The U.S. government shutdown has just wrapped up, which means the usual monthly jobs data were delayed.

The data for September is expected to be released today with forecasts showing +53k in employment and a 4.3% unemployment rate.

But does the market care?

Since the report covers September, by the time it comes out it will feel like a throw-back.

Economies move fast, and traders are already looking ahead to what’s happening now.

Some analysts argue the market may “look through” the print because it’s dated.

The market may be more concerned with forward guidance and data that is forward looking.

My Take

I think all employment data is important, at the beginning of the year my main concern was unemployment rates rising towards 5%. I do worry about the recency of the report, and the market narrative right now is more towards the AI story.

That being said, the market will tell all. If the market shows a strong reaction then we know it cares, if the reaction is minimal then we know it doesn’t.

Ultimately, it will come down to expectations.

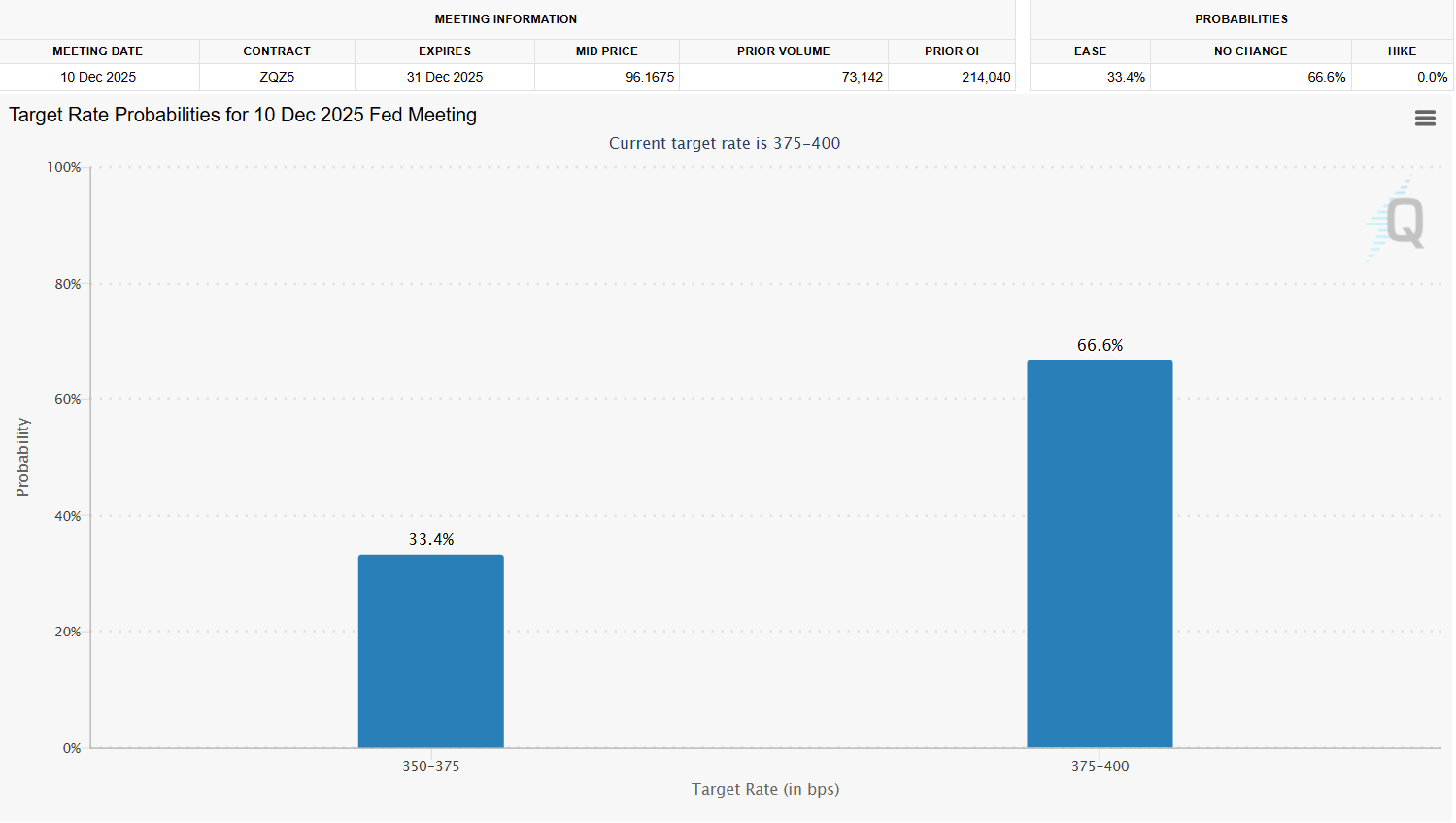

We have seen a big shift recently in how the market sees the Federal Reserves rates playing out in December.

It now stands at a 66.6% chance of a rate pause, just last week it was a 62.9% cut. If the NFP numbers come in strong then the market may take it more seriously, and the chances of a cut coming in December will continue to fade.

In that scenario I imagine USD will continue to strengthen.