Good morning. The shortest U.S. recession in history lasted just two months, March to April 2020, yet it caused one of the fastest market crashes ever.

Proof that panic sells faster than logic buys.

-Jonathan Kibbler, Pat Lewis, Shaun A

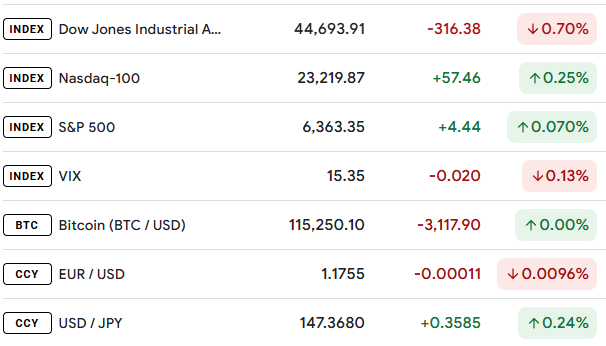

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

How $249 Turned Into an $80,000 Payday

For the past few quarters, prop‑firm payouts have been climbing, and in Q2 2025, three firms alone handed out over $34 million.

MyFunded Futures led the pack with $14.8 million on an 80/20 split, FundedNext followed at $10.9 million (75/25, plus a 1 % trailing‑drawdown “safety net”), and The 5 %ers chipped in $8.9 million (splits from 50/50 up to 80/20 depending on plan).

But big numbers don’t guarantee big wins, your strategy has to fit the rules.

What are we looking at?

Prop‑firm challenges usually boil down to four rules:

Hit a profit target.

Respect overall and daily drawdowns.

Trade within a set timeframe.

Pay an entry fee.

Pass the challenge and you get firm capital, plus a share of all future profits.

I must say, it’s a game‑changer for traders who don’t have deep pockets but do have solid strategies.

What should you look for?

First, profit target vs. timeframe: a 10 % goal in 30 days demands roughly 0.5 % daily returns and you have to be honest about what your strategy can deliver.

Next, drawdown limits: if you swing‑trade or hold overnight, choose firms with higher daily drawdown caps or no intra‑day rule. Check your payout split (50/50 up to 80/20) and how often you’ll see cash hit your account, weekly, bi‑weekly, or monthly.

Don’t forget scaling paths: some firms double your buying power at 4 % profit, others drip‑feed increases after each milestone.

Finally, compare fees and refund policies and any refundable option takes the sting out of a failed challenge.

I’ve been through a few of these myself, and what separates the pros from the rest is discipline. Treat your demo phase like real money. Stick to your plan. Log every trade. If you do that, a $249 entry fee can indeed become an $80,000 payday, one disciplined tick at a time.

Good luck on your journey!

SPONSOR

“Big Plastic” Hates Them

From water bottles to shrink wrap, Timeplast has a $1.3T market opportunity with its patented plastic that dissolves in water. But the clock is ticking to invest. You have until midnight, July 31 to become a Timeplast shareholder as they expand globally.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

CRYPTO

Ethereum Could Steal The Show Coming Months, Says Novogratz

While Bitcoin continues its impressive run, the billionaire investor believes Ethereum could actually outperform its bigger rival in the near future. Speaking in a recent CNBC interview, Novogratz pointed to growing institutional interest as a key driver that could push ETH higher in the next three to six months.

Ethereum's recent price action certainly supports this view. The cryptocurrency has been climbing steadily, currently trading around $3,730 after hitting a 2025 peak of $3,848 earlier this week. While still about 24% below its 2021 all-time high of $4,878, ETH has shown remarkable resilience and momentum. Novogratz specifically mentioned the $4,000 level as a likely near-term target, suggesting the current rally still has room to run.

What's interesting is how institutional players are approaching Ethereum these days. Publicly traded companies have started adopting the Bitcoin treasury strategy popularized by MicroStrategy, but with an ETH twist. BitMine Immersion has emerged as the leader in this space, amassing a staggering $2 billion worth of Ethereum. SharpLink Gaming isn't far behind, with over $1.3 billion in ETH purchases since May. This corporate accumulation creates a fundamentally different demand dynamic than we've seen in previous cycles.

The enthusiasm for Ethereum extends beyond corporate treasuries. The recently approved spot ETH ETFs have been attracting significant capital, with a record $726 million flowing into these products in a single day last week. Over the entire week, these funds collectively pulled in more than $2.1 billion, demonstrating strong institutional appetite. This growing institutional participation helps explain why Novogratz sees such potential in Ethereum's current setup.

That's not to say Novogratz is bearish on Bitcoin. Quite the opposite - he maintains a $150,000 price target for BTC by year-end. Bitcoin currently trades around $118,628, slightly down over the past week but still up nearly 12% for the month. The cryptocurrency recently set a new all-time high at $122,838, proving its continued dominance in the digital asset space.

The market seems to share Novogratz's optimism about Ethereum's prospects. Prediction markets currently give ETH a 55% chance of setting a new all-time high before 2025 ends. This growing confidence reflects a broader recognition of Ethereum's evolving role in the crypto ecosystem - no longer just Bitcoin's little brother, but a serious contender with its own compelling value proposition.

As the crypto market matures, we're seeing more nuanced investment theses emerge. Bitcoin remains the digital gold standard, but Ethereum is increasingly being viewed as the backbone of decentralized finance and the broader smart contract ecosystem. With institutional players now treating ETH as a legitimate treasury asset and regulators providing clearer guidelines, Ethereum's growth story appears to be entering a new chapter. Whether it ultimately outperforms Bitcoin in the coming months remains to be seen, but one thing is clear - the competition between these two crypto giants is heating up.

WATCH

Assets We Track Every Morning

GAMES

Trading Brain Training

I’m sweet to bulls when growth is strong,

Tech stocks love me all day long.

But when rates climb, I start to slide,

High multiples can’t hide the tide.

What Am I?

GET TO IT

🦖 Understand how Market Makers work.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Nasdaq 100 $NDX ( ▲ 1.26% )