I have been a bit of a bear on the GBP even though it is still strong on the currency strength meter. But Friday could be the day this comes to fruition.

What’s happening Friday?

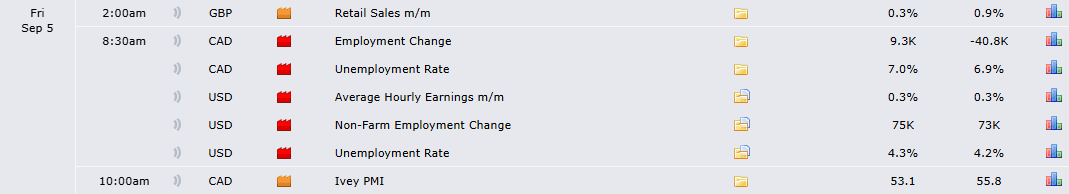

The British pound hasn’t had it’s best of weeks, and this week’s retail sales print on Friday could be the catalyst that adds some extra pressure.

Forecasts show a slowdown from 0.9% to 0.3%, suggesting there is weak consumer spending herding into the Autumn Budget. That’s not what the government would be wanting to see starting at a £35 billion fiscal hole.

Some Positives

Better than expected data: CPI came in above expectations again and Services PMI were revised higher. Which in theory will support the GBP.

Bond markets are fruity: Long dated gilt yields ripped higher not because of optimism, in fact quite the opposite. Markets are demanding higher risk premiums for holding UK debt.

BoE is kind of stuck: The Bank of England’s recent hawkish cut hasn’t really convinced markets that it can tame inflation. Although tax rises or spending cuts by the government could strangle peoples pockets, this isn’t happening today.

Hedge Funds Selling

The Commitment of Trader reports data show hedge funds are adding to their short positions and decreasing their long positions. This tells us that institutional money doesn’t really buy into the GBP recovery story.

How is this useful?

In my experience this tells me two things:

If retail sales disappoint, GBP upside could be limited. I am interested in selling GBPJPY and GBPAUD so those are the markets I will be watching.

Institutions aren’t buying into the GBP and they do typically follow the trend, so any upside here could see institutions increase their short positions.

Keep an eye out for the data drop and let’s see what happens.