It’s one of those Mondays where the market looks sleepy… but it’s not actually sleepy. It’s hiding something.

When you have U.S. inflation data, NZD rate decisions, and the UK’s Autumn Forecast coming up all in the same week, Monday is never real. It’s just the calm before the charts actually move.

So don’t let the slow start trick you into thinking this week will be quiet, it won’t, never absolute. You never know.

Here’s what you need to know heading into the week:

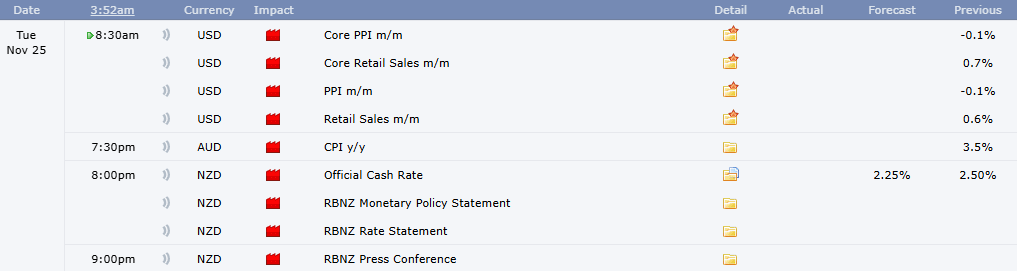

1. The USD’s Big Test Starts Tuesday

Core PPI, Retail Sales, and PPI all drop on Tuesday and these three can flip USD momentum immediately. We want clarity after weeks of mixed data. Hot numbers support the dollar; softer prints can break ranges fast.

2. NZD’s Most Important Day of the Month

The Kiwi faces a full event stack Tuesday night: Official Cash Rate, RBNZ Statement, and a live Press Conference. NZD has been weak, but any surprise in tone or forward guidance can spark aggressive moves across NZD/USD and the crosses.

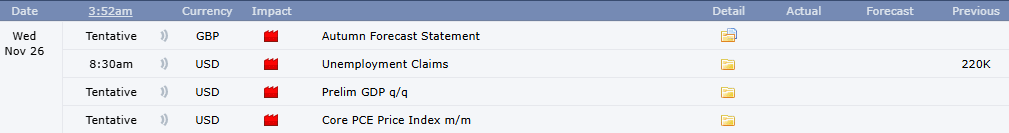

3. GBP & USD Collide Midweek

Wednesday brings the UK Autumn Forecast Statement and GBP reacts more to tone than data. Add U.S. unemployment numbers landing the same day, and GBP/USD becomes a two-sided battleground.

The follow-through continues into Thursday–Friday with Core PCE, which will confirm the USD’s direction for the rest of the week.

My Takeaway

This week is the type where one piece of data can flip sentiment overnight.

If you’re also trading today, let’s keep it simple: Watch ranges. Prep your zones and

don’t rush entries before the real catalysts hit.

The fireworks might not start today, but the preparation does and the traders who wait will have the advantage.