If you’ve been watching the GBPAUD forex pair you’ll know that it’s trading in a range. But looking ahead at the fundamentals and sentiment, this pair is on my radar for a break.

AUD Side of the Story

The Aussie dollar has been caught up in a bit of back and forth. On one hand GDP is forecasted to show growth in Q2 to 0.5% vs 0.2% in Q1 which is positive. On the other hand, the RBA has already cut rates to 3.60%, with implied rates showing a decline to 3.30% by November.

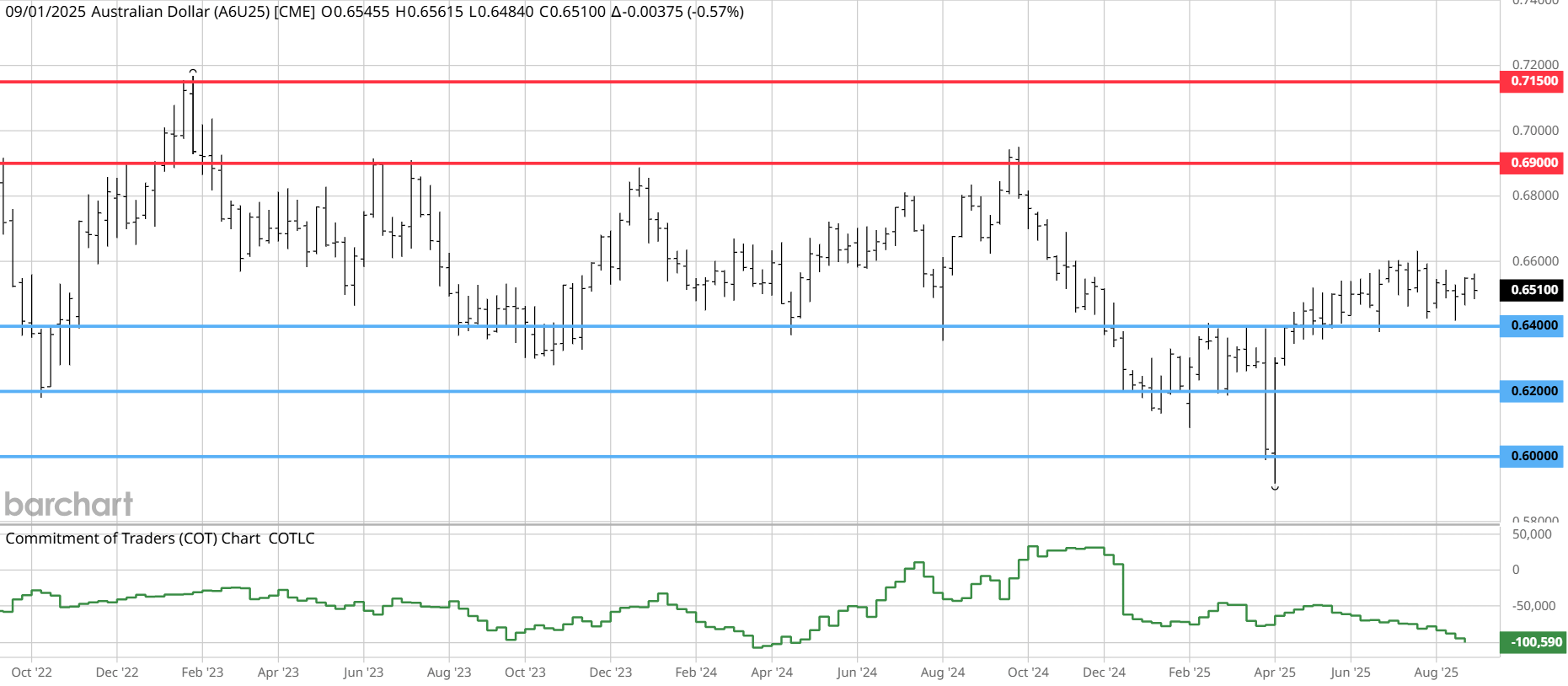

But that being said, sentiment analysis shows something interesting. The Commitment of Traders reports show non-commercials are holding extreme short positions in AUD futures. This overcrowding or extreme positioning can often see sharp reversals. Upside surprises in data could be a catalyst for a strong AUD.

GBP’s Turn

The GBPUSD price fell sharply after UK bond markets ripped higher. The 30-year gilt yields hit its highest level since 1998. Normally, higher yields would support a currency, but in this case it’s all about fiscal stress, not optimism.

