Today feels kinda slow and that’s normal for a Monday for us traders.

The market is waiting. However, we have important news coming later this week, and we don’t want to take big positions before the data arrives.

This is the kind of day where patience matters more than entries.

Let’s look at what’s coming up, and why it matters.

Here’s What You Need to Know

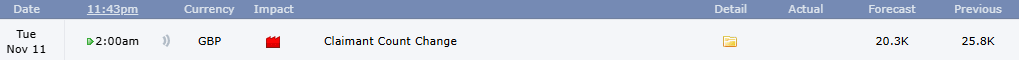

1. GBP Jobs Data on Tuesday

The UK will release its jobless claims report. If more people are losing jobs, it tells us the UK economy is slowing. That could make the Bank of England think about cutting interest rates sooner. So GBP may move, depending on what the numbers show.

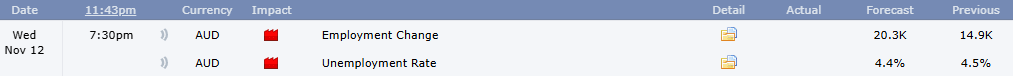

2. AUD Employment on Wednesday

Australia will release jobs and unemployment numbers. AUD has been moving because of market mood, not strong data. This report will show if the bounce was real, or just temporary.

Stronger jobs = AUD may rise

Weaker jobs = AUD may drop again

3. The Big One: U.S. CPI on Thursday

This is the most important event of the week.

CPI tells us how fast prices (inflation) are rising in the U.S.

If inflation is lower, the Fed may cut rates which means the dollar could weaken

If inflation is higher, the Fed may need more time which means the dollar could strengthen

Many pairs will wait until CPI before making real moves.

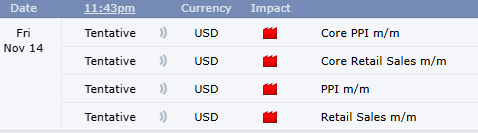

4. U.S. PPI & Retail Sales on Friday

These reports show how businesses and consumers are doing.

This helps confirm the story: Is the economy slowing because of job cuts? Or is spending still holding strong?

My Takeaway

Today is not about forcing trades. It’s about preparing for the moves that come later in the week. The market is quiet because many traders are for sure waiting for real information.

We don’t need to guess, we just have to wait for the data and react with clarity.

This week, timing will matter more than speed.