This week’s 25 bps rate cut from the Fed is already priced in.

If you’re trading the headline you’re already late.

The real trade lies in what comes after the cut.

This FOMC meeting isn’t about what Powell does. It’s about what he says.

What Really Matters

The question out of this meeting isn’t “will the Fed cut?” it’s “will the Fed keep cutting?”.

Bond traders and the USD’s next move relies on this.

If Powell opens the door to more rate cuts than the two expected that’s bullish for gold.

Why?

Lower rates reduce the appeal of holding US bonds.

This can weaken the USD and put pressure on inflation.

However, if Powell sounds optimistic, suggesting he doesn’t see the need to cut rates further, that could be bearish and gold prices could continue its pullback.

What to Listen for in Powell’s Speech

It’s important to focus on the tone during the press conference.

If Powell sounds worried or cautious about the labor market, it suggests that the Fed is still biased towards easing.

On inflation, if he downplays inflation risks or calls them “well anchored”, it reinforces the same message.

That to me could be the catalyst that keeps the narrative we have currently, and in which could see gold trade higher.

Don’t react to the cut

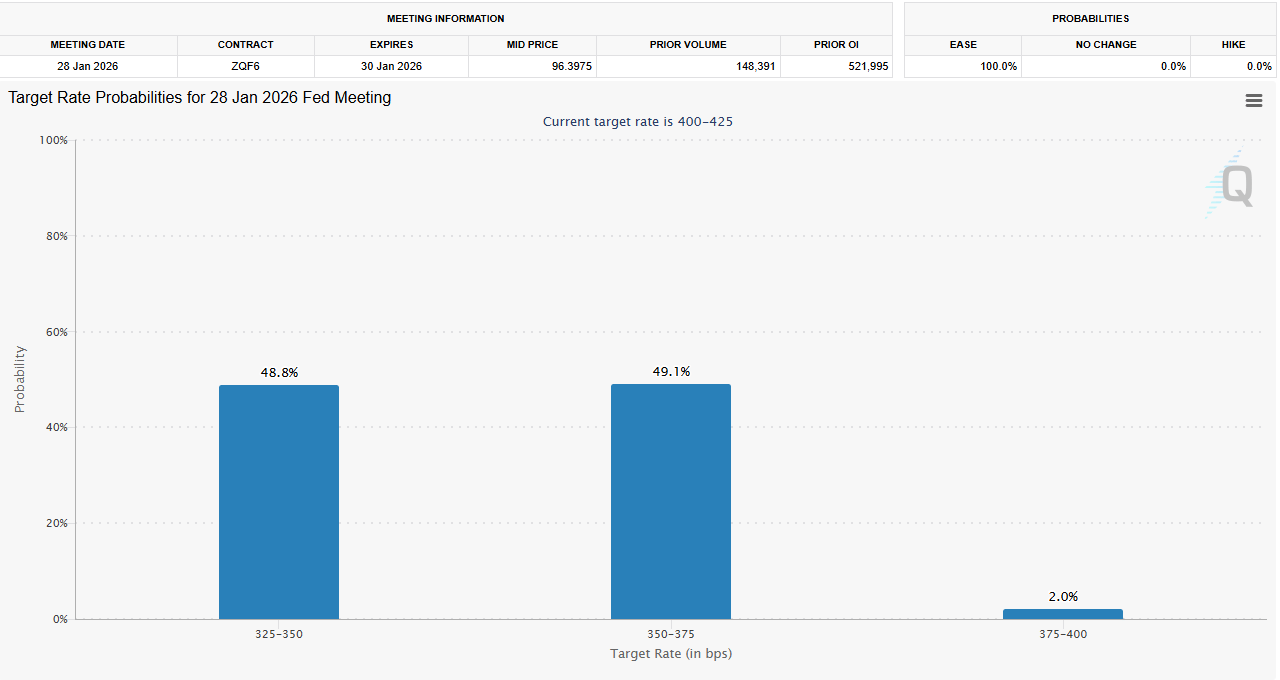

Look at the CME FedWatch Tool.

This is the January meeting probabilities. At the moment it is 50/50 between a hold or a cut.

After this week we could see this change, a skew towards a cut in January will be key as bond traders will likely buy to lock in higher rates, which will send yields lower.

In turn this will push USD lower and gold higher.