The first trading day of September isn’t wasting time. After a summer loaded with tariff drama, Fed tension, and shaky economic data, markets open the month with one theme dominating: How soon will the Fed cut rates?

For me, this type of week is where patience pays. Mondays already bring slower flows, and when you layer in the anticipation of Friday’s NFP and Powell’s policy signals, it’s easy to get trapped by noise. I’d rather let the market show its hand instead of guessing early.

Here’s what you need to know and why it matters:

1. Dollar Still Holding Ground

The dollar enters September firm, even after softer U.S. data last week. The DXY trades steady at support because traders are waiting for confirmation from ISM and jobs numbers. Until those reports come out, the greenback isn’t giving much back.

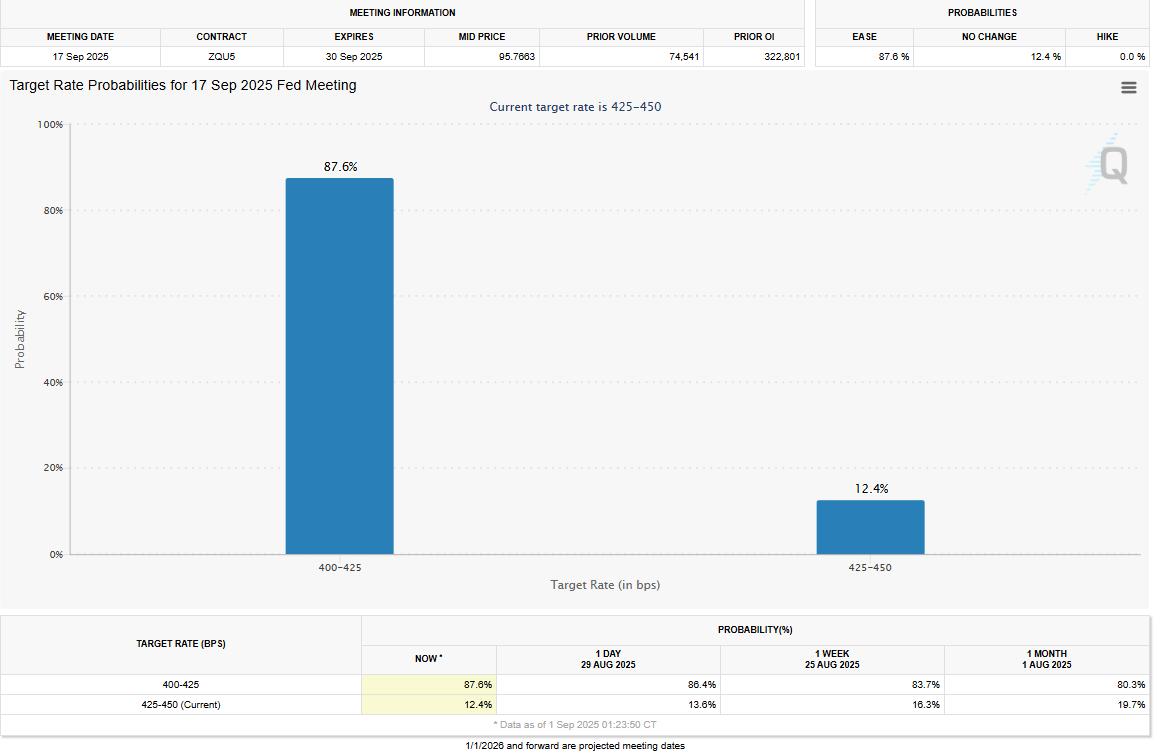

2. Fed Cut Odds Are Rising

CME’s FedWatch Tool shows traders pricing in an 87.6% chance of a September cut. That’s the backbone of this week. If ISM or NFP miss expectations, those odds will solidify, and the dollar could finally crack lower. If the data surprises on the upside, the Fed may wait longer, giving USD another leg higher.

3. USD/JPY Stuck in Range

The pair sits near 146.80, caught between resistance at 148.50-150 and support closer to 146 and 145. It’s a classic range play right now. I’m not interested in guessing which side breaks first. A real move will come when the data and Fed guidance align until then, chop is just chop.

4. The Week Ahead Will Drive Sentiment

Tuesday: ISM Manufacturing PMI

Traders are looking for signs of recovery after last month’s weak print.Wednesday: Australia GDP and RBA

AUD will be put to spotlight, it could spill into cross flows.Friday: Nonfarm Payrolls

The main event. Jobs growth is expected to slow again, which would boost cut bets and put pressure on the dollar.

Here’s My Takeaway

September opens with the Fed at the center of everything.

For us traders, this is about not rushing. Dollar strength is holding for now, but that could flip fast if NFP comes in soft. Gold and EUR/USD will both feed off any cracks in the greenback. USD/JPY will likely be the clearest barometer of market conviction.

I’m treating this week as a waiting game. Big releases are lined up, and they’ll decide whether September starts with a break lower in the dollar or another round of resilience.

Until then, structure and patience remain my focus.