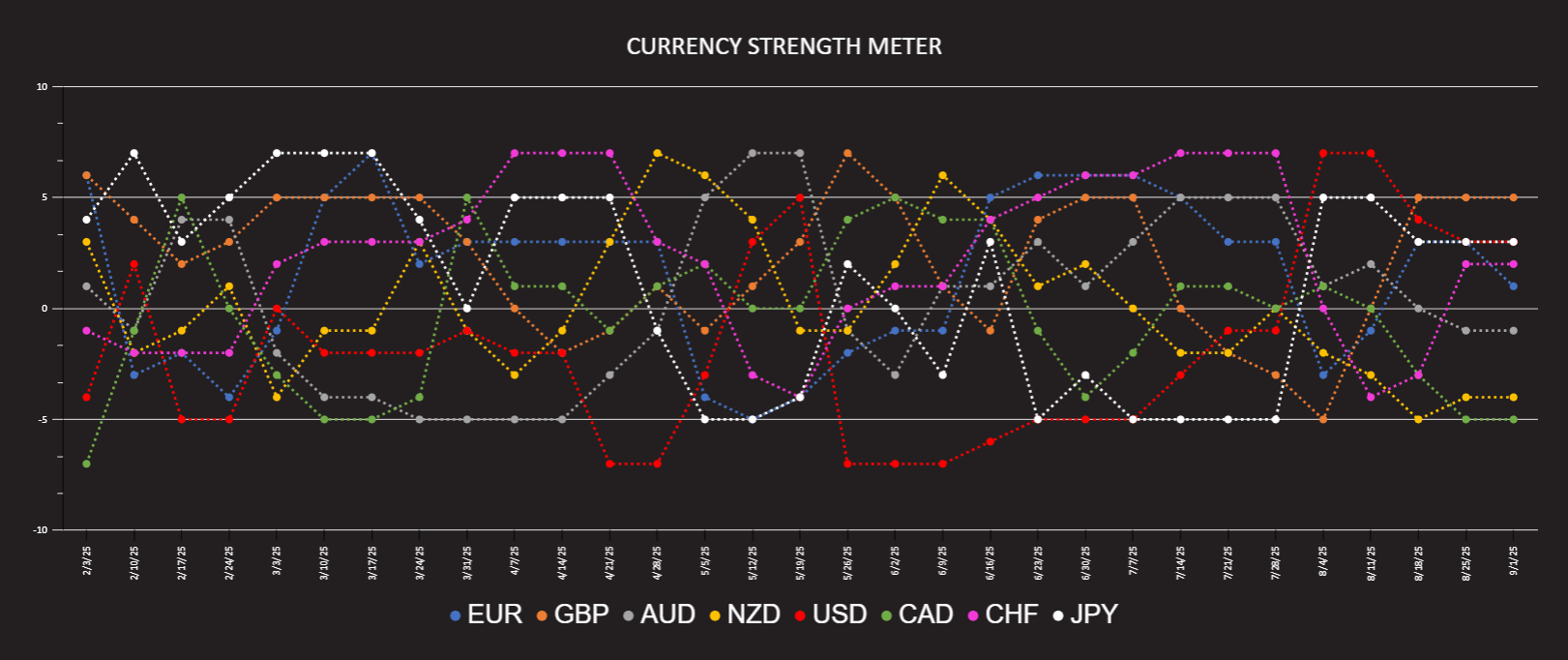

Currency Strength Meter: Analyses the trends of the market to highlight which currency is strong and which is weak. This often requires the trend to form first and is considered a lagging indicator. But when a trend goes, it can go for weeks.

Let’s take a look at what to watch this week.

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

GBP: The British pound is the strongest currency at the moment at +5 and has been for the past three weeks. The Bank of England's chances of cutting rates have fallen sharply due to inflation pressures, and this is causing the GBP to remain strong for now.

CHF: The Swiss Franc has been gaining strength consistently for the past four weeks and is a market on my radar at +2. This is being driven by shaky fundamentals across the US giving a slight safe haven advantage to the CHF.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

CAD: The Canadian dollar is a weak currency at -5 and is where I would like to target for opportunities. Fundamentals aren’t great, the Canadian stock market is struggling and oil prices remain low.

NZD: One to watch for sure is the New Zealand dollar, this currency is very weak right now as the RBNZ is forecast to cut rates another two times.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

GBPCAD | CADCHF |

GBPNZD | NZDCHF |

As always this doesn’t mean we just go to these markets and start pressing buttons. We need to add in other factors of confluence. But it’s a start for deeper analysis.

Good luck traders. Chat soon.