Good morning. The first ever IPO in history happened in 1602, when the Dutch East India Company sold shares to the public. It’s considered the birth of the stock market.

From spice ships to tech stocks, trading has always been about chasing the next big thing.

-Jonathan Kibbler, Shaun A, Pat Lewis

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

FOREX

USD/JPY’s Secret Weapon Is Back – Are You Watching It?

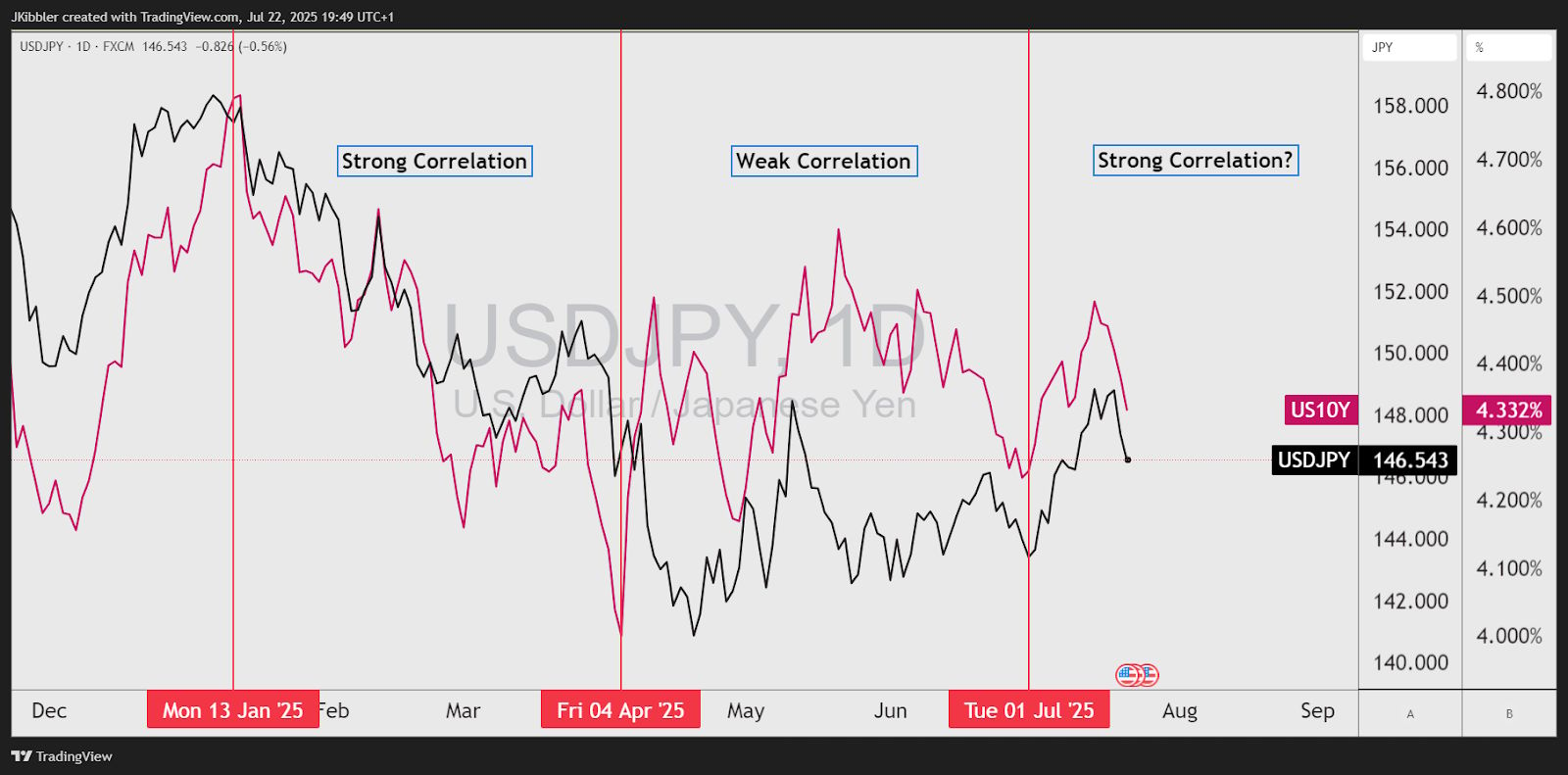

For the past two to three months the correlation between the bond market and currency market has been patchy at best, frustrating many traders who rely on this metric for trading opportunities. But looking at the charts again suggests that the correlation could have returned.

What are we looking at?

