Good morning. In 1929, during the Wall Street Crash, the stock market fell so sharply that telephone lines were jammed for hours as brokers struggled to execute trades.

It was one of the first times technology itself couldn’t keep up with market panic.

-Jonathan Kibbler, Shaun A, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

FOREX

USD/JPY Shorts Below 146.00?

US rate cuts, stronger Japan GDP and a BOJ that could be leaning hawkish could drive USD/JPY lower. However, the technical analysis suggests the move lower may not be ready just yet. Here’s what to look for.

Why USD/JPY Now?

Markets still lean heavily toward a September Fed cut, keeping the dollar on the back foot even after a hot PPI blip. That cut probability has hovered in the mid-90s per CME FedWatch, and PPI’s pop didn’t really knock it off course.

From Japan’s point of view Q2 GDP beat forecasts, while wholesale inflation is still 2.6% YoY, cooling, but above the BoJ’s target narrative. The combination keeps talk of more BoJ tightening later in 2025 alive.

The USD/JPY price can correlate strongly with the US10Y bond yields which has been tracking lower of late. If this does continue it could drag USD/JPY lower too.

This setup I’m watching

Since early July, USD/JPY has chopped between 146–150 with a well-defined shelf around 146. That shelf looks like a neckline for a potential top. A decisive break could see sellers really step in.

Why I like it:

U.S. policy expectations could see USD weaker.

Japan data isn’t hot, but it’s firm enough to keep BoJ hike chatter alive into September.

Technicals show buyer fatigue into 148s and a clean trigger below 146s.

What Every Investor Reads Before the Bell

Every morning, Elitetrade.club delivers fast, smart, no-fluff market insights straight to your inbox. Join thousands of investors who don’t miss a beat.

MARKET ANALYSIS

Oil Softens as Peace Talk Plans Emerge

Oil prices edged lower in early Asian trading Tuesday, as markets weighed the possibility of direct peace talks between Russia, Ukraine, and the U.S. that could reshape sanctions on Russian crude.

Brent futures dipped 0.11% to $66.53, while U.S. WTI for September delivery slipped 0.09% to $63.36. The more active October contract eased 0.14% to $62.61. This comes after crude closed about 1% higher in the previous session, highlighting how quickly sentiment is swinging.

Here's what you need to know and why it matters:

1. Peace talks on the horizon

Trump announced he had spoken to Putin and begun setting up a trilateral summit with Ukraine’s President Zelenskiy. The news followed meetings with Zelenskiy and European allies in Washington, where Zelenskiy called his talks with Trump “very good.” Many are watching this closely: peace talks could ease sanctions, altering the global oil flow.

2. Sanctions risk keeps many guessing

TD Securities strategist Bart Melek notes that outcomes diverge sharply: tougher U.S. secondary sanctions on Russia’s oil buyers could push crude back toward recent highs. But a breakthrough that eases tensions might see prices drift lower, with Melek projecting $58 per barrel on average for late 2025 into early 2026.

3. The market mood is still fragile

Despite Monday’s uptick, sentiment is thin. Every headline from Washington, Moscow, or Kyiv is capable of swinging crude in either direction. Many are reluctant to make big bets before clarity emerges on the shape of negotiations.

