On October 29th I discussed my trading plan for EUR/NZD long.

Using my W.C.S method I identified why the trend could continue, the conditions around the market and the strategy I would use to enter.

I had to wait a while to implement the strategy. But yesterday I had a signal.

Over the course of the past couple of days, price moved in line with expectations and hit target.

Let’s recap what the trade was, and how it played out.

First, Why?

There were a few reasons why I saw this market continuing higher. They included:

The currency strength meter showed EURO as strong and NZD as weak.

ECB policy is steady, and NZD unemployment has been rising, causing the RNZ to look to cut rates.

The interest rate differentials showed EU02Y - NZ02Y in an upward trend.

Next, Conditions

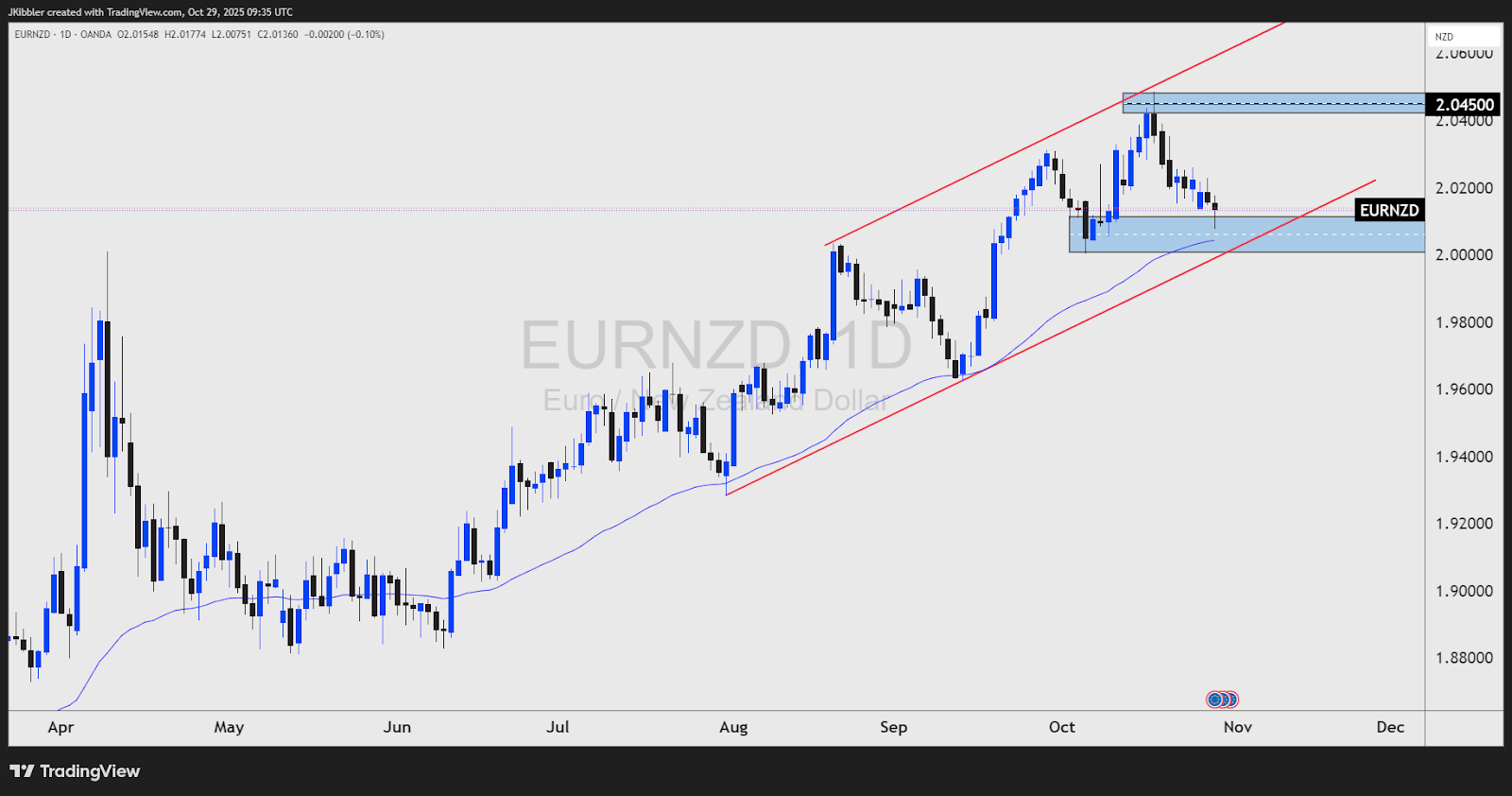

This was the EUR/NZD chart we showed in the previous newsletter. We saw that the price was in a strong upward trend and testing supporting lows. The price was also above the daily 50 moving average.

