The U.S. Securities and Exchange Commission (SEC) just got its most crypto-friendly leader ever, with the swearing in of Paul Atkins as chairman. And wouldn’t you know it, the digital asset world is already feeling the ripple effects. After years of what critics called Gary Gensler's "regulation-by-enforcement" approach, where crypto companies often learned they were breaking rules only when the lawsuits arrived, Atkins brings a radically different approach to the United States’ top regulatory agency. His appointment marks a watershed moment for an industry that's spent literally years begging for clearer rules rather than legal ambushes.

Paul Atkins, the SEC’s new Chairman

For Atkins, this is actually a bit of a homecoming for the SEC, having already served as commissioner from 2002 to 2008 under then President George W. Bush. But it's his recent work that has the whole crypto industry sleeping easier. Since 2017, he's been co-piloting the Digital Chamber's Token Alliance, where he helped craft sensible guidelines for an industry that's long operated in a gray zone. President Trump made his support crystal clear in a December Truth Social post, making Atkins out as the vital missing link between traditional finance and the blockchain revolution needed to "Make America Greater than Ever Before." The difference between Atkins and Gensler couldn’t be clearer. The incredibly unpopular Mr Gensler, who saw crypto as a lawless frontier that he had to police like a power hungry Sheriff. Atkins on the other hand, has consistently advocated for frameworks that allow innovation to flourish while still protecting investors.

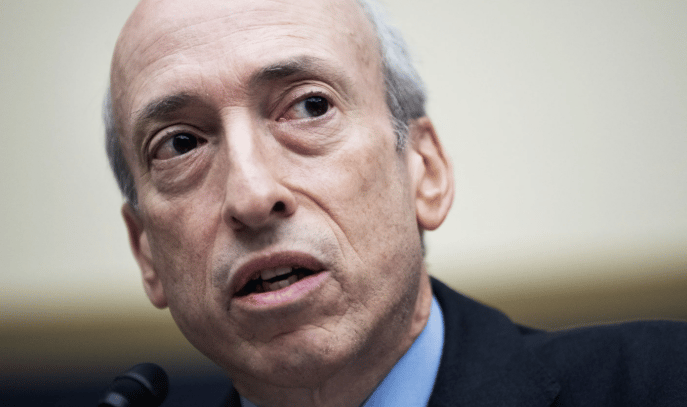

The outgoing, incredibly unpopular, Gary Gensler

In fairness, the winds of change started blowing even before Atkins officially took the wheel. Acting Chair Mark Uyeda, briefly holding the reins between Gensler's departure and Atkins' confirmation, wasted no time dismantling some of the most bizarre policies. The first domino to fall was Staff Accounting Bulletin 121 (SAB 121), an obscure but really impactful rule that effectively barred major banks from offering crypto custody services by forcing them to list customer crypto holdings on their own balance sheets. Uyeda's repeal of this incredibly unhelpful rule in January opened floodgates that had been basically completely shut since 2022, with firms like JPMorgan and Bank of America now quietly exploring crypto custody offerings that would have been unthinkable six months ago.

Mark Uyeda helped get the SEC in the right direction.

In March, Uyeda also signaled plans to abandon another controversial proposal that would have forced decentralized crypto platforms to register as securities exchanges, a move that would have hamstrung most of the DeFi ecosystem. Around the same time, he shelved Biden-era rules tightening digital asset custody requirements, removing yet another roadblock for institutional adoption. Then to top it all off, Uyeda launched a new Crypto Task Force led by none other than Hester Peirce, the Republican commissioner affectionately known as "Crypto Mom" for her years of dissenting against Gensler's aggressive enforcement actions. The task force has been holding frequent roundtables with industry leaders in order to move the entire industry forward together - a big departure from Gensler’s "us versus them" dynamic. So, credit where credit is due: Thank you Mark Uyeda.

Not everyone is over the moon about this though. Senator Elizabeth Warren has emerged as Atkins' most vocal critic, lambasting him as a "Wall Street lobbyist" who spent years fighting penalties against corporations that misled investors. Her concerns seem to echo most Democratic worries that the pendulum may swing too far from investor protection to industry permissiveness. But Atkins seems to have bipartisan support for now.

Giphy

For investors like you, these bureaucratic shifts in the U.S. could translate to very real changes, very positive changes across the globe. The dismantling of SAB 121 means your brokerage might soon offer Bitcoin ETFs alongside your stocks and bonds. The potential easing of exchange rules could breathe new life into decentralized platforms that have been operating in legal limbo. And the new task force's industry dialogues suggest future regulations may actually reflect how crypto works in practice, rather than trying to force square pegs into round securities-law holes.

The trillion-dollar question is whether Atkins can thread the needle between creating guardrails that protect consumers without recreating the hostile environment that drove so much crypto innovation offshore. Early signs suggest he's serious about finding that balance. In his confirmation hearing, he emphasized "capital formation" as a core SEC mission alongside investor protection, which was a semi subtle, but significant shift from Gensler's sue-now-ask-questions-later approach. For an industry that's been battling this for years, even a simple reframing like that feels like a huge turn in proceedings.

Gif by pudgypenguins on Giphy

Time will tell how this plays out, but it’s a really promising start: after years of regulatory whiplash, the SEC may finally be entering an era of predictability. Whether that translates to mainstream adoption or just lets existing projects breathe easier remains to be seen. But for the first time in a long time, the conversation that the biggest crypto innovators are having has shifted from "how will they punish us next?" to "how can we build something great together?" And that is a really exciting change.