Good morning. In 1907, the U.S. faced the Bankers’ Panic, when markets crashed nearly 50% and banks began to fail. Financier J.P. Morgan personally stepped in with his own money to stabilize Wall Street.

That crisis eventually led to the creation of the Federal Reserve in 1913.

-Jonathan Kibbler, Shaun A, Jordon Mellor

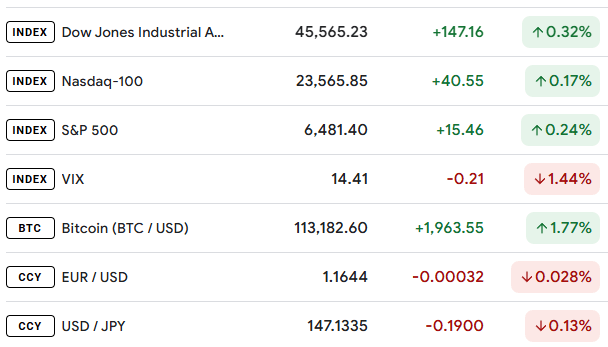

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

Don’t Learn to Trade With Real Money

If you’re new to trading, chances are you’ve already made this mistake, or you’re about to. It’s the one thing that wipes out more accounts than any technical pattern, indicator, or “bad luck.”

Just jump in

It can feel natural to jump into the market straight away. It’s an exciting new world for you and you think you’ll be able to learn by just getting stuck in.

The barrier to entry these days is very low and this gives you a sense of being able to learn by being active. At first the low deposit is fine, but when you consistently lose this over and over again, it can become a bigger problem.

When you don’t have a strategy, process or experience, every trade becomes an emotional battle, trying to get your money back.

Why It Can Be Damaging

Trading with real money before you’re ready can expose you to risks that can prevent your growth before you get going.

The first is general market risk, the flows of the market that you will not yet understand. Now some traders can get lucky, but it's rare. I once remember a very popular forex news website interviewing a young trader that made over $100,000 in a few days buying oil after covid. During the interview the trader spoke about losing thousands of dollars first before it came to fruition because he didn’t understand the market mechanics. He got lucky.

The next is emotional risk. Now this one will come on early as you begin to feel the fear, greed, FOMO, revenge trading…all the emotions which will be amplified because you're risking your hard earned cash.

A combination of these two risks is why the percentage of traders failing sit somewhere between 70-95%.

Think about it

This might be rich coming from me, the trader who jumped in with two feet opening a live account and ran with it. But I come from a place of experience. Looking back, if you asked me what I would have done differently, I would have said something like, start with a demo account. Learn about why the markets move and what the market mechanics are.

Think of it like this, a professional football player prepares all week for a 90 minute competitive game. Before this game they will review how they played the game before, review the opposition, identify a strategy, train all week.

That’s how I view the market, prepare, plan and execute.

Trading with demo accounts gives you the luxury to learn in a real market environment with no risk, and it should be used as a tool to understand the why.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

MINDSET

The Trading Psychology That Works for Me

Every trader has their quirks. Some meditate before the open, some blast heavy metal, and some (like me) just need coffee and rules taped beside the screen.

Over the years, I’ve realized psychology isn’t just about mindset, it’s about habits. The small things you actually do every single day when money’s on the line.

Here’s what keeps me steady and why it matters.

1. Rules on Paper, Not Just in My Head

I keep my rules printed and pinned right beside my screen. Simple, direct, and impossible to ignore:

2–3 quality trades a day only.

Shutdown the PC after 2 consecutive losses.

Always follow the setup, no setup = no trade.

It’s not about discipline “in theory.” It’s about making it so obvious I can’t cheat myself without feeling dumb. I’m not sure if it applies to all but it works for me though.

2. Past is Past, Every Day is Fresh

One of the hardest lessons was not dragging yesterday into today. A bad trade yesterday has zero impact on the market this morning. So why let it live rent-free in my head? I treat every day like a reset. Clean slate. Fresh beginning.

But trust me, its not that easy when I started it LOL. But when I got used to it, I feel like my trades from the past doesn’t affect my mentality anymore for every trading day.

3. Losses Don’t Get Extra Credit

Two consecutive losses = shutdown. I don’t negotiate with myself, I don’t chase. The market doesn’t care how much I want to “make it back.” The moment I break this rule, I’ve already lost more than money, I’ve lost control.

I’ll be honest, I struggled to follow this rule at first. But when I stuck to it, it proved its worth.

One day, I was trading with friends on Discord. Some were live trading, others just placing their own entries. The market turned ugly fast. I took two consecutive losses and, based on my rule, I shut my PC down. My friends kept going. By the end of the session, two of them had completely burned their accounts.

Mine survived. That was the moment I realized how powerful this rule was. Walking away saved me, and it taught me that discipline beats ego every single time.

4. The Setup is King

I don’t trade opinions, I trade setups. If my setup doesn’t trigger, I don’t click. Even if the move happens without me. That’s fine. Because the one time I break that rule, I’ll remind myself why the rule exists.

Here’s my takeaway

For me, trading psychology isn’t about motivation, it’s about structure. I don’t hype myself up or read affirmations, I just follow the blueprint I built. Rules, resets, limits, and trust in the setup. That’s my edge.

Every trader needs their own version. This just happens to be mine.

GAMES

Trading Brain Training

I’m fizzy, famous, and dividend-proud,

A Buffett favorite, loved by the crowd.

Red and white brand seen round the globe,

Defensive stock when markets probe.

What Am I?

GET TO IT

🦖 Understand how Market Makers work.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Check out these recommended trading tools.

ANSWER

Answer: Coca-Cola $KO ( ▼ 0.31% )