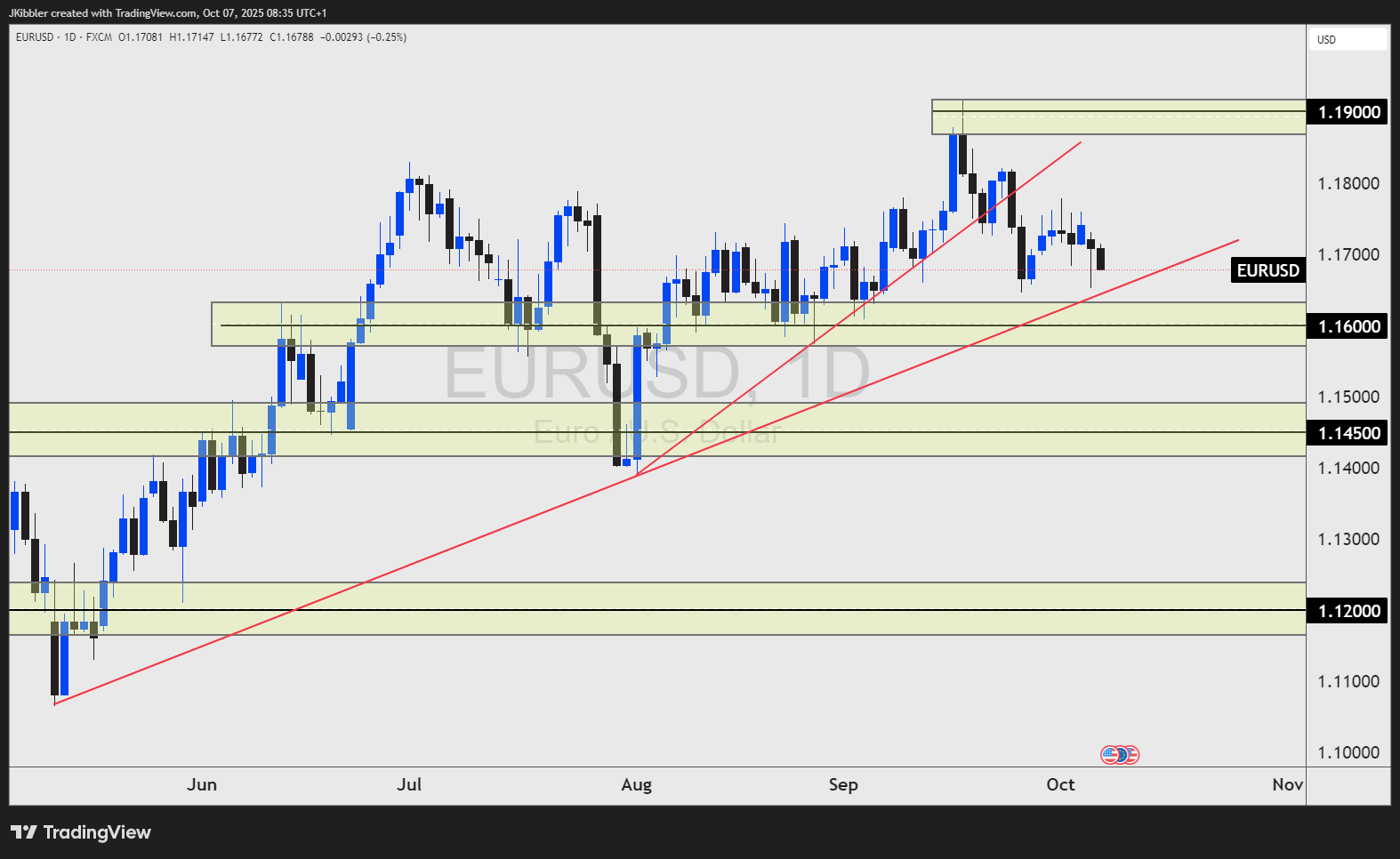

The EUR/USD price has been slowly grinding higher since August up until recently. A reversal from the 1.1900 handle could show underlying pressures for the forex pair.

