Good morning. In 2021, retail traders on Reddit’s WallStreetBets sent GameStop (GME) soaring over 1,700% in just two weeks, triggering short squeezes, halts, and global headlines.

It wasn’t Wall Street that moved the market… it was memes.

-Jonathan Kibbler, Shaun A, Jordon Mellor

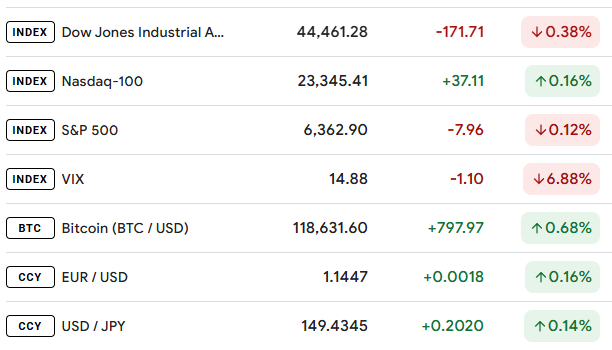

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

Fed in Crisis: Dissenters Challenge Powell—What Does This Mean for the Market?

Well there we have it folks, the Fed Chairman Powell held interest rates. Shocker!

However, the comments are where the juicy stuff is, so let’s take a look at what the chairman had to say and what it could mean for me and you as retail forex traders.

The economic outlook looks solid.

If I had a shot every time I heard Jerome Powell say the economy is in a good place or the economy is looking solid, I would not know where my eyes would be pointing.

The chairman said that the economy is in a good position overall, but consumer spending is slowing. Retailers may start to see less demand for their products, which could hurt the bottom line of companies in sectors dependent on the consumer.

Inflation remains above target.

Inflation, which remains a big worry for the Fed considering the trade tariff ordeal is ramping up again, is still running above the Fed’s target. Again, not great for the stock market which is down today, in particular the Russel 2000 which is down -1.20% at the close.

Jobs are slowing (NFP Reports Friday).

The Fed Chairman commented on the labour market stating that job growth is slowing especially in the private sector. If the NFP report on Friday shows a significant fall in jobs, and a rise in the unemployment rate, then stocks could take another short dip.

Interest Rate probabilities fading.

The Fed is waiting for more data before deciding whether to cut interest rates. If rates stay high, it could put pressure on growth stocks. If the Fed cuts rates, borrowing becomes cheaper, which could give stocks a boost.

The CME FedWatch tool however points to rate cuts in September becoming more unlikely. Before the meeting, a chance of a cut was up at 63.3%, and after it moved to 45%. This could explain the recent boost in the USD against the G7 currencies too.

How This Affects the USD and Stock Market

If the Fed keeps interest rates steady or raises them (highly unlikely), the USD could strengthen. A stronger dollar can make imported goods cheaper but may hurt U.S. exports. As for stocks, expect some volatility as traders react to uncertainty around tariffs and interest rates.

Keep an eye on the upcoming employment, inflation, and interest rate data. A stronger than anticipated NFP on Friday could see the narrative of a rate hold in September increase in popularity, which could have a positive impact on the USD.

TRADER INSIGHTS

Gold Cracks Below $3,300

It was all eyes on Jerome Powell Wednesday, and traders got exactly what they didn’t want: a firm “not yet” on rate cuts. The Fed held interest rates steady at 4.50% as expected, but Powell’s tone was anything but dovish. Gold responded by puking more than 1.5%, diving below the $3,300 zone, erasing gains and triggering fresh selling momentum.

This wasn’t just about rates staying on pause. It was about Powell dousing September cut hopes with cold water, all while GDP numbers complicated the macro picture further. So now we’ve got a hawkish Fed, shaky data, and a market recalibrating fast. Let’s break it down.

Here’s what you need to know about the move.

1. Powell Shuts the Door on September Easing

The Fed kept rates unchanged at 4.50%, which the market already priced in. What spooked gold bulls was Powell’s press conference. He said the Fed would take it “meeting by meeting,” but poured doubt on the likelihood of a September cut.

His key quote: “Tariff passthrough to prices may be slower than thought.” This means, the Fed still thinks inflation might have legs, and won’t move until it’s sure it’s contained. That hawkish hesitation crushed gold sentiment and fueled a rally in real yields.

2. The Chart Broke But Bulls Are Hanging by a Thread

Gold finally cracked the rising trendline support after weeks of tight coil formation. The break below $3,300 dragged price down to $3,273 intraday, brushing the key 100-day SMA (orange line) around $3,267. That zone between $3,267 and $3,273 is now acting as the new battleground.

While the breakdown confirms near-term bearish momentum, bulls aren’t entirely out of the fight. Price is currently hovering just above the 100-day SMA and horizontal support (green line) around $3,273. If this zone holds, we may see a technical bounce but upside is likely capped unless price reclaims the $3,300–$3,342 confluence.

3. Yields Surge, Dollar Rips, and Gold Bleeds

With the Fed in no rush to cut, yields climbed. The U.S. 10-year Treasury yield rose to 4.36%, while real yields pushed near 1.88%. That’s a double whammy for gold higher opportunity cost and a stronger dollar.

The U.S. Dollar Index (DXY) surged to 99.43, and gold crumbled under pressure, breaking below $3,280 after peaking at $3,334 earlier in the session.

4. Market Odds for a Cut Took a Hit

The CME FedWatch Tool now shows just a 45–50% probability of a September rate cut, down from 60% pre-meeting. Powell’s words and the GDP resilience clipped expectations hard. Traders will be laser-focused on the next key inflation readouts: Core PCE, NFP, and ISM Manufacturing PMI due this week.

Any soft data might revive cut hopes but until then, gold’s upside looks capped, and the dollar remains king.

Here’s the Takeaway:

The Fed stayed put, but Powell’s tone hit like a rate hike. With yields up, the dollar flexing, and September cuts in doubt, gold couldn’t hold the line. Bulls need weak data and fast to turn the tide. Until then, the precious metal is on the defensive. Worth to watch the $3,250 zone. If that cracks, the next leg lower may not be far behind.

GAMES

Trading Brain Training

I’m not a rumor, but I move with heat,

A CPI spike makes me hard to beat.

Too much of me, and rates must rise—

I shrink your cash before your eyes.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Understand how Market Makers work.

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Inflation