There are three things that a trader can control.

How/When to enter the market.

How/When to exit the market.

How much risk to apply.

Notice how I didn’t mention ‘control the markets’ in those statements. That’s because they are random, they are driven by so many variables.

Let’s check out number one again.

How/When to enter the market.

Many retail traders try to find trading opportunities every day, some taking multiple trades per day.

But even these types of traders can struggle when the markets don’t seem to align.

And this is what we have in front of us right now.

Markets that typically correlate to each other are getting out of whack, and that makes it difficult to trade for anybody.

So before you go getting FOMO and switching strategies on me, let’s discuss what’s going on.

The large reason behind this is President Trump's announcement of reciprocal tariffs. Although the market has known about this for a while, it seems we are yet to see how aggressive these tariffs will be, or if there will be a few surprises thrown in there.

This uncertainty brings turbulence to the market as traders begin to anticipate what could happen next.

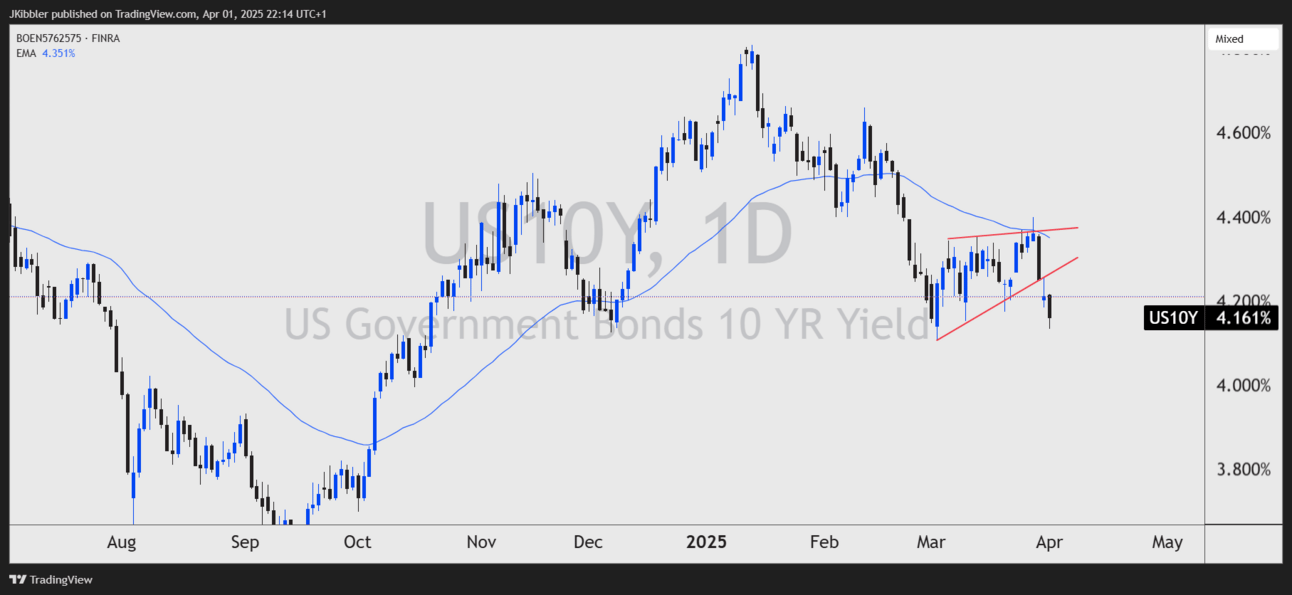

The US 10 year treasury bond yields are falling. Traditionally this means that traders are buying bonds, this can lead to the USD falling, due to interest rate cut expectations.

US10Y Falling

When bond yields fall it can signal the following:

Recession Concerns: Bond yields falling can signal concerns about economic growth. Especially when we see flows out of risk assets, such as stock markets, and inflows into bonds, particularly government bonds, which are considered low risk. We recently saw the yield curve (the difference between short term and long term yields) invert, which often leads to a recession.

Lower Inflation Expectations: if traders expect lower inflation rates in the future, they may buy bonds to lock in returns, which can cause bond yields to fall. This could signal that interest rates will be lower, or that easing is coming from a central bank.

Central Bank Expectations: As stated above falling yields can reflect expectations that a central bank will cut interest rates to stimulate the economy. This often happens during times of economic weakness, where a central bank wants to encourage borrowing and investing.

Either point we use here, falling bond yields often tell us that the market sentiment has shifted towards caution, indicating that traders expect economic growth to slow down, or that central banks will need to act to provide stimulus.

Yield Curve Inversion Leading To Recession

I say the markets are confusing because we can often see the U.S stock market rise when yields fall. That’s because it can signal lower inflation and interest rate expectations, which can see stocks rally, like in late 2022.

But unlike back then, consumers are becoming worried about future inflation. Largely down to the tariffs that President Trump is going to impose.

If the bond yields continue to fall as well as the stock market, then I think this could spell some economic troubles ahead.

This brings me back to one of the points we can control. How and when we enter.

I think when we see an event coming up like this it can be easy to get ahead of ourselves and put ourselves into a position where we can make some silly decisions.

I remember back when I traded the first time Trump was voted in as president. I for one did not expect him to win the vote, and bought up gold only for him to win and for the commodity to tank.

What I am trying to say is, when the markets become a little unhinged it’s best to sit on cash.

Why bother putting substantial risk into the market when it is difficult to predict what will happen next.

I have seen so many calls over the last week that this stock market dip is just a ‘dip’ and that it’s one that should be used for long opportunities.

That to me, was a little risky.

For me I will be sitting on the sidelines until April 2nd is over with and we can understand how the market sees this fresh round of tariffs.

Good luck out there traders!