Forex currency pairs are driven by interest rate differentials. Interest rate differentials are the gap between the interest rates of two currencies. Traders pay attention to this because currencies with higher interest rates tend to attract more buyers, while lower yielding currencies are often used for funding.

USD/JPY often moves in correlation with U.S.10 year yields. When the US10Y rises it suggests that interest rates could remain higher in the US which attracts foreign investors, on the other hand lower interest rate yields can push investors away, as they seek out higher interest rates.

Recently, the link between the two assets were disrupted by Donald Trump’s trade tariffs which could become front and centre again on August 1st, where the next tariffs are meant to come in.

Is this correlation back?

When we take a closer look at the two charts together we can see that at the beginning of this year the correlation between the two assets was very strong.

However, between April and July the correlation was all over the place. This made it very difficult for traders that rely on this information to make trading decisions.

Looking at the two assets at the beginning of this month (July) we can see the movements are very similar and highly correlated. Which suggests that we could look for one market to lead the other, which is super helpful for retail traders.

How to use this information

For retail traders, the return of the USD/JPY and U.S. yield correlation is a big deal because it gives you a clear macro signal to lean on again. When the correlation weakens, USD/JPY can feel random, swinging on risk sentiment or short-term positioning. But now, with the correlation looking like it’s back, watching U.S. Treasury yields can act as your early warning system for USD/JPY moves.

Keep a close eye on this, and understand that correlations come and go, but when they’re in form they can be extremely useful.

SPONSOR

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

NEWS

Trump vs. Powell: The Saga Continues

President Donald Trump isn’t letting up on his criticism of the Federal Reserve but he seems to be cooling on the idea of actually firing Chair Jerome Powell.

Speaking to reporters at the White House, Trump fired another verbal broadside at the Fed chief:

“I think he’s done a bad job, but he’s going to be out pretty soon anyway. Eight months, he’ll be out.”

Trump thinks Powell’s days are numbered, but not by executive action. Powell’s current term ends in May 2026, leaving plenty of room for political theater in the meantime.

Here’s what you need to know and why it matters.

1. Trump Still Thinks Powell Is “Too Late”

This isn’t new. Trump’s been hammering Powell for years, calling him slow on the rate-cut trigger. Even after the Fed slashed its benchmark by a full point in late 2024, Trump says Powell “should have lowered rates many times” earlier.

His main gripe? High borrowing costs are choking housing affordability. In classic Trump style:

“People aren’t able to buy a house because this guy is a numbskull.”

2. Legal Firestorm Avoided for Now

Trump’s floated firing Powell before, even asking GOP lawmakers last week if he could pull it off. But the president admitted it’s “highly unlikely” he’ll try. Why? Legal gray zones. The Federal Reserve Act makes it tricky to can a chair mid-term without cause. Traders can breathe, for now, knowing Powell isn’t getting the boot overnight.

3. Renovation Drama Adds Fuel

The Fed isn’t just battling Trump on policy, it’s catching heat for spending. The White House is questioning a $2.5 billion renovation of two Washington buildings. Treasury Secretary Scott Bessent hinted at “mission creep” inside the Fed and promised a deeper probe:

“Not their monetary policy, but everything else.”

This just shows will expect more noise about Fed accountability, even if rates stay center stage.

4. Rate Cuts Still the Real Story

For us traders, this isn’t about Powell’s office furniture, it’s about policy tone. Trump wants faster, deeper cuts to juice growth ahead of the election. The Fed? Still cautious, eyeing inflation data before moving. Futures now price in a 74% chance of a cut by September, but that path is far from guaranteed if Powell holds his line.

5. FX Watch: USD Volatility in Play

Political jabs at the Fed usually don’t move markets much, until they do. If this rhetoric starts pressuring Powell or sways Fed messaging, expect the USD to wobble, especially against safe havens like JPY and CHF. For now, the DXY is holding steady, but traders are watching the July CPI print like hawks.

Here’s the Takeaway:

Trump’s threat to fire Powell looks like more bark than bite, but the messaging war isn’t over. Every jab adds political heat to the Fed’s already high-stakes balancing act. For us traders, the Powell-Trump saga is background noise, until it isn’t. Keep your eyes on inflation data and the September Fed meeting. That’s where the real volatility lives.

GAMES

Trading Brain Training

I was mined before I was minted,

A shiny metal, long since hinted.

Central banks keep me in their vault,

When fear takes over, I’m the default.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Check out these recommended trading tools.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Understand how Market Makers work.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: GOLD $XAUUSD ( 0.0% )