The GBP strength is now falling and the currency strength meter is showing it as the worst performing currency of last week. Poor data combined with a central bank leader becoming more dovish has fueled the GBP bears.

UK’s Growth Remains a Struggle

Much like the day I got back from my stag do last week, the UK economy is running on fumes.

It’s no secret too.

When looking at the key data points, GDP growth remains in the negative for a conservative month. Industrial and Manufacturing production remains in the red. And now the Bank of England Governor has stated that rate cuts in August are likely.

The Guardian reported that Governor Bailey insisted that the path for rates is downward.

When a central bank becomes vocal about cutting interest rates then the market tends to sell that currency. I feel although we expected this GBP weakness to come, it’s only been reflected on the charts the past two to three weeks.

Backed By the Currency Strength Meter

The currency strength meter is telling us the GBP is in trouble. Across the board last week, it lost against all but the JPY. This is the technical feedback we can use when identifying the weakness which typically starts because of the macro economic shift.

Looking at the meter we can see that the GBP moved from +5 which is a strong but reversal zone, to 0, moving lower by 5 places. The stronger currencies include the CHF (Swiss Franc), AUD (Australian dollar) and CAD (Canadian dollar).

This means we could be looking at opportunities on GBPCHF, GBPAUD and GBPCAD.

Upcoming Data Could Add To Woes

On Wednesday, the UK will see the release of the latest consumer price index which is forecast to remain the same at 3.4%, with core also forecast to see no change.

This one metric could put doubt into the mind of traders looking to short the GBP.

However, if this number were to fall and head lower the chances of a rate cut from the Bank of England would increase substantially.

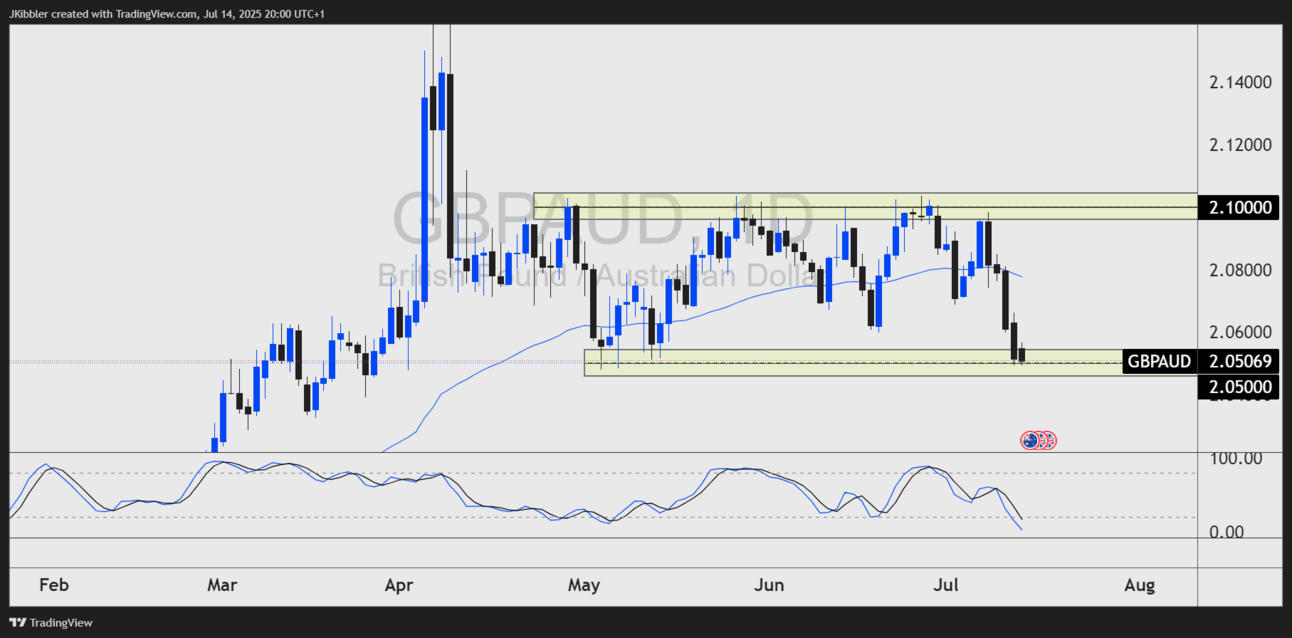

GBP/AUD Approaches Support

The price of GBP/AUD has reached a crucial support zone of 2.0500.

This is the key support of a range that has stemmed back from April of this year.

Shorts from the highs of the range have been fruitful over the past few weeks, but if the GBP weakness is going to continue a breakout of the range lows looks more likely.

Being short at these levels doesn’t make sense, I need to wait for the price to bound higher and reach resistance or break and retest the lows first.

Key Takeaways

GBP is the weakest major currency last week, confirmed by the currency strength meter.

UK data remains soft: negative growth, weak production, and slowing consumer momentum.

BoE turning dovish — Governor Bailey signals rate cuts likely in August.

GBP underperforms across the board, especially vs CHF, AUD, and CAD.

GBP/AUD nearing key support (2.0500) — watching for breakout or bounce setup.

This week’s UK CPI could trigger the next move — a softer print may accelerate GBP selling.