From a currency strength and weakness point of view there’s no change.

It all seems a little quiet in the markets.

Some may say it is too quiet.

In my experience that’s what can happen heading into a high impact news week.

We have four central bank decisions including the Federal Reserve.

Week’s like this can bring about a shift towards risk off markets.

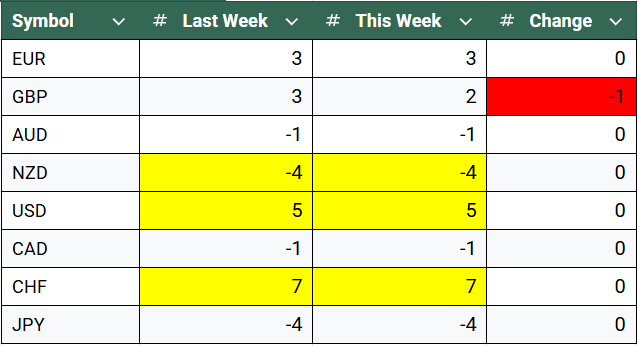

As it stands this is what the currency strength meter looks like.

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

CHF: No change for the Swiss Franc which tells us that the market is still not dipping its toe fully back into the risk on markets, despite some downside in gold last week.

USD: The greenback also remains strong. It will be a pivotal week as we expect a 25 basis point cut from the federal reserve but forward guidance has been a little murky. If Powell seems concerned about the economy and jobs in particular we may see USD weakness return as more cuts could come.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

NZD: No changes here too the kiwi remains a weak currency and that looks likely to continue in the near term.

JPY: In Japan the currency weakened once more as oil prices spiked after new sanctions by the US on major Russian suppliers. If oil prices climb higher then the case for JPY weakness remains.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

CHFJPY | NZDCHF |

USDJPY | NZDUSD |