Good morning. The New York Stock Exchange is so old it predates electricity,it was founded in 1792 under a buttonwood tree on Wall Street. Traders back then tracked prices with paper and ink, not screens.

From handwritten ledgers to high-frequency algorithms, the hustle has always been the same: buy low, sell high.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

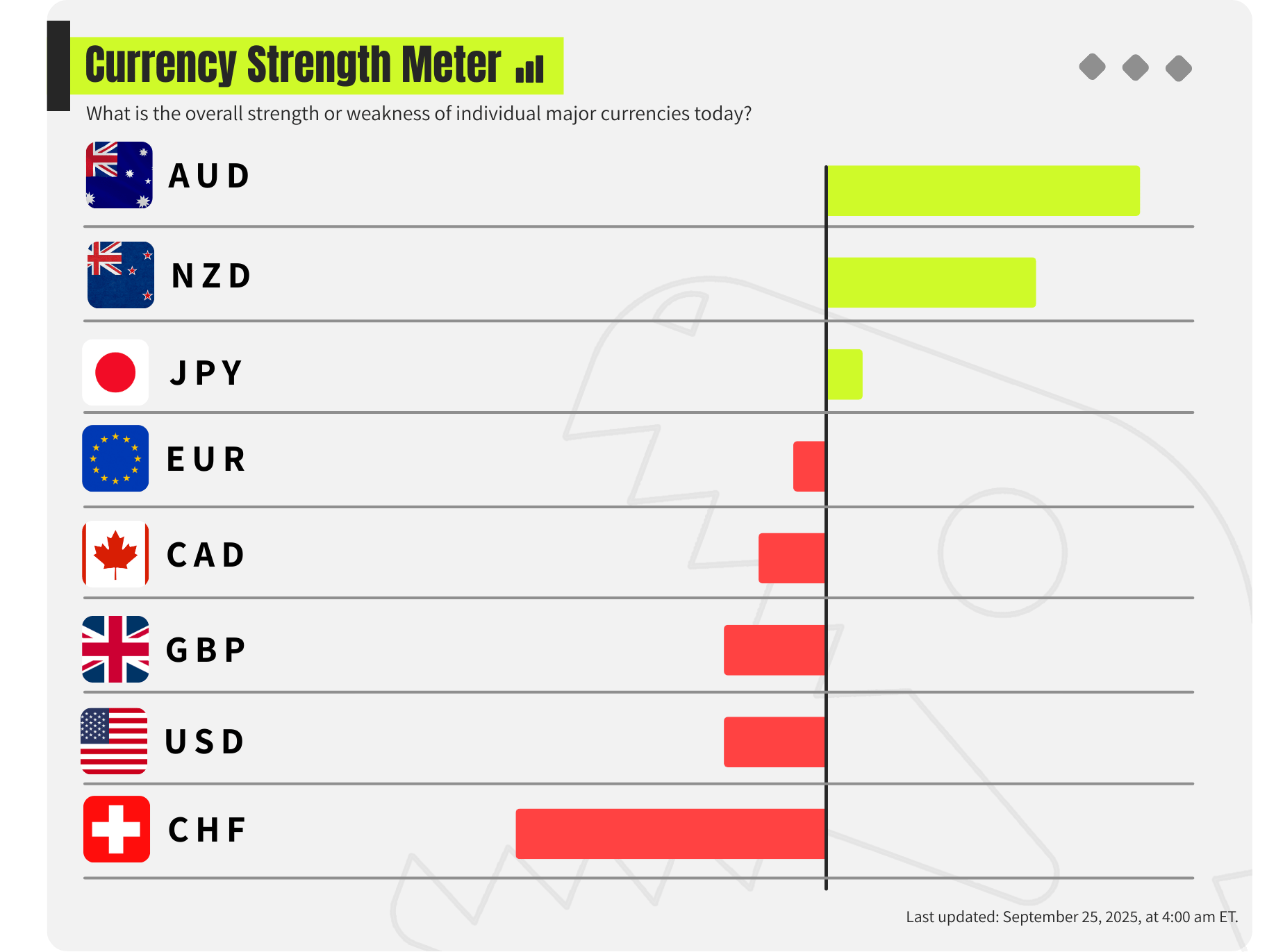

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

NEWS

Smaller Accounts Just Got a Big Win

For years, smaller retail traders lived under one of the most frustrating rules in U.S. markets: the infamous $25,000 pattern day trading (PDT) requirement. If your account didn’t clear that hurdle, you were capped at three round-trip trades every five business days, unless you wanted to risk a margin violation and a frozen account.