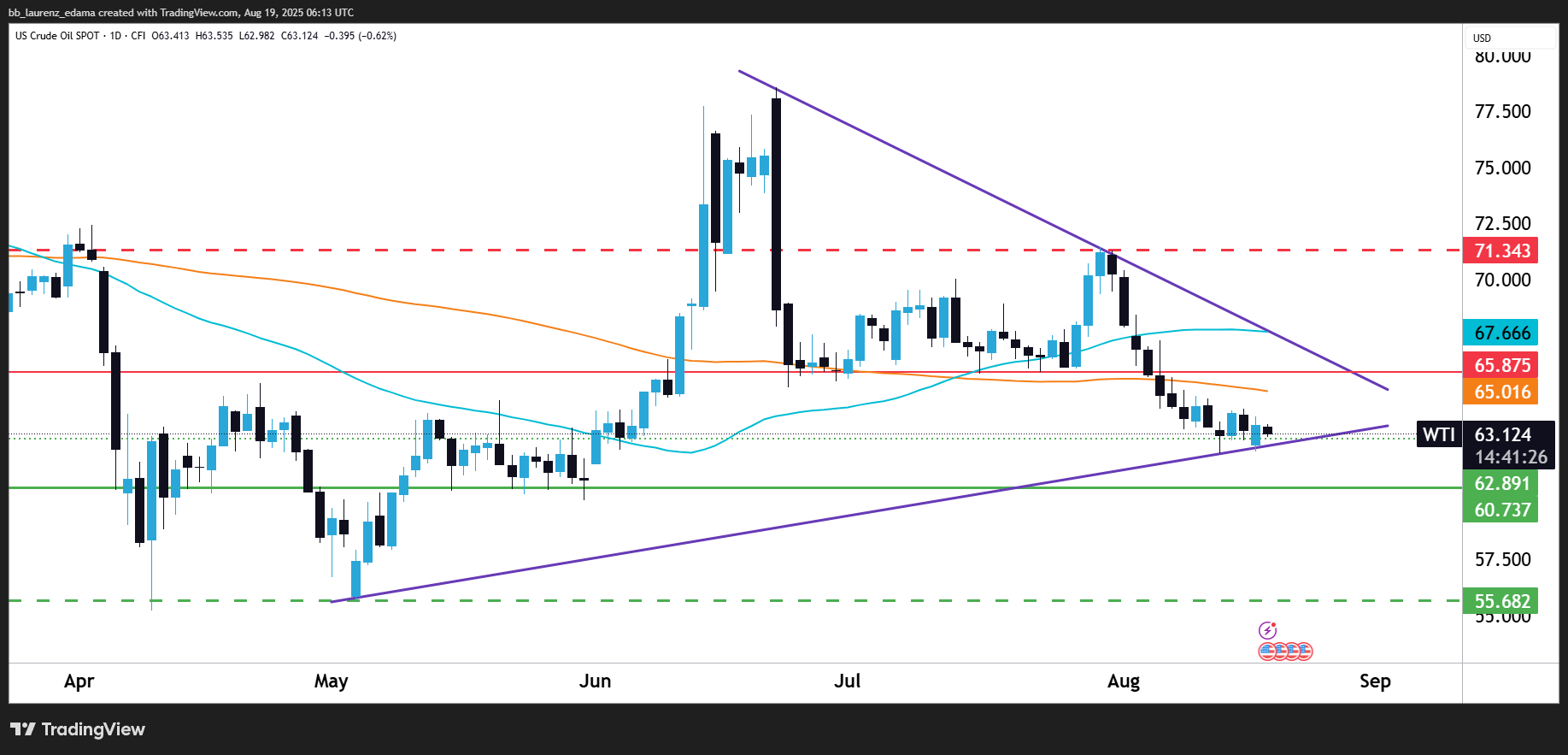

4. Technical Picture – WTI and Brent

WTI continues to drift lower, trading just above $63 after failing to hold ground earlier in the month. Price is leaning on the $62.90–$62.50 zone, which has become the key support to watch. A close under $62 would likely shift attention back toward $60, with $55.70 further down as a deeper target. On the topside, resistance around $64.50 is capping any recovery attempts, while the descending trendline adds extra weight above.

Brent is also under pressure, holding near $65.70 and struggling to regain momentum. The first solid floor sits at $64.90, and below that $62.00 comes into play. If sellers push through those levels, a slide toward $58.80 cannot be ruled out. On the upside, the $66.70–$67.00 area is the first hurdle, followed by $68.70 if buyers can manage a stronger bounce.

Both contracts remain heavy, with momentum tilting against the bulls. Unless WTI clears $64.50 or Brent lifts above $67, the path of least resistance looks lower.

Takeaway

Oil traders face a binary setup: peace talk progress could unlock a major supply shift and drag prices lower, while tougher sanctions risk snapping prices higher again. Until the trilateral summit details firm up, crude is likely to stay choppy and headline-driven.

GAMES

Trading Brain Training

Sweet by name, but bitter in cost,

From pods to bars, I’m weather-tossed.

El Niño whispers, my price takes flight—

Hedge me in London or New York night.

What Am I?

GET TO IT

🦖 Watch Professional Traders trade live in London

🦖 Understand how Market Makers work.

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

ANSWER

Answer: Cocoa