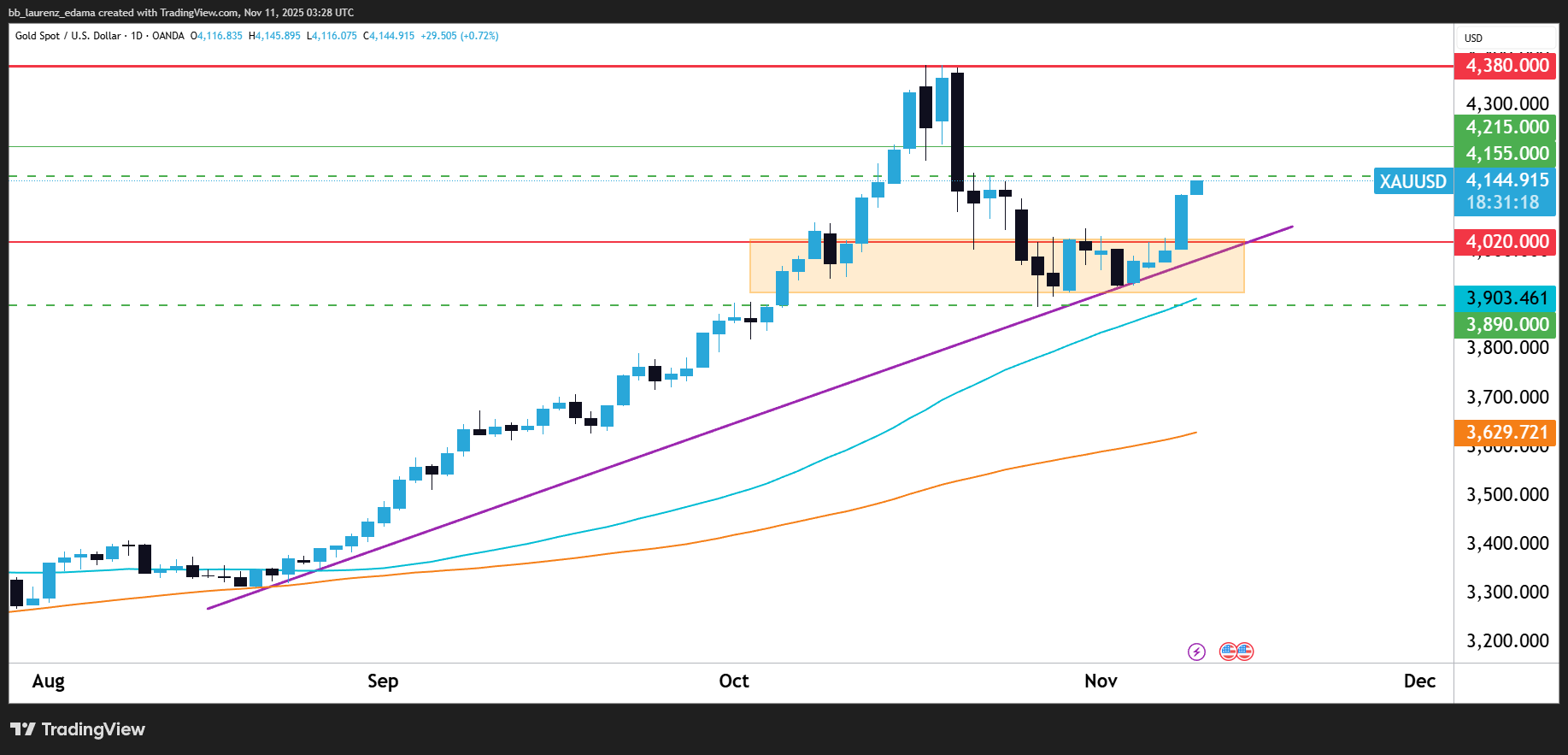

Gold continues to defend the $4,000 support region after a multi-week pullback from its recent all-time highs.

The bounce here is significant, this zone has acted as a key demand area multiple times and also aligns with the rising trendline on the daily chart.

On the daily timeframe, price is now climbing back above short-term structure, aiming toward the $4,155–$4,215 resistance pocket. This level previously capped bullish attempts, so this is where momentum will be tested.

The moving averages continue to slope upward, showing that the broader uptrend remains intact, the recent downmove was corrective, not a trend reversal.

Switching to the weekly chart, the broader structure remains strongly bullish. The pullback into the $4,000 region looks healthy, a normal retracement within a steep impulse leg. The next major bullish continuation target remains the $4,380 area (previous high).

However, if price fails at $4,155–$4,215 and breaks back below $4,000, that would signal fading bullish strength and open the door toward deeper retracement zones like $3,903 and $3,447.

Key Levels I’m Looking:

Resistance: $4,155, $4,215, $4,380

Support: $4,100, $4000, $3,903, $3,890, $3,447

My Takeaway

Gold is still bullish overall but this bounce now needs follow-through.

Hold above $4,000 = buyers in control.

Break below $4,000 = deeper correction likely.

Watch how price behaves at $4,155–$4,215, that zone could decide the next move.