Here’s what every trader is talking about today: the clash between the White House and the Federal Reserve is heating up again. President Trump has asked a federal appeals court to clear the way for him to fire Fed Governor Lisa Cook, and he wants it done before the FOMC meets next week.

This isn’t just politics. For markets, the fight over Fed independence raises real questions about rate policy, credibility, and the dollar.

Here’s what you need to know:

1. Trump Presses Appeals Court Before FOMC

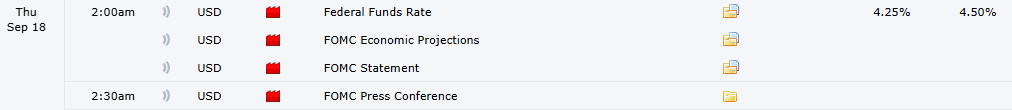

Trump’s lawyers filed with the D.C. Circuit Court on Thursday, asking for permission to remove Cook ahead of Tuesday’s FOMC meeting. They want a ruling by Monday, just before the Fed gathers to decide whether to cut rates.

2. Fed Independence in the Crosshairs

Cook, a Biden appointee, has voted alongside Powell in resisting Trump’s push for immediate cuts. The lower court ruling earlier this week blocked her removal, with Judge Jia Cobb stressing that “the public interest in Fed independence” outweighs political maneuvering. The appeal tests whether that shield will hold.

3. Market Stakes: Rates and Credibility

The FOMC is widely expected to cut rates next week, but the scale and credibility of that move could be shaken if Trump reshapes the Board mid-meeting. Traders know this isn’t just about one seat, it’s about whether policy decisions are being driven by data or political pressure.

4. Dollar Traders on Alert

The dollar index (DXY) has been consolidating near 97. A ruling that weakens Fed independence could undermine the dollar longer-term, even if rate cuts support it short-term. FX markets will be watching headlines closely into Monday’s deadline.

Chart Snapshot: EUR/USD

EUR/USD is holding steady around 1.1725, trading in a tight range as markets wait for clarity. The pair has strong support near 1.1710–1.1685, with deeper backing at the 50-day SMA (1.1658). On the upside, resistance looms near 1.1800, with the bigger magnet sitting at 1.1900 if momentum builds.

A dovish Fed outcome next week could be the catalyst that finally unlocks the upside, pushing EUR/USD toward 1.1800–1.1900. But if Trump scores a legal win against Cook, undermining confidence in Fed independence, the dollar could catch a bid and drag the pair back toward 1.1650–1.1480. For now, it’s a coiled chart, building energy, waiting for politics and the Fed to decide direction.

My Takeaway

Markets hate uncertainty, and this battle delivers plenty. It’s not just about Lisa Cook, it’s about how much independence the Fed really has heading into a critical rate decision.

For us traders, this means one thing: don’t ignore the headlines. The outcome could tip the dollar, gold, and risk sentiment before CPI and the FOMC even hit the wires.