Well, the markets are on the move and some currencies have refreshed their strength and weaknesses.

As the US government shutdown continues and key data is released it is important to stay on top of the key markets that are moving.

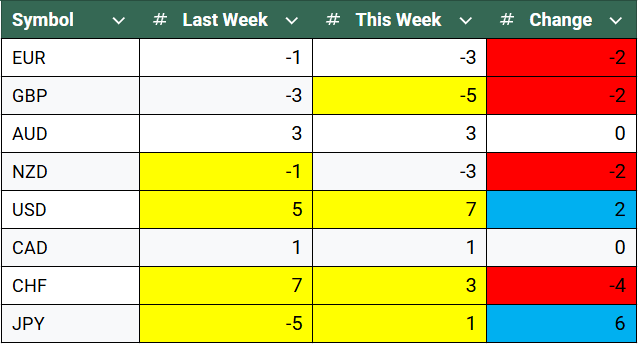

Here’s how the currency strength meter stands:

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

USD: The USD takes the top spot for now. Historically the longer the US shutdown goes on the weaker the USD gets, however we are in new territory now. The USD is strong and with stocks falling, if the CPI and PPI data this week comes in hotter it could play into this strength.

AUD: Taking a look at the Aussie, we can see that it is unchanged, but the currency is stronger then most after the RBA held rates and remained concerned over sticky inflation. Over the weekend we had stronger CPI and PPI out of China which could fuel some AUD strength.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

GBP: The British pound is now the weakest currency technically. The Bank of England held rates but the MPC showed a potential cut is coming. This week we see key employment and growth data released, if these show signs of weakness we could see continued downside.

NZD: The kiwi is a currency that continues to weaken. With the unemployment rate rising the RBNZ will be looking for another cut soon and this shows in the pricing across other currencies.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

AUDNZD | GBPUSD |

NZDUSD | |

GBPAUD |