Gold prices are back in the spotlight.

The precious metal climbed to a two week high already this week trading above $4,100.

This market has now come back on my radar and here is how I'm applying my W.C.S method to it.

W-Why is Gold Moving?

The “why” is all about interest rate expectations and fear.

Recent data shows cracks forming in the U.S. economy:

Job losses were concentrated in the government and retail sectors.

Layoff announcements are rising as companies tighten costs and shift toward automation.

Consumer sentiment just hit its lowest level in nearly 3.5 years.

Together, these factors pushed traders to assign a 67% probability of a Fed rate cut in December (CME FedWatch).

When markets start to price in lower rates, gold shines.

Why? Because gold doesn’t yield interest when cash and bonds offer less, holding gold becomes more attractive.

Even the U.S. government shutdown drama has added to uncertainty, which fuels the bid for gold. Once that risk fades, focus returns to the Fed and the Fed looks ready to ease.

Conditions of the Market

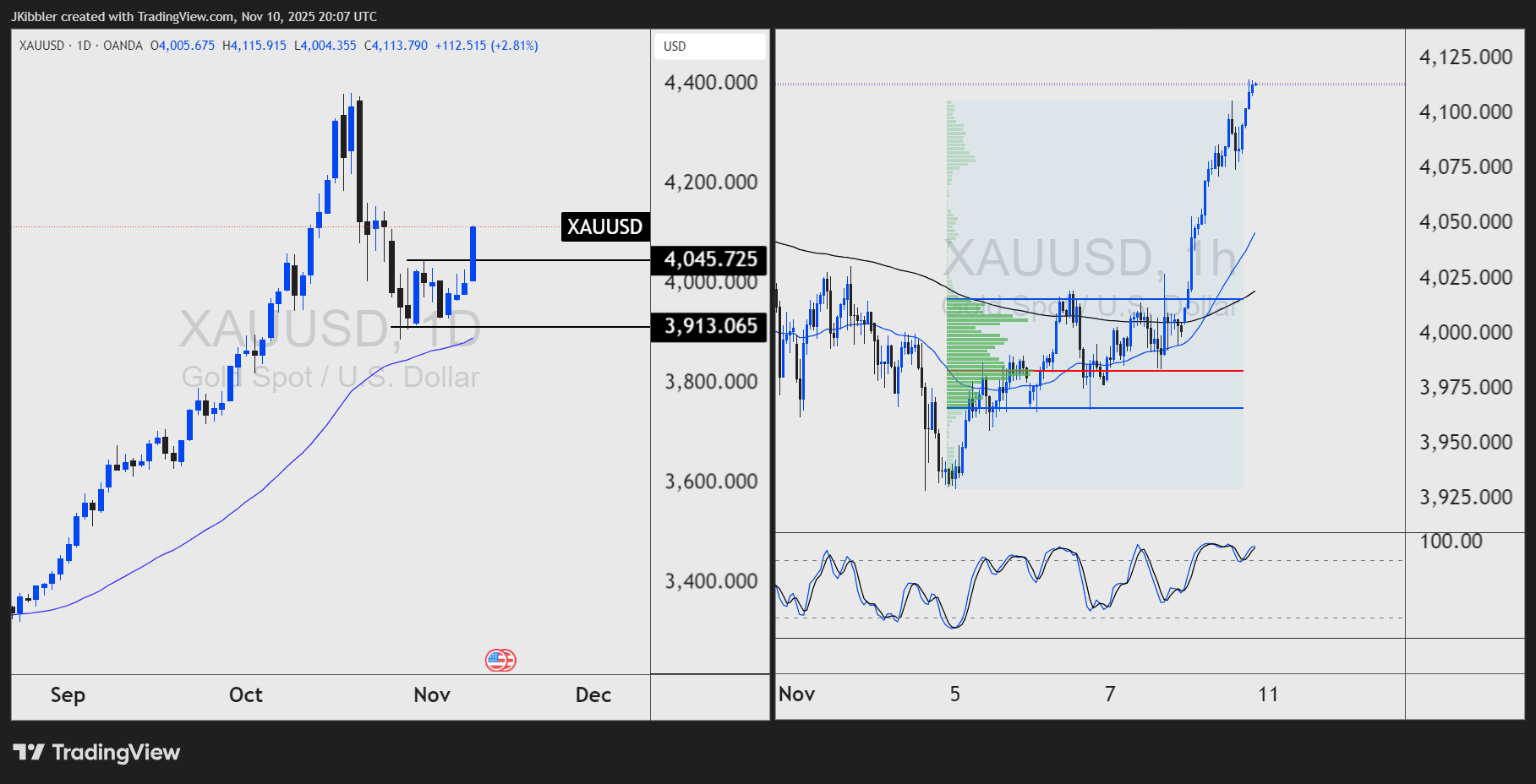

The daily chart on the left hand side has broken through into new highs above $4045.00.

Price remains above the 50 period daily moving average.

On the hourly chart on the right hand side we can see the 50 and 200 moving averages have crossed bullish.

Strategy

Volume has been built between $4035 and $3970, this zone could offer a zone of support moving forward.

If the price dips back towards this level and forms a bullish rejection with the price closing above the 50 moving average I will look to buy the dip here.

Targets could reach up to the previous swing highs.