Gold is taking a breather after testing a near two-week high. While Friday’s weaker NFP report sparked a fresh wave of rate cut bets for September, the yellow metal hasn’t pushed higher just yet. That’s partly due to modest USD strength and a risk-on mood that’s keeping a lid on bullish momentum. But don’t count gold out. With tariffs heating up and Fed expectations rising, any dip could be seen as a buying opportunity.

Here’s what you need to know and why it matters.

1. Gold Finds Support After Weak NFP

Gold bulls got a shot of momentum after U.S. jobs data missed the mark. July’s NFP report pointed to a cooling labor market, reinforcing expectations that the Fed will cut rates in September. This sent U.S. Treasury yields lower and gave gold a lift above $3,380 on Monday, though buyers have since stepped back.

The yellow metal now trades near $3,370, with the $3,385 swing high acting as short-term resistance. Despite the pause, the fundamental backdrop remains supportive.

2. Trump Tariffs Keep Safe-Haven Demand Alive

Last week, President Trump signed an executive order imposing sweeping tariffs on dozens of countries, set to take effect August 7. The uncertainty around global trade, especially U.S.-China talks, continues to underpin demand for safe-haven assets like gold.

With U.S. Treasury Secretary Scott Bessent noting that any extension of the tariff truce with China is still undecided, traders remain on edge. The geopolitical risk is another layer of support for gold amid broader market noise.

3. Fed Cut Odds Climb Above 90%

According to the CME FedWatch Tool, markets are now pricing in over a 90% chance of a 25-basis-point rate cut in September. Combine that with recent weak factory orders data (-4.8% in June), and the case for easing grows stronger.

Rate cuts typically weigh on the dollar and support gold. But for now, the dollar has stabilized after slipping post-NFP, creating a short-term tug-of-war.

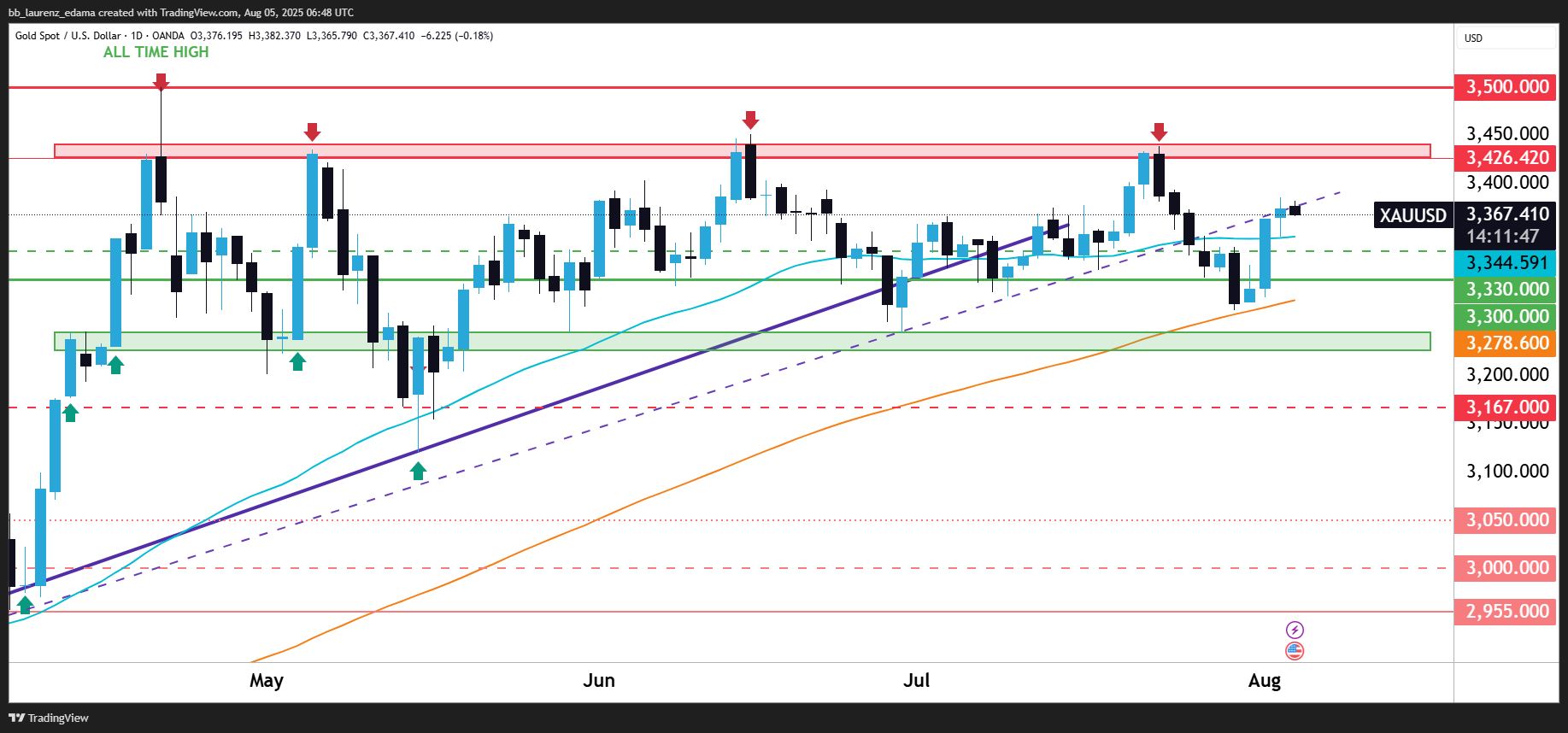

4. Technical Setup Favors Dip Buying

Gold remains in bullish territory after bouncing off the 200-day SMA and reclaiming trendline support. The $3,344–$3,330 zone held firm, making it the key dip-buying area. Price is hovering near the $3,366 pivot, a hold above could drive a push toward $3,385 and $3,426.

If bulls lose grip, watch the $3,300–$3,278 zone for renewed demand. As long as support holds, the bias leans toward buying dips, with the all-time high near $3,500 still in sight.

Here’s the Takeaway:

Gold is holding steady below its recent highs, caught between rate cut optimism and modest dollar strength. With geopolitical tensions rising and the Fed likely to cut in September, the dips are increasingly looking like buying opportunities, not breakdowns.