When you hear traders or economists talk about GDP, they’re talking about the backbone of an economy. But what does it actually mean and why should forex traders care, especially this week with UK GDP data around the corner?

What is GDP?

GDP stands for Gross Domestic Product. In simple terms, it’s the total value of all goods and services produced in a country over a certain period, usually quarterly or yearly.

It matters because it’s the broadest measure of economic health.

A strong GDP growth can signal a healthy economy which is growing, which can be bullish for a currency.

A weak or falling GDP can signal trouble prompting support from the government or a central bank, which can lead to a weaker currency.

UK GDP Upcoming

The UK releases its latest GDP figures this Friday and the forecast isn’t great.

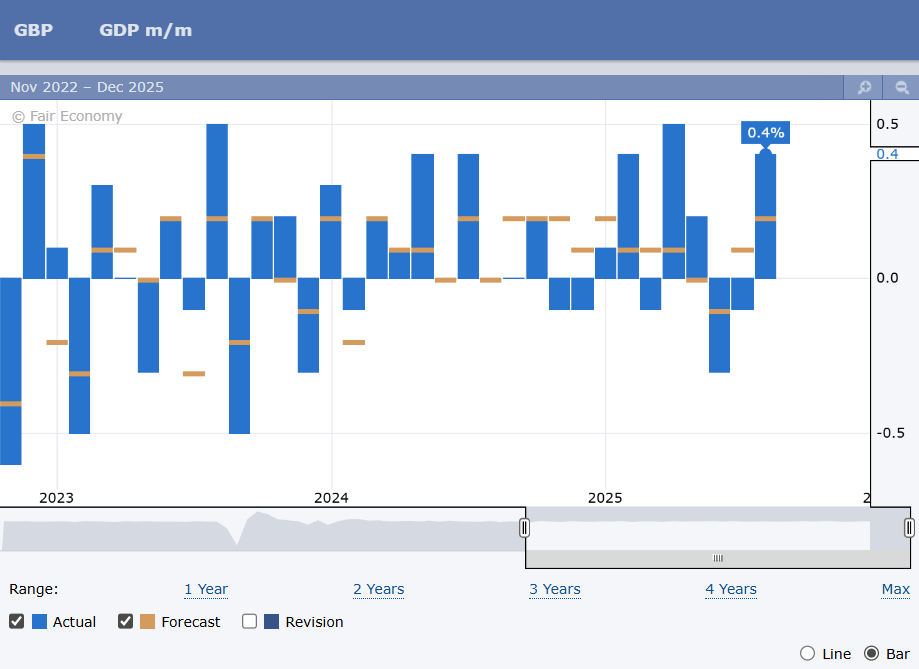

In August GDP rose to 0.4% up from the previous -0.1%, which triggered talks about the Bank of England's future rate path. This month its forecast to be weaker at 0.0%.

If this happens it could raise doubts about the UK economy's resilience, especially with inflation still running hot.

What scenarios could play out

A weaker than expected print (below 0.0%) could trigger GBP selling, as it suggests the economy is stalling while the government still faces tough fiscal challenges.The price of GBP/USD is trading up at the 1.3575 resistance, this level could hold in this scenario.

An inline or stronger print (0.1% or more) could give GBP a short-term lift, especially since hedge funds are already holding heavy short positions in the pound as seen in the Commitment of Traders report. A break of the 1.3575 level could see the price trade up to 1.3750.