The U.S. dollar continues to dominate across major pairs, and USDCAD is no exception.

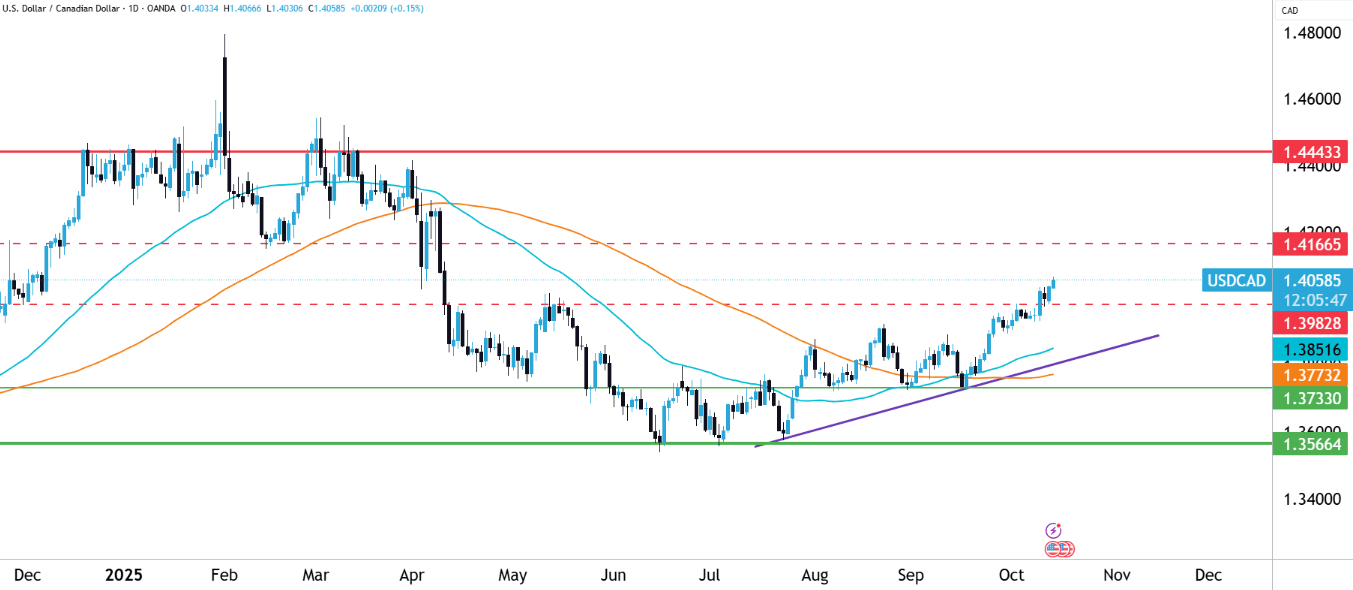

The pair is trading near 1.4058, holding firm after a clean breakout above 1.3980, its previous resistance. That move came as the greenback stayed supported by resilient U.S. inflation data and hawkish Fed remarks, while oil, Canada’s biggest export, failed to sustain any rebound.

From a technical view, momentum remains firmly bullish. Price sits comfortably above both the 50-day and 200-day SMAs, confirming trend alignment to the upside. The next major test lies at the 1.4165–1.4170 resistance zone, an area that previously triggered heavy selling pressure in early 2024. A daily close above this level could clear the path toward 1.4450, with extended upside potential to 1.4720 if dollar strength continues.

Zooming out to the weekly chart, USDCAD maintains a solid long-term uptrend, supported by a rising trendline dating back to 2022. The pair continues to respect higher lows, a clear sign of buyer control. Unless price falls back below 1.3850, the structure remains bullish.

My Takeaway:

USDCAD’s direction still favors the bulls. The combination of a strong dollar, steady U.S. yields, and soft crude prices keeps the Canadian dollar on the defensive.

Short-term pullbacks may offer better entries, but as long as 1.3980 holds, the path of least resistance points higher toward 1.4165, and possibly beyond.