“I had to do it”, Trump on Tariff Pause.

In a shock turn of events, the U.S. President Donald Trump announced a 90 day pause on reciprocal tariffs. This pause would take place effective immediately, however he has increased tariffs on Chinese imported goods to 125%.

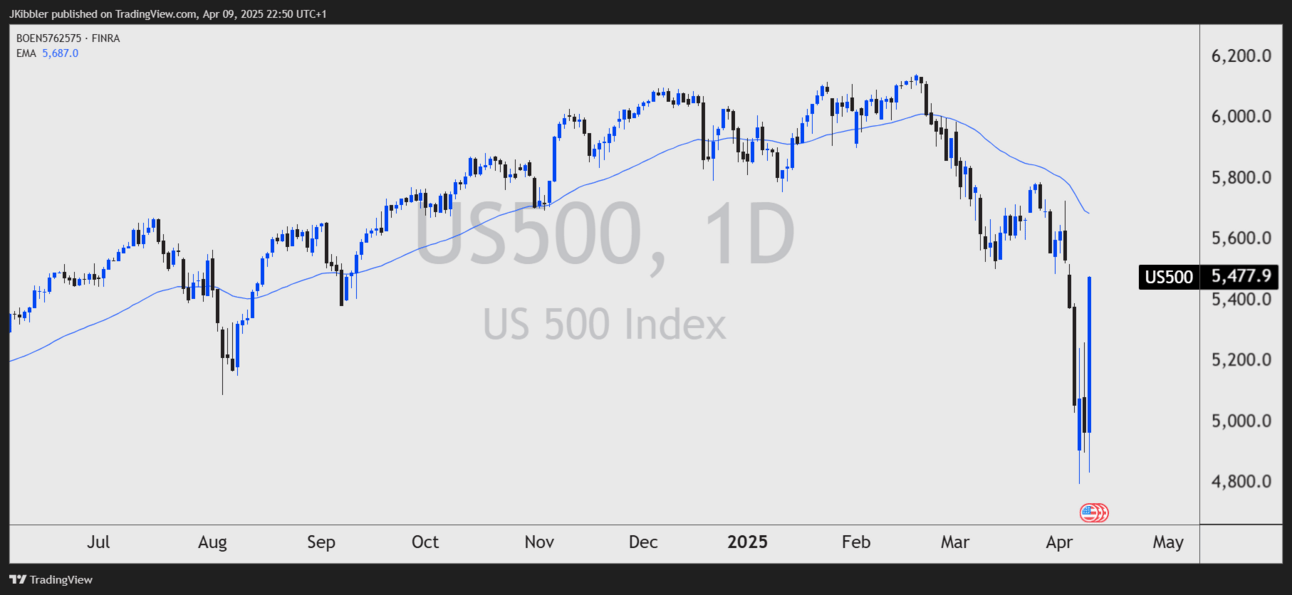

US markets have rallied on the news, taking the pause in their stride. As of 20:51 GMT here’s how the markets are shaping up:

VIX (Volatility Index) -37%.

S&P500 +10%.

Nasdaq 100 +12.50%.

Dow Jones +8%.

Crude Oil +7%.

The President said China’s higher rate is because they have shown a lack of respect to the world’s markets. Personally, I think Trump was worried about the bond market. When asked about it he said he was watching the bond market and stated “I saw last night where people were getting a little queasy”. We have seen this in the past, bond markets react aggressively and then policy changes, has Trump just become the new Lizz Truss?

Where do we stand now?

Honestly from here anything is possible, I didn’t think that President Trump would back down so quickly on his tariff announcement which he quoted as ‘liberation day’. Now all of a sudden he’s talking about being ‘flexible’. I wonder how long the market will take to stop taking Trump seriously considering he can chop and change his mind.

Many democrats are calling for an investigation into the president's comments the day before the announcement as he said it would be a ‘great time’ to buy the stock market. He wasn’t wrong, although could we class this as mass market manipulation?

We now have to ask ourselves, what will China do from here? Despite the initial rally in the bond market, that soon faded and China has some options to put pressure on Donald Trump again. If they start selling US treasuries it could push bond prices lower, forcing yields higher, really adding stress to the market.

They could also look to devalue the Chinese Yuan, which would make exports cheap and alleviate some of the pressure on the tariffs imposed by the United States. A sharp decline in prices against the USD could run the risk of financial instability.

There’s still an undercurrent of uncertainty within the market, if by some reason China does want to make a deal with the United States then I think that would open the floodgates for ‘risk on’ and stocks would almost certainly soar in that environment.

As traders what do we do?

Personally, I will be focusing on not trading too much, if I see an opportunity I will take it at a lower risk. I was short AUDJPY going into today, I managed to take some of my position off until the announcement happened, and then the price rallied against me, I closed early in a smaller loss to prevent any significant damage.

This is the game we may have to play for a while, we may just have to lower our risk if we want to get into trades. Or look at taking positions with the European session in mind, we have seen over the past week that this session tends to be less volatile than the others.

Before this all kicked off this afternoon I was planning on talking about the correlation between the USDJPY and US10Y and how currently the correlation has de-coupled for the time being. This could create an opportunity for us though, as we usually see USDJPY catch up to any moves.

This has happened before last year, arguably under different circumstances, but back in May and June of last year, the US10Y were falling but the USDJPY prices were climbing. Eventually the USDJPY price caught up with the US10Y.

If we see the US10Y continue to climb higher if bonds continue to sell off, then we could see USDJPY rally higher. The catalyst needs to remain the same, if we see the VIX continue to sell off then the JPY could weaken as risk on returns.

Remember what I said earlier though, it’s all about trading with a lower risk in these environments. It’s better to be around to fight another day, rather than losing it all and wishing you still had a chance.

I like to use a rule in these conditions. I only use 5% of the profits already made this year. For example if I had £100,000 and I had made 10% on that account this year, giving me £10,000 profit. I would be risking a maximum of £500 per trade, which is half a percent in this example.

There’s no need to risk more than that right now. Think about the long game and not the short term plan.

It will be interesting to see how China goes about this now, surely they respond to these tariffs in a negative way. How the market takes in this will be something watched closely I’m sure. It seems all other data is out the window for now.

Good luck out there traders! Speak soon!