A couple of weeks ago I got to have a chat with a trader that I have watched and followed for a while, and the conversation I thought I was going to have completely changed. In fact it completely changed the way I view the market.

If you don’t know me by now, hi I’m Jon.

I started my journey like most retail forex traders, I got a fancy advert online explaining how trading was easy, and a quick way to financial riches. I won’t mention the company here but I was sucked into a trading course down in London. A fancy looking trading floor, set up as the ultimate sales room. I got involved and safe to say looking back, it’s not the way I should have gone about things.

But hey, everything in hindsight is great. We know that more than most.

Anyway, my journey started from there, and although I regret how I went about getting into trading, I don’t regret starting.

At first I mastered technical analysis and trading strategies, and this worked for me for a while, but I had this nagging feeling in my brain that my results could be better if I just understood what was happening. Understood WHY a market was moving.

This began my journey into looking at the ‘fundamental’ side of analysis, exploring macro trends and I tried to consume as much as possible. Even though I have had no formal training on fundamental analysis, I made it my goal to understand WHY markets are moving and how certain macro indicators can drive currency prices.

A big part of my analysis involved diving into the Commitment of Trader Reports, known as CoT reports. This report is published weekly by the Commodity Futures Trading Commission (CFTC), which breaks down the open interest in futures and options on futures markets.

It is generally categorized by different groups of traders for example, commercial, non-commercial and non-reportables. The non-commercial entity is where I focus a lot of my attention, as I want to understand where ‘large speculations i.e. hedge funds’ are positioned. And this is what this report shows us.

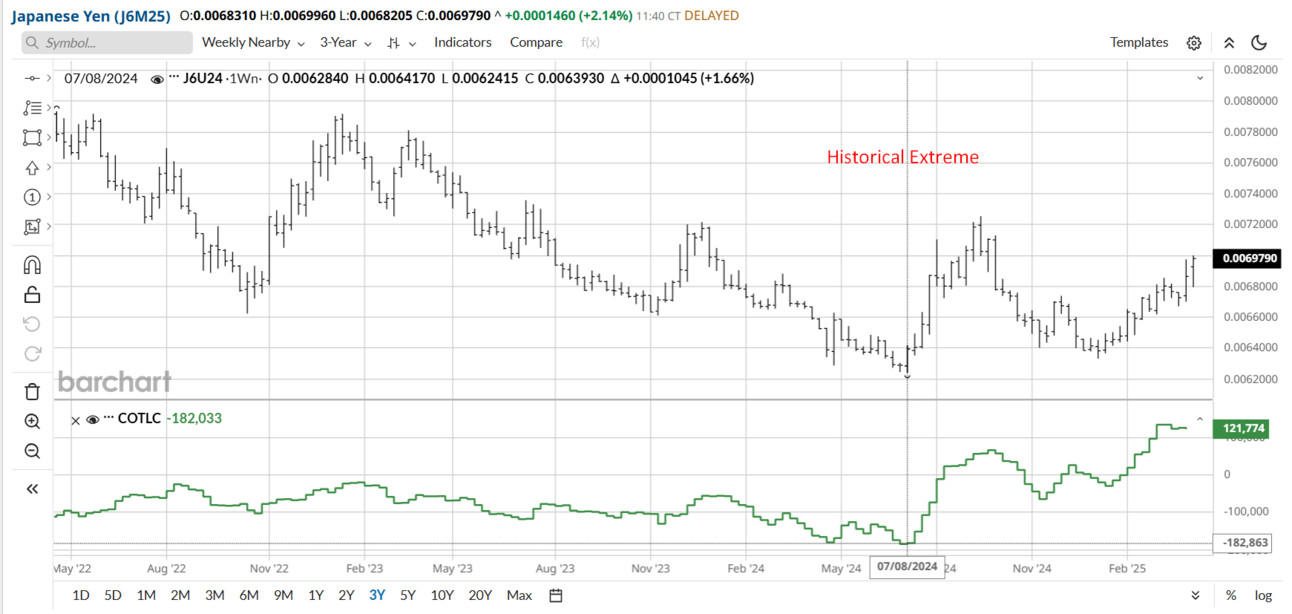

I have used this to identify some powerful trading set ups, as extremes on the report can highlight where hedge funds may be overbrought or oversold. So I like to use it as a barometer of whether the trend is going to continue or whether it will reverse depending on positioning.

