Good Morning. In 2013, a fake tweet wiped $130 billion off the U.S. stock market. Hackers got into the Associated Press Twitter account and tweeted: "Breaking: Two Explosions in the White House and Barack Obama is injured."

Markets tanked instantly, the Dow dropped 150 points in under 3 minutes.

Once proven false, it all bounced back… but it showed how fragile the system really is.

-Patrick Lewis, Jordon Mellor, Shaun A

MARKETS

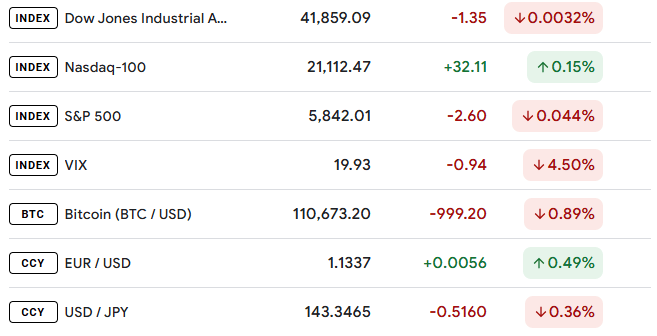

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

NEWS

U.S. & China Reconnect as Trade Talks Regain Traction

Traders love a clean chart, but this isn’t one of those moments.

The U.S. and China just fired up the diplomatic hotline again. After months of posturing and political potshots, senior officials from both sides picked up the phone, a sign that maybe, just maybe, the gears of progress are turning beneath the noise.

Here’s What Actually Happened and Why It Matters:

1. Direct Call Between Landau and Ma

On Thursday, U.S. Deputy Secretary of State Christopher Landau and Chinese Vice Foreign Minister Ma Zhaoxu held a call, their first since the Geneva summit. Both sides issued similar statements, a rare bit of coordination. While they didn’t confirm if tariffs were discussed, the symmetry in language shows deliberate alignment. That’s diplomacy doing its quiet work.

2. Geneva Summit Opened the Line

Earlier this month, the U.S. and China agreed to pause some tariffs and reestablish high-level communication. According to Eurasia Group's Dan Wang, the line of contact established in Geneva is "working" and this call is proof.

3. Beijing Signals It Wants Engagement

From Chinese Vice Premier He Lifeng’s meeting with JPMorgan CEO Jamie Dimon, to recent comments made by new U.S. Ambassador David Perdue, China is clearly signaling it wants to stay at the table for now. And that matters. You don’t bring out Dimon and Perdue unless you’re trying to project economic openness.

4. Markets React to Tone Not Just Action

No trade deal? No problem yet. This kind of high-level dialogue lowers headline risk. It reduces the chance of a surprise escalation. And for us traders? That stability gets priced into risk assets. Think USD/CNH, copper, even U.S. tech names exposed to China.

5. But Let’s Not Pretend It’s Fixed

China’s still calling U.S. chip bans "unilateral bullying." The fentanyl issue is unresolved. And mutual distrust is alive and well. One call doesn’t erase years of tension but it does shift the posture. Think of this like a bullish divergence in a downtrend: not confirmation, but worth tracking.

What Traders Should Watch

Keep an eye on any tariff headlines, even soft signals of easing could ignite moves in metals, energy, and global shipping. Meanwhile, fentanyl cooperation might seem unrelated, but it’s a priority issue for Washington and could quietly steer broader trade leverage. Don’t overlook its role in the negotiation landscape.

Also, watch how USD/CNH and broader risk assets react to any continued warming, those charts will be first to price in tone shifts. And tech tension isn’t going anywhere. With U.S. restrictions on Chinese AI chips still looming large, the next escalation could be just one press release away.

Final Thoughts

You won’t see a candle spike off this call alone. But this is how macro moves start not with fireworks, but with quiet signals.

Behind the posturing, both sides are feeling the economic drag. Reconnecting doesn’t fix anything yet, but it keeps the floor from collapsing.

And the takeaway with this is when the phones start ringing, the market starts listening.

Stay cautious still because policy’s still driving the narrative.

SPONSOR

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

MARKET ANALYSIS

Bitcoin's New ATH Just The Beginning

The digital asset, now aptly referred to as ‘digital gold’, has been on a steady climb, defying the volatile swings that have typically characterized previous bullruns. At its peak, (at time of writing) Bitcoin briefly touched $112,000 before settling slightly lower at $111,046, still a gain of more than 2% for the day.

Unlike the frenzied surges of previous cycles, where Bitcoin would skyrocket in a matter of weeks, this rally has been more measured, driven by growing institutional interest and real-world adoption. Large corporations, hedge funds, and even governments have increasingly added Bitcoin to their balance sheets, treating it as both a speculative investment and a hedge against economic instability.

Several key factors have contributed to this most recent, sustained upward trend. First, there’s the easing of trade tensions between the U.S. and China, which has improved market sentiment, encouraging investors to take on riskier assets. Second, the recent downgrade of U.S. sovereign debt by Moody’s has reignited concerns about traditional financial systems, pushing more capital toward alternative stores of value like Bitcoin.

James Butterfill, head of research at CoinShares, a leading crypto asset manager, noted that the rally is being fueled by "a mix of positive momentum, growing optimism around U.S. crypto regulation, and continued interest from institutional buyers." This institutional involvement has helped stabilize Bitcoin’s price movements, making it less susceptible to the wild swings that once defined the crypto market.

WATCH

Veteran Traders Use This Method

GAMES

Trading Quiz

Which commodity is most heavily influenced by El Niño weather patterns?

A) Crude Oil

B) Wheat

C) Cocoa

D) Natural Gas

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.*

🦖 Check out these recommended trading tools.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Understand how Market Makers work.

ANSWER

Answer: C – Cocoa. El Niño disrupts rainfall in West Africa, where ~70% of the world’s cocoa is produced.