In 1981, during Paul Volcker’s war on inflation, the Federal Reserve pushed interest rates above 20%, the highest in U.S. history.

It triggered a recession, crushed borrowing, but ultimately broke the back of runaway prices, a reminder of how far central banks will go when inflation gets out of control.

-Jonathan Kibbler, Shaun A, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

GOLD CHART BREAKDOWN OF THE DAY

Gold is still trading inside a short-term descending channel, hovering just above the 4,055 support after yesterday’s bounce. Even with intraday rallies, price keeps getting capped by the 4,086–4,100 resistance zone.

TRADER INSIGHTS

Will The Market Yawn Or React? Why September’s Jobs Report Could Be Ignored

The U.S. government shutdown has just wrapped up, which means the usual monthly jobs data were delayed.

The data for September is expected to be released today with forecasts showing +53k in employment and a 4.3% unemployment rate.

But does the market care?

Since the report covers September, by the time it comes out it will feel like a throw-back.

Economies move fast, and traders are already looking ahead to what’s happening now.

Some analysts argue the market may “look through” the print because it’s dated.

The market may be more concerned with forward guidance and data that is forward looking.

My Take

I think all employment data is important, at the beginning of the year my main concern was unemployment rates rising towards 5%. I do worry about the recency of the report, and the market narrative right now is more towards the AI story.

That being said, the market will tell all. If the market shows a strong reaction then we know it cares, if the reaction is minimal then we know it doesn’t.

Ultimately, it will come down to expectations.

