It’s Thanksgiving week in the US! For those US subs I hope you enjoy your holidays.

For us non US retail traders this week brings some risks once again.

The two big events for me:

RBNZ interest rate decision.

UK leadership budget announcement.

These two events could shape the respective currencies for at least the next couple of months.

Data out of New Zealand lately has been surprising to the upside which could see the RBNZ begin to soften the tone on how dovish they have been.

From the UK side, the budget is expected to see a fresh round of tax increases which will likely impact the growth story in the UK for the future.

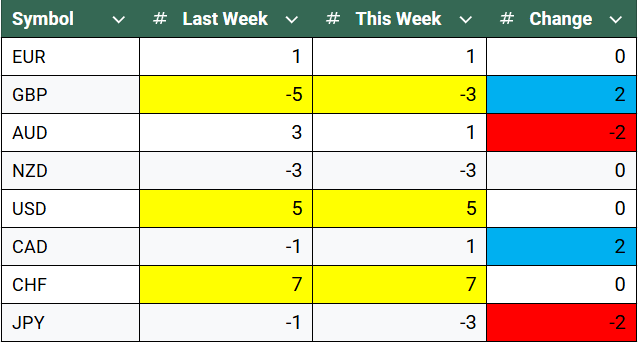

This is how the currency strength meter looks this week:

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

CHF: With the market still in risk off mode the Swiss Franc has been supported, and with the market volatility rising it looks to be sustained for longer.

USD: A shorter trading week could see the USD weaken slightly, but that is yet to be seen across the board.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

GBP: The British Pound remains under pressure across most currencies including the USD. If we see significant tax rises in the UK it could put pressure on the economy which is already struggling with growth.

NZD: If the RBNZ cut rates this week but discuss future guidance which looks less dovish the fortunes of the NZD could change, but for now it looks unlikely.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

GBPUSD | |

NZDUSD | |

GBPCHF | |

NZDCHF |