The dollar is flexing its strength again.

USD/JPY just broke above the 150-152 mark and rejected the 153.00 area, a level that’s historically been Japan’s “line in the sand.” This breakout comes as the U.S. economy continues to show resilience, inflation remains sticky, and the Fed holds firm on higher-for-longer rates.

On the flip side, the Bank of Japan still refuses to move away from ultra-loose policy, and that interest rate gap continues to drive capital toward the dollar.

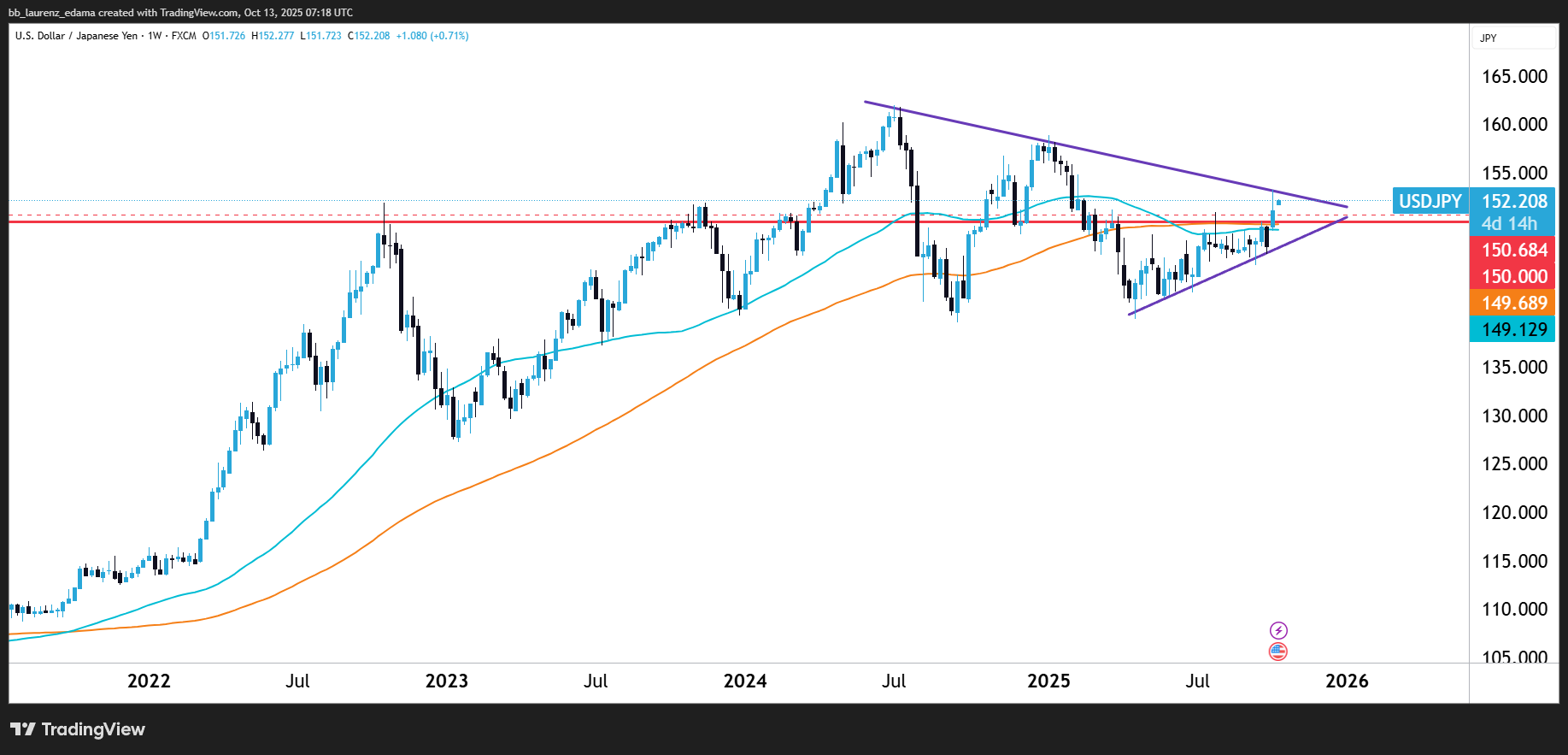

Technically, the daily chart shows strong bullish momentum after price cleared 150.70, turning it into support. The next key resistance sits at 153.10, followed by 154.50, levels that have triggered sharp reversals in the past. As long as the pair holds above 150.70, buyers remain in control.

Looking at the 1-week chart, the bigger picture supports the same story. Price action shows a clear uptrend resuming after months of consolidation, with moving averages now aligning upward. It also shows a strong rejection on the 153 level. It is now showing a squeeze inside the symmetrical triangle pattern. The long-term structure still favors the bulls but the risk of break out on either side, is still possible.

My Takeaway:

USD/JPY’s rally above 150-152 highlights strong U.S. dollar demand, but traders should tread carefully. Tokyo tends to step in quietly before the market expects it, and with yields stretched, volatility could spike fast. My bias stays bullish while above 150.70 but this is a zone where even bulls keep one finger near the exit button.