Good morning. The first female stockbroker on Wall Street was Muriel Siebert in 1967, and she had to get a loan just to afford the seat on the NYSE because no one wanted to sponsor her.

She still made millions. Lesson? Never bet against a determined trader, especially in heels.

-Shaun A, David Rosa, Jordon Mellor

MARKETS

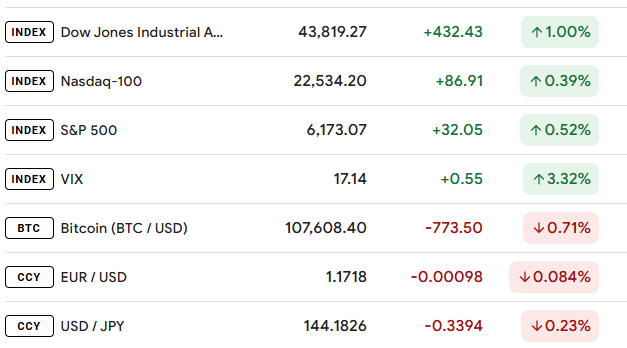

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

NEWS

Trump Says “No Deal,” Canada Hits Reverse

Canada just blinked 😉

In a Sunday night surprise, Ottawa announced it’s scrapping its digital services tax, just one day before the first payments were set to roll in. Why the sudden pivot? To get back on Washington’s good side.

This comes after President Donald Trump abruptly pulled the plug on all trade talks with Canada, slamming the tax as a direct hit on U.S. tech giants. The result? Canada pulled the handbrake, hoping to get trade negotiations back on track ahead of the July 21 timeline agreed at the G7 summit.

1. Trump Fires First, Canada Retreats

Trump’s weekend statement sent a clear message: digital taxes on American firms? Not on his watch. Canada’s tax, which included a 3% levy retroactive to 2022 and hit companies like Amazon, Google, and Meta, was about to go live on Monday. That is, until Ottawa hit pause.

The reversal shocked some observers, especially after Canada’s earlier insistence that it would hold firm. But with $762 billion in bilateral goods trade on the line, Ottawa had more to lose.

2. Carney Plays Diplomat

Giphy

Canadian PM Mark Carney framed the decision as a strategic reset. “Today’s announcement will support a resumption of negotiations,” he said, pointing to the July 21 deadline.

Finance Minister Champagne echoed the sentiment, calling the tax’s removal “vital progress” toward a broader U.S.-Canada economic and security pact.

Still, they’re not giving up total control. Ottawa stressed it will “take as long as necessary, but no longer” to land a comprehensive deal. That’s code for: We’re being flexible, but not forever.

3. Backlash Over Retroactivity

Gif by agt on Giphy

The now-rescinded tax was retroactive, applying all the way back to 2022. That’s where Washington had a real bone to pick. Treasury Secretary Scott Bessent called it “patently unfair,” noting that no EU country had imposed a similar retroactive charge.

Bessent confirmed an investigation was underway to measure the “harm to U.S. companies” and hinted at retaliation. The $2 billion tax estimate was a red flag to U.S. trade officials, and enough to spark real consequences.

4. The Bigger Picture: Global Tax Reform

The digital tax wasn’t just about revenue, it was part of a broader effort to fix outdated tax systems. Canada had long argued that digital titans profited heavily from Canadian consumers without paying their fair share.

But the long-term plan was always to roll these national taxes into a bigger multilateral framework. That’s still in the works, and the U.S. wants it to happen without unilateral moves in the meantime.

5. Markets React to De-Escalation

Markets perked up after the announcement. Risk appetite improved, and the Canadian dollar found some footing. Traders see this as a de-escalation, for now.

The U.S. has already secured limited trade agreements with other partners this month, and a thaw with Canada could be next if both sides keep talking. But any surprise from Trump, or a sudden policy pivot, could quickly put risk assets back on edge.

Here’s the Takeaway:

Canada just traded tax revenue for diplomatic breathing room. The digital tax is off the table, for now, but trade talks remain fragile. For traders watching CAD pairs or tech-heavy indices, this isn’t over.

Trump’s trade team plays hardball, and Canada’s move shows just how fast policy can shift when the pressure hits.

SPONSOR

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives ($5M-$100M net worth). No membership fees.

Connect with self-made peers in confidential discussions and live meetups.

With $100M+ invested annually, secure preferential terms unavailable to individual investors.

CRYPTO

Stablecoins Shake Up the Market: A New Chapter in Payment Processing

Markets are like reading a long story. Traders regardless of time frame are always trying to read that story and determine what most likely is to happen next. If a passage is familiar to them then they take action based on having seen similar passages that have happened in the past. It is at that precise point that a trader decides to take action.

In that same vein there is an emerging story in the market that has begun to take traction. We have all heard about the transactional fees that have continued to be charged by the likes of Visa and Mastercard. According to a Nilson Report, in 2022 Visa and Mastercard cards generated 8.272 trillion dollars in purchases in the US. Using rough math that is approximately 248 million dollars in fees generated that merchants paid to Visa and Mastercard in the US alone. Even to this day they continue to enjoy a monopoly on payment processing over the likes of American Express and others.

Times change quickly these days with the emergence and legitimization of crypto though ETFs and other instruments there are many people curious over what the next step is. Enter stablecoins. There are different types for sure but let’s focus on one type in particular. Those are those that are considered Fiat-Collateralized stablecoins. These are pegged against a fiat currency like the US dollar and as such maintain a reserve of that currency to issue stablecoins against.

What’s the big deal one might ask? Why do we even need it? Investors argue that it is a way to have crypto that is not necessarily as volatile as Bitcoin for example as it has obviously been a good store of value and has greatly appreciated in value. It is, however, hard to accept as payment as it is in fact extremely volatile.

Enter a company named circle (CRCL) who recently IPO’d and has amassed 275 percent growth in its share price since its IPO. It issues a FIAT stablecoin(USDC) that is based in the US. This combined with the senate passing the Genius Act in bi-partisan fashion, something that is difficult in the US government today(it still needs to go through the House of Representatives). The recent announcements from the likes of Amazon and Walmart on the possibility of issuing their own stablecoins has only added fuel to the fire. Coinbase is another beneficiary from recent action by the US government as they have a revenue sharing agreement with CRCL as well.

This can leave legacy payment processors in the cold as it is currently estimated that fees for transactions using stablecoins such as USDC can be as low as .5 percent versus the 2-3 percent that is currently charged by Visa and Mastercard. The market moves to price this in quickly and as such these stocks(not an all inclusive list) should continue to be on watch:

What the effect of this long term is not necessarily what I’m looking to narrate. As a trader I am paying attention and seeing what the market continues to say about these stocks day to day and not form a bias one way or another. Focusing on price action and momentum while this story plays out is key to being on the right side of the trade regardless what a trader might think.

GAMES

Trading Brain Training

I’m not news, but I make headlines jump.

Whispers of me give markets a bump.

Cut me, stocks cheer. Hike me, they cry.

I’m the silent mover behind every high.

What Am I?

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Understand how Market Makers work.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Interest Rate