That wall may finally be crumbling.

Here’s what you need to know.

1. The Old Rule, Built in the Dot-Com Era

Back in 2001, regulators dropped the PDT rule in response to the internet bubble. The thinking was simple: keep small traders from blowing themselves up chasing volatile tech stocks. To day trade actively, you had to park $25,000 minimum equity in a margin account, a huge ask for most retail investors.

Fast forward two decades, and that threshold has become one of the most debated rules in U.S. finance. Critics say it punished small accounts, pushed traders offshore, and never truly stopped reckless trading.

2. What FINRA Just Approved

On Tuesday, FINRA voted to scrap the fixed equity threshold. In its place: an intraday margin rule. Instead of a blanket $25K requirement, traders’ buying power will be determined by the same maintenance margin standards that already apply to positions held overnight.

In practice, this means your risk limit depends on the positions you actually take, not an arbitrary account minimum.

The decision now heads to the SEC for final approval. If cleared, it could reshape the landscape for smaller active traders.

3. Why This Matters for us Retail Traders

For the first time in 20+ years, active trading may actually be accessible without a five-figure balance. Smaller accounts could scale intraday strategies more freely, especially in fast-moving markets like options.

It could also encourage more participation on platforms, which already saw its shares jump after the news. For brokers, this change likely means higher volumes, more commission flow, and more active clients.

4. A Sign of the Times

This overhaul reflects how much the market has changed since 2001. Technology has leveled the playing field: zero-commission apps, fractional shares, and real-time data feeds mean retail now trades in an environment that looks nothing like the early dot-com era. Regulators are finally catching up.

My Takeaway

If the SEC signs off, this could be one of the most transformative shifts for retail access in decades. But access cuts both ways. More freedom means more responsibility, margin is still margin, and risk is still risk. The training wheels may be coming off, but whether traders use that freedom wisely will decide who wins and who blows up.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

TRADER INSIGHTS

Why Trading Less Made Me More Profitable

Look I used to be that trader, active on lower time frames, trying to catch the key turning point to maximise my profits as much as possible. However, working full time in the broker industry left me with less screen time. Ironically this has actually improved my trading.

What I did

Switched from low time frames to higher time frames like the 4hr and Daily.

Took fewer traders, but planned more thoroughly.

Focused on macro themes and the narrative of the market.

What Changed

My average risk to reward went much higher. Up from 1:1.2 to 1:2.68.

My win rate dropped from 68% to just 54.2%.

I had a 10 trade losing streak, but only lost 1% overall in that time.

Mentally, I was calmer and clearer.

Why it’s worked for me

Less emotional after a loss.

Forced to aim for higher profit targets, letting my winners run.

You’re not chained to the chart all day.

If you’re looking to radically change your trading behaviours then this could work for you. Calm the mind, use time as your friend and get a hold of those trading demons.

CHART BREAKDOWN OF THE DAY (BTC/USD)

AUD/USD is consolidating just under the 0.6600 resistance after its recent pullback from 0.6706 highs. The pair is still holding above the 50-day and 200-day SMAs, with support layered around 0.6540–0.6530. As long as buyers defend this zone, the broader uptrend stays intact, keeping the door open for another push toward 0.6700. A decisive break below 0.6530, however, could shift momentum back toward 0.6500 and 0.6400 support.

DAILY TRADING PSYCHOLOGY NUGGET

Discipline is doing what needs to be done, even when you don’t feel like it.” In trading, success comes from consistency, sticking to your rules and repeating good habits even when emotions push you to do otherwise.

TODAY’S MOST TRENDING MARKET NEWS (SEPTEMBER 25, 2025)

credits: Christian Hartmann/File Photo

Oil prices dipped slightly after reaching a seven-week high yesterday, as traders booked profits and weighed signs of weaker seasonal demand and increasing OPEC+ supply. (source: reuters)

GAMES

Trading Brain Training

I rise with greed, I fall with fear,

Bulls and bears pull me near.

From Wall Street’s bell to global fame,

I’m the world’s most-watched game.

What Am I?

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

ANSWER

Answer: The Stock Market