One market we used this on was the USD/JPY, we highlighted that hedge funds had reached an extreme short position on JPY futures at the beginning of July 2024, which meant that the upward trend on USD/JPY was likely overbrought and it could potentially reverse soon. Just a few days later the Bank of Japan stepped in and intervened. This was one of those perfect examples, but like in everything with markets, nothing is perfect, we have to take it all into context. There have been many CoT signals that just didn’t set up, and that’s fine.

One day I was scrolling through LinkedIn and spotted the trader I follow comment on someone's post about the CoT reports, saying that they are ok as a confirming tool, but shouldn’t necessarily be used as a signal as the data is always lagging.

I saw this as my opportunity to reach out to them. Ask them their opinion on the reports and why they believe they are not a great tool.

Let me introduce you to Patrick Reid.

Patrick is the co-founder and head trader/trading mentor at the Adamis Principle, where he and his business partner Adam Gazzoli provide FX consulting services, also teaching clients how to trade FX markets using a macro based approach. They have both been spot FX traders and have over 35 years experience in hedge funds and banks.

What fascinates me about Patrick, was that he changed his career path at 38, and is a big advocate for helping those change careers, to become a trader. He was once working for the BBC, and moved from there to a trading desk trading futures before moving to spot FX.

When I reached out to Patrick, it was my intention to ask some questions about the CoT reports and get you guys an insight into what institutional traders think about these reports. But he graciously gave me more than that.

But first, Patrick’s thoughts on CoT reports surprisingly aligned with mine, he said we ‘shouldn’t take them literally’ and that ‘all of it works some of the time’. Which basically means that we shouldn’t take them as gospel, in fact we should only use them for what they are, and that’s for added confluence to other analysis.

So I asked Patrick, if you don’t use the CoT reports, what should retail traders use to get an insight into the markets. Patrick went one to suggest that retail traders should focus on ‘rates and risk management’.

But this is where the conversation changed.

Patrick said to me…”What matters more than most, the narrative of the market, do you know what I mean by that”.

I replied “yeah, I think it’s similar to why markets move? What’s the reason behind the move?”.

Patrick went on to say “yes, so, let's do this. You write down three narratives, I will write down three and let’s compare”.

At this point, for some unknown reason I got pretty nervous, I was talking to an institutional trader, but I saw this as a great learning opportunity. So I replied, “Trump tariffs, Trump and Oil prices and the current UK fiscal problems”.

“Great, that’s exactly it.” Patrick replied.

What he said next, really got the cogs going in the brain.

“Let’s pick a narrative, say Trump’s tariffs, where in the narrative do you think we are? If we think about a play, we have act 1, act 2, and act 3. Where in this narrative are we?”.

Patrick learned this method from Brent Donnelly, a trader who has graced many top banks, and has extensive experience trading currencies, FX options, stock index futures and more. Patrick found this insightful for him, and added his own knowledge of the markets to this.

This really got me thinking. I had never really thought about the narrative or the why in the market with this perspective before. Essentially it’s asking ourselves are we early to the trade, or are we late to it? Often retail traders are renowned for being late to the party on trends, but now I thought is being late such a bad thing? If I understood where I was in the narrative, then I could position myself for the potential outcome.

As retail traders, I don’t think we ask this question enough.

Where are we in the narrative?

So let’s talk about it. THE hot topic right now is President Trump and tariffs and let’s be fair the market is largely ignoring all other macro indicators right now.

What act are we in? For me, I believe we are in act 2. We have known tariffs were coming for a while, so we already have the beginning. April 2nd was what the market was waiting for and that caused a significant sell off across markets. Now we have Trump and China going head to head in a tariff war. But there’s still an air of uncertainty.

In my opinion we are not at the start of the narrative, but in the same breath, it’s not over either.

Understanding this can help us make smarter decisions.

When you open your charts in the morning I want you to think about the narrative in the market, what’s driving it, and more importantly, what act are you in?

I hope you found this post interesting and insightful, feel free to reach out to me to chat markets.

If you would like to find out more about Patick Reid and follow his insights you can do so by heading over to his LinkedIn profile here. He is very approachable and I’m sure he would be happy to answer any questions you have.

Looking for a mentor in trading? Then Patick may be able to help you. You can visit the Adamis Principle website and discover their mentoring services.