Investors are uncertain about the latest plans to raise tax or cut spending by the UK government and are voicing their concerns by sending yields higher.

Uncertainty = Weakness and this could be the path for the GBP in the coming weeks.

Breakout Opportunity?

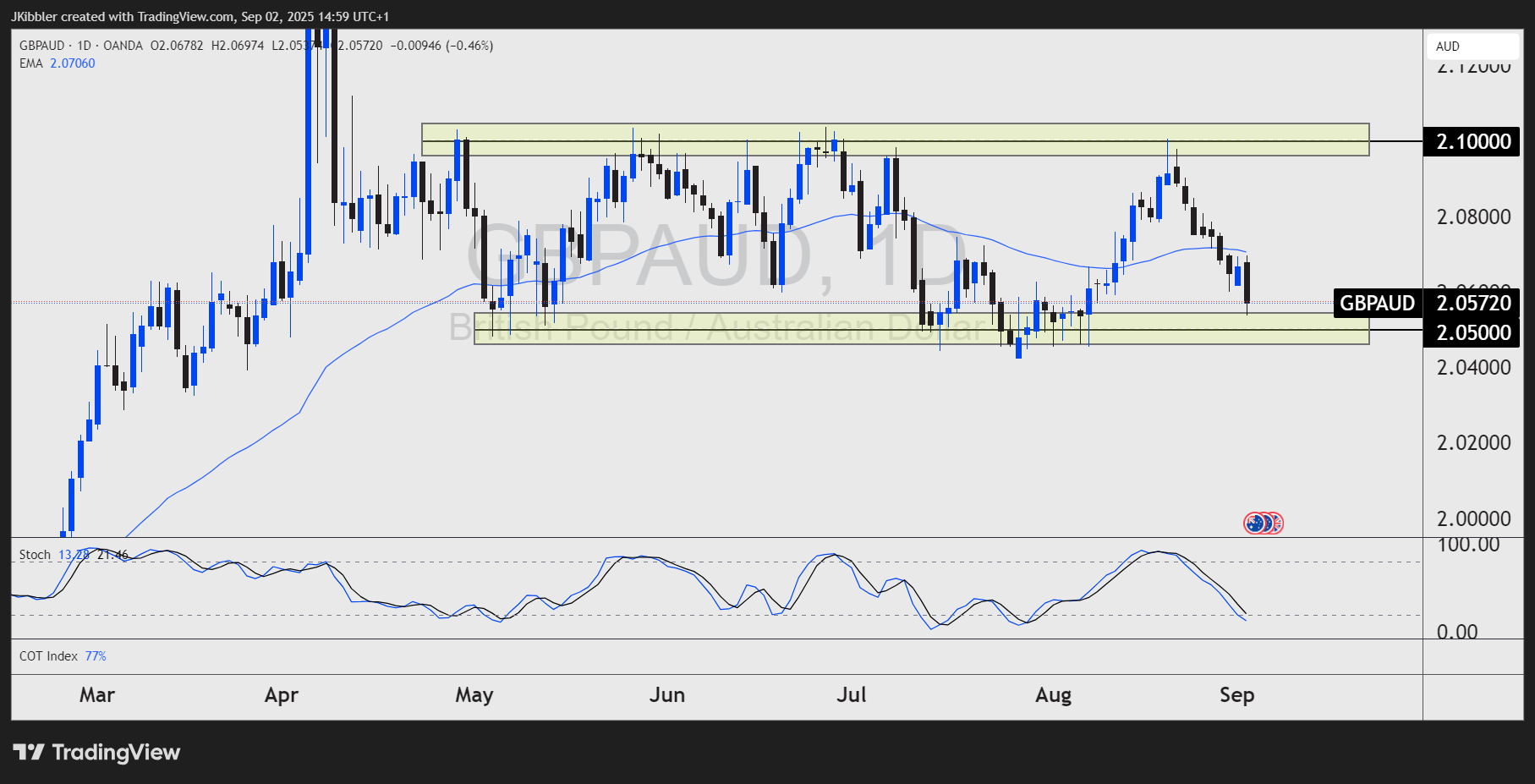

The price of GBPAUD is in a trading range, and this may remain in the near term. But there are two scenarios I am watching.

Breakout: If the price breaks through the range lows, then I will be looking for a retest and to short lower in line with the fundamental and sentiment view.

Short from range highs: If the price however remains within the range, then I favour shorts instead of longs. So a rejection of the resistance highs would be ideal for a short for me.

Traders, this is one I am keeping an eye on this one once again, will the breakout happen this time?