Good Morning. You liked the last one, so this one is for you Des. In 2012, a trader at Knight Capital hit “buy” instead of “cancel” unleashing a flood of unintended orders. Within 45 minutes, the firm lost $440 million and nearly collapsed.

One wrong click. $6 billion in trades. Still wondering if hotkeys need a confirmation prompt?

-Jonathan Kibbler, Jordon Mellor, Shaun A

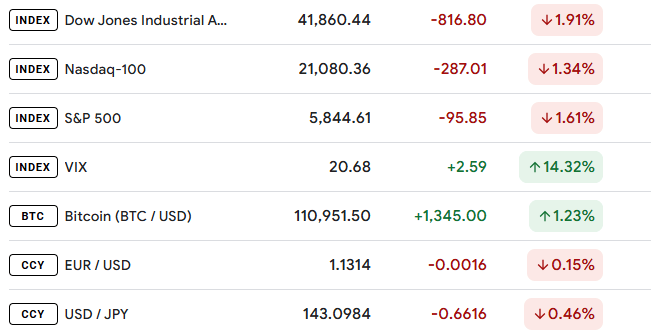

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

The 5% Signal That Could Shake the Forex Market

I recently talked about the 30 year bond yields and how most were looking to this as a signal of uncertainty to come, but the 10 year bond yields are usually used when it comes to future pricing in FX.

The US 10-year yields have rallied since 2020, reaching 4.5% as of writing this on May 21st 2025. This rally saw yields break a 40 year decline from the highs in 1981, to the lows in 2020.

If US10Y breaks above 5% and sustains it, we could see a significant shift that could impact global markets.

Could it also provide an interesting move for the USD?

The end of an era

For decades, the US10Y has dropped, driving asset prices higher and destroying fixed income returns. But in 2020, that macro narrative shift flipped.

Yields bottomed below 1% after the Covid pandemic led to large stimulus flowing into the market, driving up inflation. The Fed had to act, and did so by hiking interest rates to their highest levels since 2001.

It's not only the US10Y but this is the one I think we should watch a little more closely. This has now begun to form a new trend considering the previous downward channel has now been broken.

What does this mean for us? the retail trader

In recent history rising US yields have support the USD. The logic behind this is relatively simple, higher returns on US assets attracts capital inflows, meaning more demand for the USD. This is easiest to see in carry trader, where traders borrow low interest rate currencies like the JPY or CHF and use it to invest in high interest rate currencies such as the USD.

But recently this correlation between the rising yields and the USD has faded.

It comes down to the narrative.

If yields rise because of strong growth and inflation, that is bullish for the USD, as the Fed is more likely to be hawkish, and hiking rates.

If yields rise due to supply and demand uncertainties, for example the recent trade tariffs, the USD is more mixed in performance.

If traders anticipate rate cuts due to recession fears, the yield curve may steepen even if the USD weakens.

Will the USD catch up with yields?

This is a question I wanted to explore, in history when we see the yields and USD decouple from each other the USD tends to catch up at some point. But that doesn't mean it will happen this time.

US10Y and USD/JPY have a strong relationship, the image below shows the comparison of the two assets.

Unless something drastically changes, I mean if we see US10Y break and run above 5%, I will look for breakout opportunities to buy USD, as the macro could be in sync with the technical at that point.

Either way keeping an eye on the US10Y will be important going forward. The USD remains soft as yields remain below the key 5% so the trigger could be that breakout.

Let's keep a keen eye on this traders.

SPONSOR

The key to a $1.3T opportunity

A new trend in real estate is making the most expensive properties obtainable. It’s called co-ownership, and it’s revolutionizing the $1.3T vacation home market.

The company leading the trend? Pacaso. Created by the founder of Zillow, Pacaso turns underutilized luxury properties into fully-managed assets and makes them accessible to the broadest possible market.

The result? More than $1b in transactions, 2,000+ happy homeowners, and over $110m in gross profits for Pacaso.

With rapid international growth and 41% gross profit growth last year, Pacaso is ready for what’s next. They even recently reserved the Nasdaq ticker PCSO.

But the real opportunity is now, before public markets. Until 5/29, you can join leading investors like SoftBank and Maveron for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

MARKET ANALYSIS

Gold Pushes Higher as USD Slips on Fiscal Concerns

Gold is back in the spotlight and this time, it’s not just a shiny chart move. There’s real heat behind this rally.

On Thursday, XAU/USD climbed for a fourth straight session, tapping a two-week high near $3,315–3,345 during Asian trade.

What’s fueling it? A cracking U.S. Dollar, a messy U.S. fiscal picture, and that good old risk-off fear factor that gets gold bugs grinning.

Here’s What’s Fueling the Gold Rally:

1. Moody’s Downgrade + U.S. Deficit Worries

Moody’s recent downgrade of the U.S. credit outlook has spooked markets. Add in the ballooning deficit from President Trump’s tax reforms, and investors are getting jittery about U.S. credit risk. That’s pushing flows out of dollar assets, and into gold.

2. Weak Demand at 20-Year Bond Auction

This week’s 20-year Treasury auction flopped. That’s a red flag. When demand for U.S. bonds weakens, it usually signals broader investor concern about fiscal credibility and strengthens gold’s safe-haven appeal.

3. US-China Trade Tensions + Geopolitical Risks

Renewed trade friction and persistent global instability are driving risk-off sentiment. Gold thrives when uncertainty rises and right now, the macro backdrop is delivering plenty of it.

4. Fed Rate Cut Expectations for 2025

Markets are increasingly pricing in further rate cuts in 2025 as inflation softens and growth slows. That’s bearish for the USD and bullish for non-yielding assets like gold. With real yields under pressure, gold regains its shine.

5. Technical Breakout Above $3,250

Earlier this week, gold cleared the key $3,250–3,255 resistance zone and has held gains above key moving averages. Oscillators are turning higher, and price action is confirming momentum.

WATCH

Riddle Fun

GAMES

Trading Quiz

I’m global, liquid, and priced in green,

A gauge of fear and everything between.

When I rise, stocks tend to fall,

But safe havens love me most of all.

👉 What asset am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.*

🦖 Check out these recommended trading tools.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Understand how Market Makers work.

ANSWER

Answer: The U.S. Dollar Index $DXY ( 0.0% )