Trade Strategy & Recap

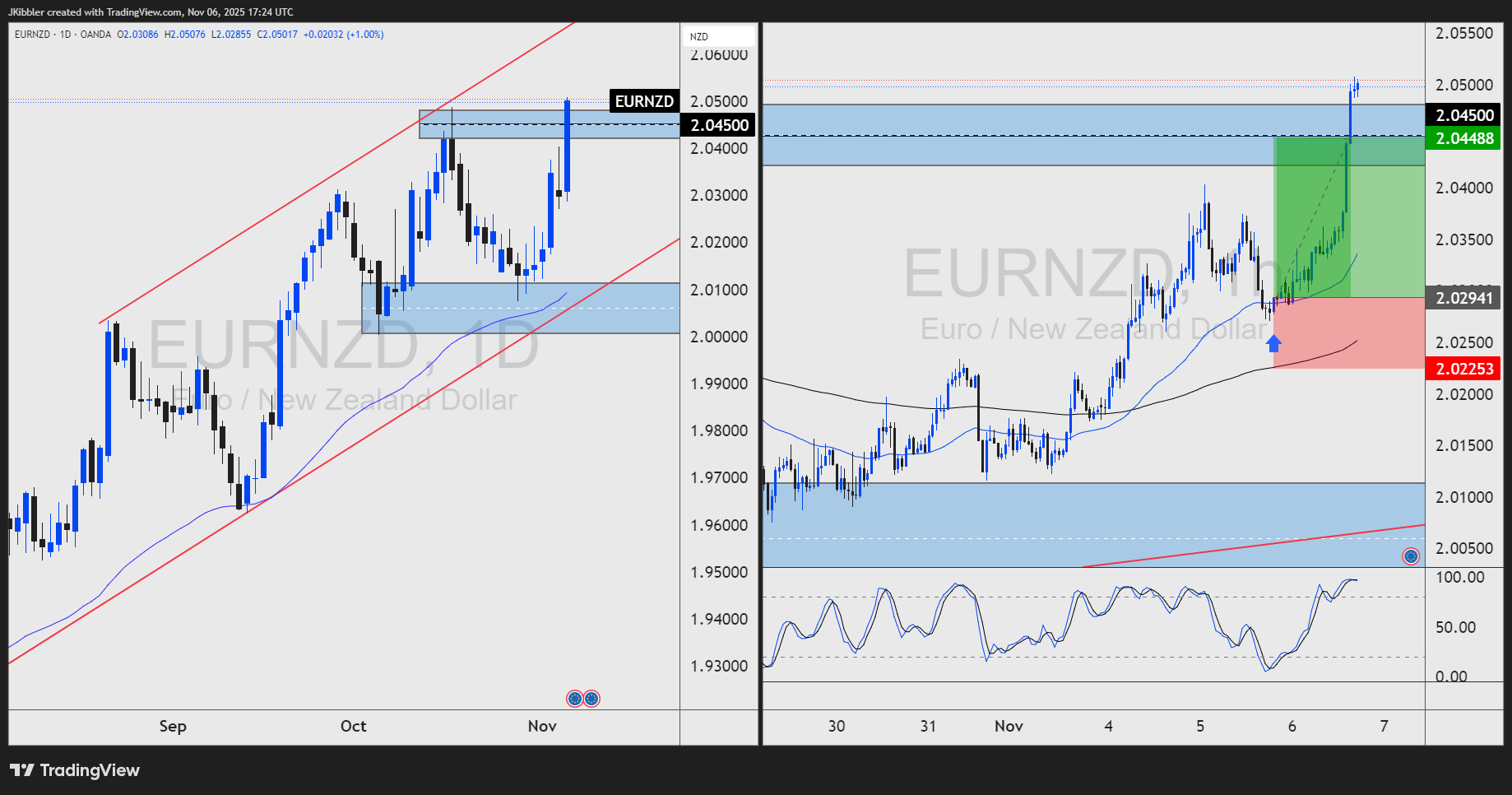

One of my swing trading strategies includes a moving average crossover and retest combined with an oversold stochastic.

Yes, it’s that simple.

Once the 1HR chart showed the change in trend and the moving averages crossed, I watched this chart every day.

When the market tested the moving averages with the stochastic in oversold conditions, all I had to do was wait for a close back above the 50MA.

This occurred, and I entered the market.

I placed my stop loss below the 200MA and set my target at 2.0450 the middle of the previous daily swing high, which netted over 150 pips in profit.

Stick to your plan

I am showing you this because it shows that a plan was made and followed through.

It can be so easy to get distracted and miss opportunities like this.

It’s why I built my method. To help me identify the trending markets.

I am also in a CHF/JPY short, so we will see how that one plays out.