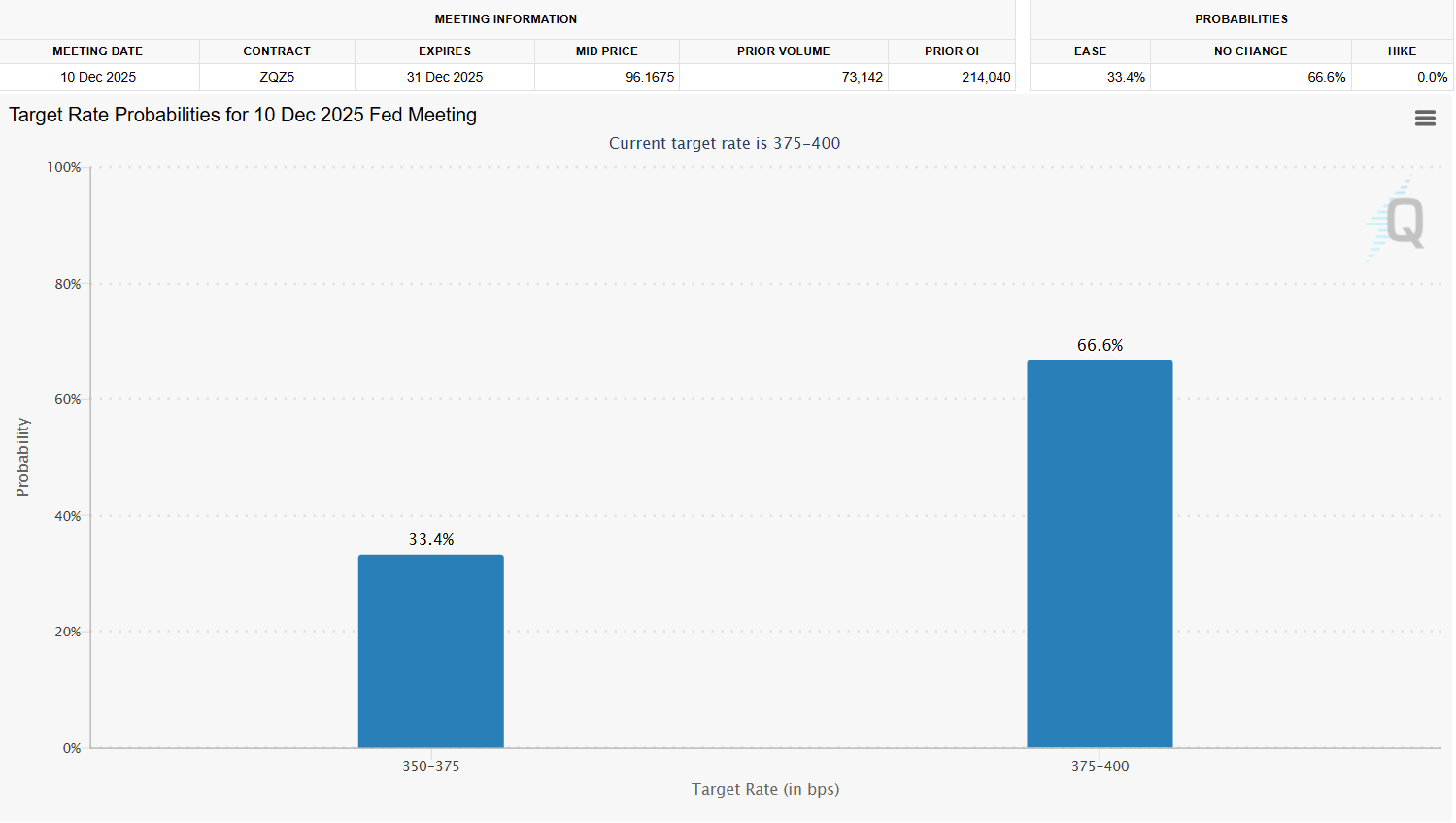

We have seen a big shift recently in how the market sees the Federal Reserves rates playing out in December.

It now stands at a 66.6% chance of a rate pause, just last week it was a 62.9% cut. If the NFP numbers come in strong then the market may take it more seriously, and the chances of a cut coming in December will continue to fade.

In that scenario I imagine USD will continue to strengthen.

8 Weeks to Real Estate Investment Confidence

Join a global network of 5,000+ professionals in the Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate.

In just 8 weeks, learn from top firms, collaborate on real-world case studies, and gain skills that last.

Save $300 with code SAVE300 + $200 with early enrollment by January 12.

NEWS

Japan’s Rate Hike Is Back on the Table

Japan is finally at that point again, the point where everyone in the market sits up a little straighter. The Bank of Japan hasn’t been an active player for years, but now the tone is shifting. The yen is at multi-month lows, inflation pressure is building from imports, and economists think December could be the moment the BOJ finally moves.

It’s still a knife-edge decision, but it’s the closest we’ve been to a real shift in Japanese monetary policy in a long time.

Let’s break this down simply.

Here’s What You Need to Know

1. A December Hike Is Now the Base Case

A Reuters poll shows 53% of economists expect the BOJ to raise short-term rates from 0.50% to 0.75% at the December 18–19 meeting.

Not a huge move but symbolically massive. Japan hasn’t touched rates since January’s 25-bp hike.

The story here isn’t the number. It’s the shift in direction.

2. Yen Weakness Is Forcing the BOJ’s Hand

The yen has been hammered, the worst-performing G10 currency in recent months.

It’s now sitting at a 10-month low vs USD and the weakest level ever against the euro.

A falling yen means more expensive imports + higher inflation + more pressure on the BOJ to act. This is why economists say conditions for a hike are “falling into place.”

3. Wage Growth and Government Pressure Both Matter

Prime Minister Takaichi wants the BOJ to move slowly, but wage negotiations in early 2025 will be the real deciding factor. If wage momentum improves, it gives the BOJ the green light.

Most economists still expect 0.75% by March, and potentially 1.00% by end-2026, slow but steady normalisation.

4. What This Means for JPY Pairs

A December hike or even a strong hint could finally give the yen room to breathe.

But until then, JPY pairs stay sensitive to headlines.

USD/JPY: Any hint of a hike could trigger fast downside moves after months of yen weakness.

EUR/JPY: Overextended. Vulnerable if BOJ signals tightening.

GBP/JPY: Still volatile, rate expectations in both UK and Japan can swing this pair hard.

The market has priced in yen weakness for months; it hasn’t priced in BOJ action.

My Takeaway

Japan doesn’t move often but when it does, the market feels it.

A December hike isn’t guaranteed, but it’s finally realistic. That alone makes JPY pairs worth watching closely. If the BOJ leans hawkish next month, the unwinding on USD/JPY, EUR/JPY, and GBP/JPY could be sharp.

For now, let’s keep our levels tight and flexible. The yen doesn’t stay quiet forever and this might be the moment it wakes up.

DAILY TRADING PSYCHOLOGY NUGGET

“A calm mind sees better entries.”

When you’re tense or rushing, every candle looks like an opportunity. But when you slow down and stay composed, the market becomes clearer, cleaner, and easier to read and the right setups naturally stand out.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 20, 2025)

credits: REUTERS/Androniki Christodoulou

Tech stocks got a shot in the arm as Nvidia Corporation reported blow-out earnings, easing fears that the AI rally was overdone and rallying global equity markets in Asia and Europe. (source:reuters)

GAMES

Trading Brain Training

“When I surge, currencies bend.

When I fall, equities smile.

I’m priced in fear, shaped by policy,

And every trader checks me before taking a trade.

What am I?”

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Understand how Market Makers work

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: The US Dollar Index (DXY) $DXY ( 0.0% )