Today the United Kingdom’s central bank has decided to leave interest rates unchanged at 4.50%. The monetary policy committee (or MPC) vote showed only one member, Swati Dhingra, voted for a 25 basis point cut. In the last meeting, a hawkish member Catherine Mann also agreed by voting for a quarter-point cut, but this time around she has done a U-turn. So a fairly hawkish hold from the outside looking in.

But there’s a BIG problem.

Stagflation.

You will become very familiar with this word as inflation pressures persist and growth forecasts decline globally.

It is the one outcome a central bank wants to avoid.

What is stagflation?

Stagflation is a combination of high inflation, slow economic growth and high unemployment.

I can hear the cogs turning within your brain, and you’re right.

How does a central bank provide stimulus to the market to prevent high unemployment without increasing inflation pressures?

You can see why this is now a big dilemma for many central banks, not just the UK. Many other countries are going through the same thing, mainly keeping one eye on the United States.

The actual textbook definition of stagflation is:

“Stagflation is a period where the economy experiences both stagnation (slow or no growth) and inflation (rising prices) simultaneously.”

Did you know that there is an indicator out there called the ‘Misery Index’ which pits the Unemployment Rate + Inflation Rate together?

Is the United Kingdom facing stagflation?

Well, we can have a look at the numbers.

First, let’s start with inflation. CPI (consumer price index) rose to 3% in February vs the previous 2.8%. Not only this but CORE CPI which leaves out volatile sectors such as food and energy rose to 3.7%, up from the previous year's 3.2%. The target range of inflation for a central bank is 2%. So, the UK central bank has a dilemma here.

One way that a central bank controls inflation is by raising interest rates, but they can't do that right now, because of the next two points that make up stagflation.

Second, the unemployment rate. Now the unemployment rate in the UK hasn’t changed too much as it has remained at 4.4% since November of last year. To put that into perspective, the rate of unemployment was at 4.2% just before the COVID-19 pandemic. So in theory the job market isn’t too bad in the UK. But this is causing a problem of its own, as lower unemployment rates can mean more money in the pockets of consumers, leading to more demand, which is why inflation rates are persistent.

Thirdly, and the most problematic for the UK economy is GDP or Gross Domestic Product. When the new Labour government came into parliament, Chancellor Reeves was tasked with the new budget. In this budget she announced less government spending, and higher taxes, to “stop the rot” under the previous government. The problem with that is it prevents growth. The latest release of the UK GDP figures on March 14th showed this, falling to -0.1% down from 0.4% the previous month.

UK Inflation vs UK Unemployment vs UK GDP Growth

So to put it plainly, the UK isn’t in stagflation…yet.

If the lack of growth flows into higher unemployment whilst inflation remains elevated, then the UK has real problems.

Looking across the data, if the unemployment rate rises beyond the somewhat stable 4.4%, this could spark some selling of the GBP. The central bank may have no choice but to prioritise employment over inflation in the short term.

How did the GBP/USD price react?

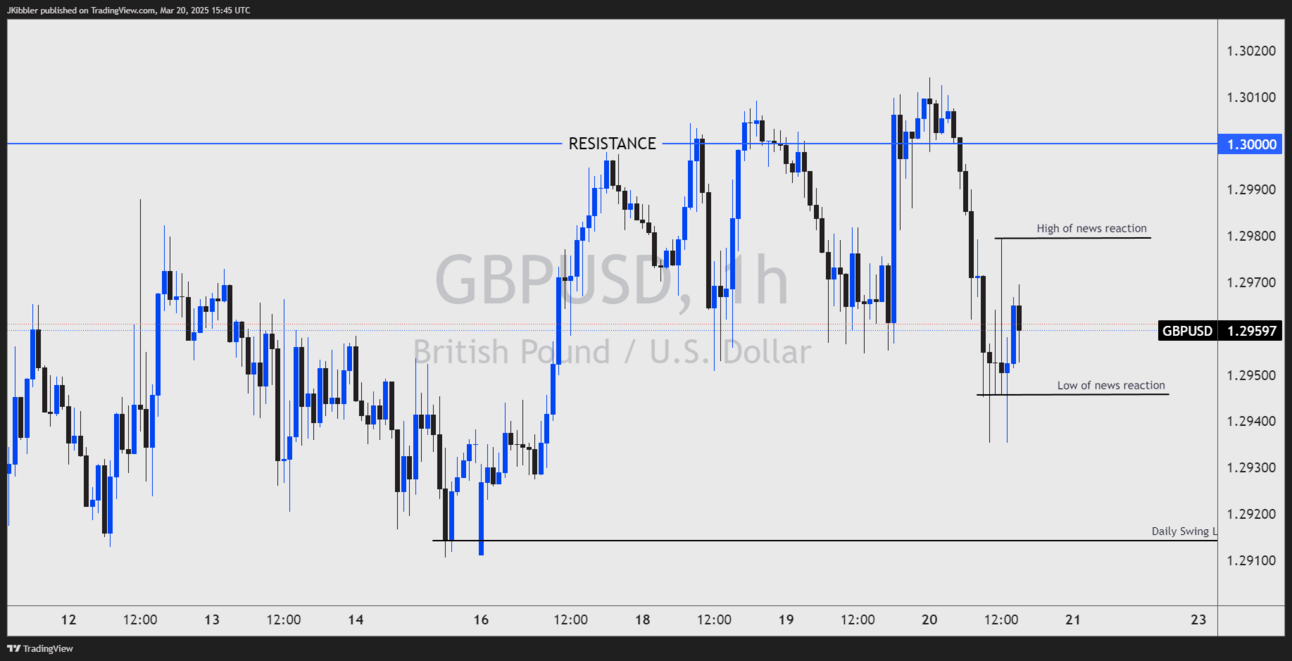

Initially, the GBP/USD price spiked from a low of 1.2950 up to 1.2980, but this was short lived. The price has since traded lower towards 1.2940. The one saving grace for this forex pair is the USD weakness. If we see a switch from the market to a stronger USD, then GBP/USD prices could trade much lower.

If the price remains below the weekly resistance of 1.3000 then a move back down towards the 1.2700 would be a likely outcome, in my opinion.

GBP/USD 1 Hour Chart

What about GBP/JPY?

I was having this discussion with Will from the London Live Trading Floor. The GBP/JPY price has suddenly become interesting to me. If the market sees no path forward but rate cuts for the Bank of England, then the GBP may be vulnerable to stronger currencies. The strongest currency at the moment is the Japanese Yen. If data from Japan continues to show higher inflation rates and stronger wages, then the Bank of Japan will hike interest rates.

This means that the GBP could be weaker against the JPY as the two central banks' policies diverge.

When looking at the GBP/JPY chart we can see the price is rejecting a weekly high of 194.50. If this continues then the price may trade towards 2024 lows of 182.50. However, if the price trades above 194.50 then this idea becomes invalidated to me, and I will reassess the fundamentals driving this market.

GBP/JPY Daily Chart

Well then traders in summary, while the UK is not yet in stagflation, the warning signs are becoming clearer. Inflation remains stubbornly high, economic growth is stalling, and if unemployment starts to rise, the Bank of England could face an impossible dilemma.

The impacts on the forex market could be vast, especially when looking at the GBP.

Moving forward, keep an eye on the economic data, and those geared towards unemployment, inflation and growth.

Peace!