Good Morning. In 2015, a hedge fund bought an entire neighborhood. Yep, a fund called Raineth Housing bought 200+ homes in a single Sacramento suburb, turning it into a rental empire overnight.

Imagine checking Zillow… and realizing Wall Street owns your street.

-Jordon Mellor, Jonathan Kibbler, Patrick Lewis

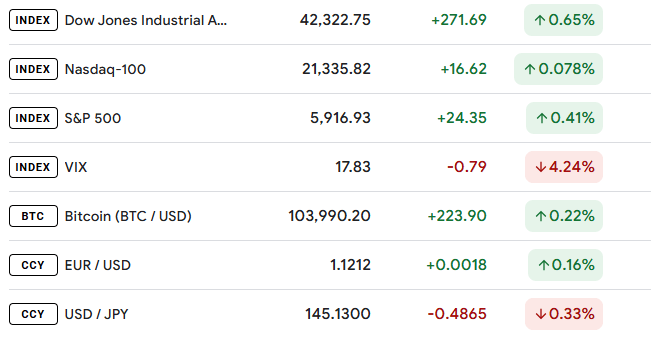

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

The Thing That Wrecks My Trading (And I Hardly Notice)

I used to think my biggest threat was a red trade. Turns out, the real danger is trading on autopilot because my brain is cooked.

Everyone talks about risk management. But nobody warns you about losing your edge when your head gets foggy. It sneaks up. One minute, I’m sharp. The next, I’m just clicking buttons and calling it “work.”

Staring at charts for hours messes with my focus. By noon, I’m reacting, not thinking. I once read that judges hand out tougher sentences late in the day, just because they’re tired. I truly believe traders are no different. By the end of a session, I’m more likely to break my own rules.

Picture your brain like a phone battery. Every trade, every chart, every decision drains it. If I don’t charge up (step away, take a walk, eat something) I start making dumb calls.

This is how it looks when I’m running on fumes:

Jumping into setups I can’t explain

Overtrading just to feel busy

Ignoring stops or risk because my brain’s fried

Letting small losses tilt me off the rails

I’ve burned myself out too many times. Dr. Brett Steenbarger says real traders don’t go all day. They focus on quality windows, maybe a couple hours, then they walk.

If I want to keep my edge, I have to protect my focus. That means knowing when to stop and recharge. No badge for grinding myself into mush.

How do you guys prevent brain fog?

SPONSOR

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

MARKET ANALYSIS

Yields Are Ripping, Is It Time to Freak Out?

I felt a punch in the gut when I saw the US 30-year pop to 5%.

Japan’s 30-year just clocked 3.01% (the highest since Y2K). That’s not supposed to happen. Everyone’s talking about it for a reason. Yields this high mean the market’s spooked, and when bonds get wild, the rest of us feel it.

Let’s cut the noise. Here’s what’s really happening:

1. Currencies move with yields.

When big economies see yields spike, currencies usually chase. The US 10-year and USDJPY are classic, when one jumps, the other follows (check the chart, it’s textbook… until it isn’t).

Right now, Japan’s 30Y yield is up after a hot auction, but sellers bailed quick to lock in profit. Less foreign bond buying means money stays in Japan, which could put a floor under the yen. With the BOJ still holding back on rate hikes, the JPY might wake up. I’ve been long USDJPY lately, but if 148.00 keeps holding, I’m watching for the reversal. Hedge funds are loading up on yen, maybe not a bad time to follow.

2. Gold’s still got juice.

Rising yields scream inflation or tighter money. That can be a headwind for gold, but with tariffs still stoking the fire and inflation not cooling, gold and silver look stubborn. Remember 2022? Well, Gold lagged stocks, then ripped higher. Tariffs are sticking at 10% minimum, even more if you’re on that naughty list (looking at you, China).

3. Stocks… brace yourself.

Inflation expectations are a gut punch for equities. When capital gets expensive and margins get squeezed, stocks bleed. The US-China deal gave us a bump, but one slip and we’re right back in the red.

Here is my napkin cheat sheet:

Yield Spike | What It Suggests | Market Reaction |

|---|---|---|

Short-term up | Central bank tightening | 🔼 FX, 🔽 stocks, ❓ gold |

Long-term up | Inflation fears, fiscal issues | 🔽 stocks, 🔼 gold (maybe), ❓ FX |

Short > Long (inversion) | Recession risk | 🚨 Risk-off |

Long > Short (steepening) | Reflation/fiscal stress | ⚠️ Volatility in all asset classes |

I’ve ignored bonds before and paid for it. Don’t make the same mistake. When yields break out, nothing trades the same.

WATCH

Holding Through NFP.

GAMES

Guess The Chart

You zoom out on a weekly chart and see:

• A parabolic rise in 2020

• A brutal crash in 2022

• Choppy recovery in 2023–2024

• Volatility now creeping in again

Is it:

A) ARK Innovation ETF (ARKK)

B) Bitcoin

C) Zoom Video (ZM)

D) GameStop (GME)

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.*

🦖 Check out these recommended trading tools.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Understand how Market Makers work.

ANSWER

B- Bitcoin