EUR/USD Lower?

The USD Index shows the USD is gaining strength against the basket of currencies.Why?

Before the US government shutdown some data was beating forecasts in a positive way. Mainly talking about GDP, Unemployment Claims and New Home Sales.

US10Y has been on the rise tightenging the interest rate differentials between the US and Europe.

CoT positioning on EUR futures before the shutdown show extreme long positioning from the non-commercials, this can often see the price reverse in the short term.

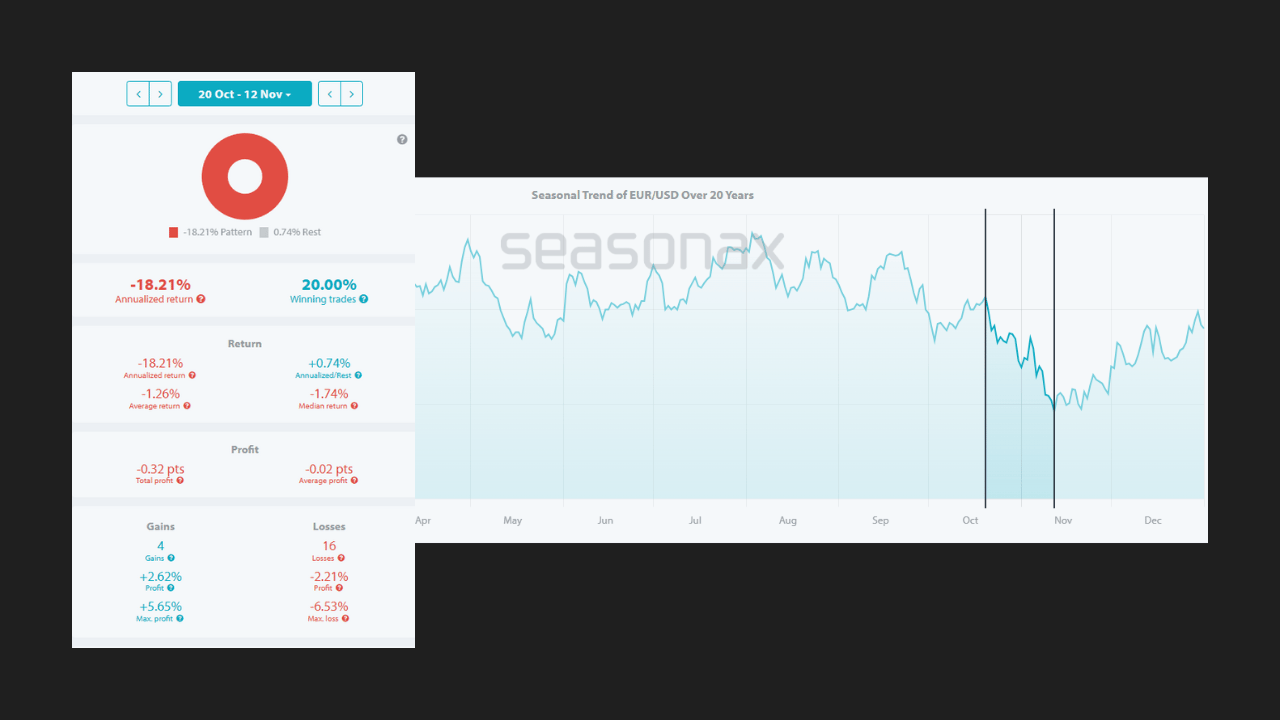

Seasonal Bias

Historically, EUR/USD struggles between October 20th and November 12th. Over the last 20 years, this pattern has played out 80% of the time making it one of the more reliable seasonal trades on the board.

It doesn’t guarantee anything, but it does give you context that many traders skip.

The Technicals (Weekly trend)

EUR/USD remains technically in a weekly uptrend, but it's moved into a secondary phase, meaning momentum has stalled, and structure is starting to shift.

The big level 1.1600 is one to watch, if we break this level with conviction, that could signal the trend is turning, and open up downside continuation.