The Australian dollar has been quietly building strength, and this week’s price action plus central bank messaging gives us a clearer direction. If you’ve been waiting for AUD to show its hand, this might be the moment.

Let’s break down what’s driving the aussie… and where the best opportunities may sit.

Why AUD Strength Is Back on the Table

The Reserve Bank of Australia’s latest communications lean hawkish, and that’s the big story behind the aussie stabilising and starting to push higher.

Here’s the key points:

The RBA held rates at 3.60%, but made it crystal clear inflation is still a problem.

Core inflation in Q3 came in materially hotter than expected.

Housing costs, services inflation, and private demand are all picking back up.

The Bank even labelled monetary policy as only “a little restrictive” central bank code for: “We’re not cutting anytime soon.”

Markets agree. Rate-cut odds for December have collapsed to under 5%, meaning traders now think the RBA has finished easing.

Where This Really Gets Interesting: GBPAUD Shorts

If you’re looking for a directional play, GBPAUD is ticking the boxes for me.

AUD is getting stronger and GBP is getting weaker.

The GBP is struggling to gain any traction as markets are now pricing a 78% chance of a December rate cut from the Bank of England.

Weak growth, rising unemployment and sticky inflation is making the GBP unattractive to investors.

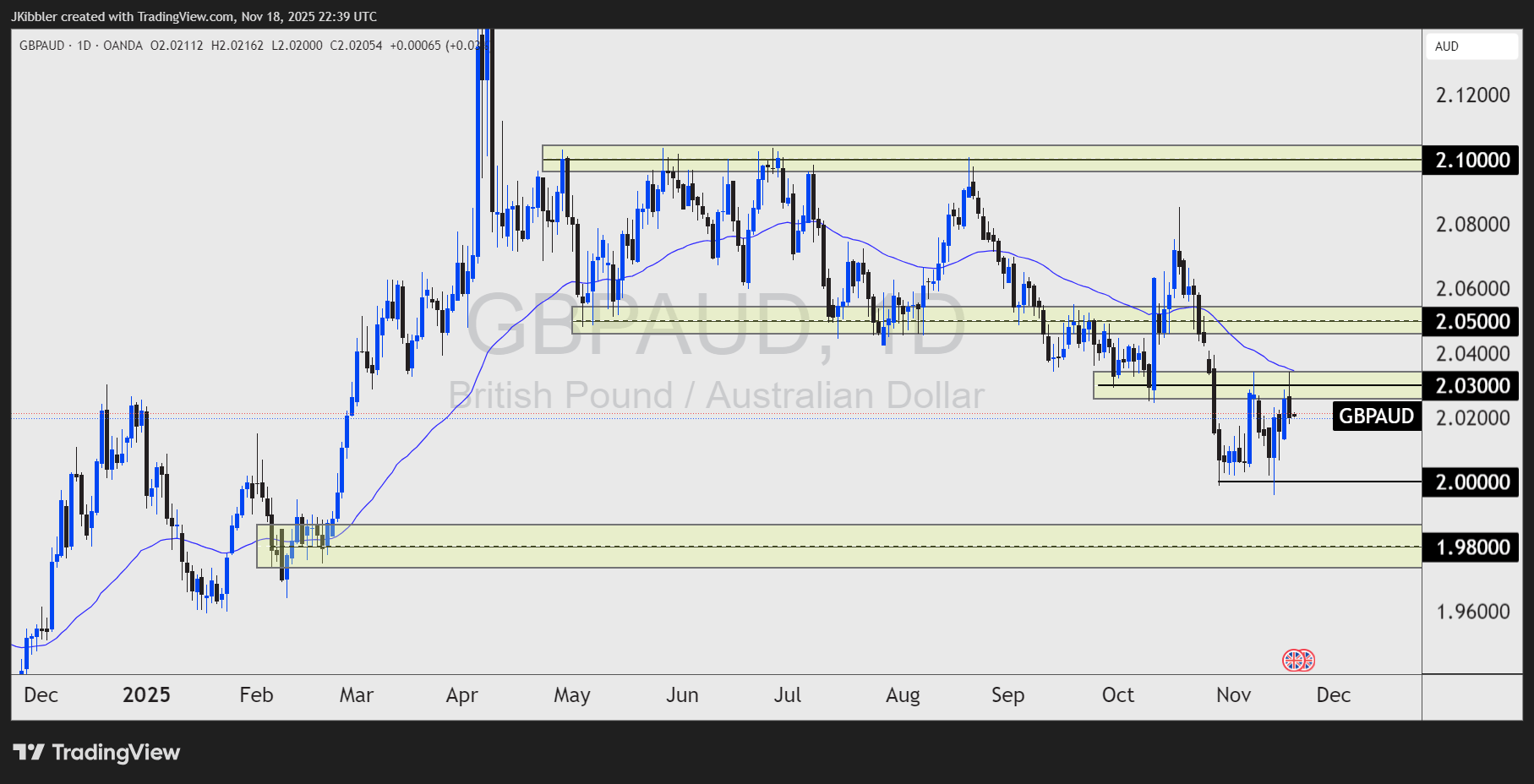

GBP/AUD Technicals

The price is below the 50 day moving average.

A rejection of the current levels could see the price move back to the lows of 2.000. A break of this level will see the price trade towards 1.9800.

This will be invalidated if the price forms new highs above 2.0300.