Good morning. The "Buttonwood Agreement" of 1792 was signed by 24 stockbrokers under a buttonwood tree on Wall Street, marking the birth of what would become the New York Stock Exchange.

No suits. No screens. Just handshakes and a tree.

-Jonathan Kibbler, Shaun A, Jordon Mellor

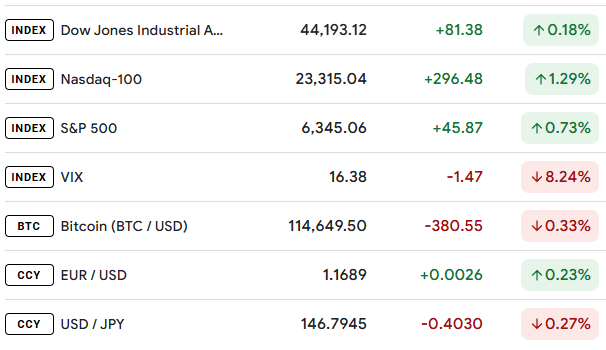

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

The USD Woes Resume! Here’s Where I’d Look to Profit

The US dollar's weakness has returned and so have the buyers for EUR/USD, and with rate cut expectations climbing again, the pair could have more room to run. But what's really interesting here is that seasonality might be backing the move too.

Over the past 20 years, EUR/USD has shown a strong tendency to drift lower between August 5th and 15th, with about a 68% win rate for short trades during that window. But more recently, the pattern has been less effective. If you look at the last 10 years, the pair tends to find a bottom around the 16th of August, and then tops out toward the end of the month.

That shift is important, especially when you zoom out and look at the USD macro landscape right now.

What’s Pressuring the Dollar?

There are a few things weighing on the greenback:

Weak US Jobs Data

Last week’s NFP print missed across the board, but the real concern came from the massive downward revisions. The 3-month average now sits around 36k a sharp slowdown that’s hard to ignore. Markets are starting to question the underlying strength of the US labor market.Rate Cut Bets Are Back

Before the jobs data, there was already some chatter about a possible rate cut in September, but after the report, those odds surged from around 63% to 96%. The market is now pricing in a cut next month, and Powell’s comments about "sticky inflation" haven’t been enough to cool that speculation.Fed Speakers Are Getting More Dovish

Despite holding rates steady, two FOMC members dissented at the last meeting, pushing for cuts. With more soft data expected in the weeks ahead (ISM, jobless claims, another NFP), it's hard to see the dollar regaining much bullish momentum unless we get a surprise reversal in the data.

EUR/USD and the Opportunity

The euro has already started to benefit from the dollar’s weakness but if seasonality holds, there may still be more upside left.

On top of that, the COT report shows hedge funds are holding near-extreme long positions in euro futures, whilst this adds an element of caution: a squeeze higher could be on the cards, especially if incoming US data continues to disappoint.

Something to Watch

Right now, EUR/USD could continue higher for the following reasons:

USD macro weakness

Rate cut momentum

Seasonal bullish bias

Positioning support from COT reports

It seems that the forex pair has some decent backing, let’s see if the price can continue higher.

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

LEARN

The Pressure Cooker of Forex: Currency Pegs Explained

Currency pegs sound dull, until they break. Then they become some of the most violent and profitable events in forex.

A currency peg is when one country fixes its currency to another, usually the U.S. dollar or euro. Instead of letting the exchange rate float, the central bank actively maintains a fixed level or a narrow band.

For example:

HKD is pegged to the USD between 7.75–7.85.

SAR (Saudi Riyal) is pegged to the USD at 3.75.

These pegs are used for stability. For oil-exporting countries like Saudi Arabia, pegging to the USD (the currency oil is priced in) makes revenue and budgeting more predictable. For financial hubs like Hong Kong, it boosts investor confidence.

But a peg doesn’t float freely. To defend it, central banks intervene constantly, buying or selling their own currency, adjusting interest rates, or restricting capital flows. It’s a balancing act, and one that costs money.

And here’s where it gets dangerous.

When Pegs Break, Traders Get Burned (or Paid)

No peg lasts forever. If a country runs out of reserves or loses economic credibility, the peg can snap, and usually violently.

Take Switzerland. In 2011, the SNB pegged the franc to the euro at 1.20 to protect exporters. Traders believed the peg was untouchable, until January 15, 2015, when the SNB shocked markets by dropping the floor.

EUR/CHF crashed 30% in minutes.

Brokers failed. Accounts got wiped. Traders who ignored the risk paid the price.

That’s the risk: when a peg breaks, it doesn’t give you time to react. Liquidity vanishes. Stop losses fail. Slippage becomes brutal.

How to Trade Pegs (Carefully)?

Most traders use pegged currencies for range setups. The HKD, for instance, trades in a narrow band ideal for mean-reversion strategies.

But if you suspect a peg might break, watch for:

Falling central bank reserves

Extreme FX volatility pricing

Outflows or political instability

Emergency rate hikes or capital controls

These are warning signs.

You can bet against the peg, but it’s expensive and risky. If you’re wrong, you’ll bleed slowly. If you’re right, the payoff is massive. Just ask George Soros 😀

Here’s the Takeaway:

Currency pegs aren’t “set and forget.” They’re engineered stability, until they’re not. For traders, pegs create opportunity, but also serious risk. Know what’s behind them, watch for stress, and never assume they’re unbreakable.

Because when a peg breaks, everyone feels it.

WATCH

What’s Your Trading Style?

GAMES

Trading Brain Training

I’m not a guard, but I limit pain,

Set me tight, or you won’t trade again.

I trigger fast when trades go sour—

Use me well, I save your power.

What Am I?

GET TO IT

🦖 Understand how Market Makers work.

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Stop-Loss Order