Good morning. Every trader swears their timeframe is the “right one.” Scalpers chase seconds, swing traders hold for days, and long-term investors call everyone else impatient.

The truth? The best timeframe is the one that fits your temperament,not your trading hero’s.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

The Bias Trap: When Timeframes Betray You

I’ve been there more times than I’d like to admit. You see a clean setup on the 5-minute chart, a tight range, a breakout candle, perfect entry and then you glance at the daily and realize… you’ve just gone long into a brick wall of resistance. That’s not bad luck. That’s what happens when timeframes don’t agree and your bias takes over.

Here’s what you need to know:

1. The Mismatch Problem

Every timeframe tells a different story. The weekly sets the tone, the daily gives the direction, and the smaller ones like the 5-minute or 15-minute just zoom in on the noise.

When I analyze, I always start from the top down: 1W and 1D to define the trend, then I drop to 5M or 15M for entries. The big picture keeps me grounded, while the smaller frames give me precision.

If the higher timeframes say “bullish,” I’ll only look for buys on the small ones. Anything else, I ignore.

Early in my career, I did the opposite. I’d find something “promising” on the 15-minute, convince myself it would flip the daily, and then watch it fail spectacularly. Turns out, you can’t fight the structure that’s already built. As the famouse trading phrase says, “The trend is your friend”

2. When Bias Turns to Blindness

The tricky part is that once you want to see something, your brain will make sure you do. That’s confirmation bias and it’s deadly in trading.

I used to redraw my levels, remeasure my Fibs, and tweak my zones until the chart agreed with me. It wasn’t analysis; it was self-sabotage with extra steps.

Now, I let the higher timeframe call the shots. The smaller ones? They’re just timing tools.

3. Alignment Builds Confidence

Once I started aligning my charts 1W, 1D, 4H, 15M my trading changed. I wasn’t reacting anymore; I was waiting.

When everything lines u, trend, structure, and timing execution feels natural. You’re not second-guessing; you’re following flow.

TradingView’s multi-timeframe tools make this easy. One glance, and you’ll see whether your setup’s in sync, or setting you up.

My Takeaway

My worst trades didn’t come from the wrong idea. They came from the wrong timeframe.

Zoom out first, narrow down, and let your analysis lead not your impulse. The market rewards structure, not speed.

Don’t get SaaD. Get Rippling.

Software sprawl is draining your team’s time, money, and sanity. Our State of Software Sprawl report exposes the true cost of “Software as a Disservice” and why unified systems are the future.

FOREX

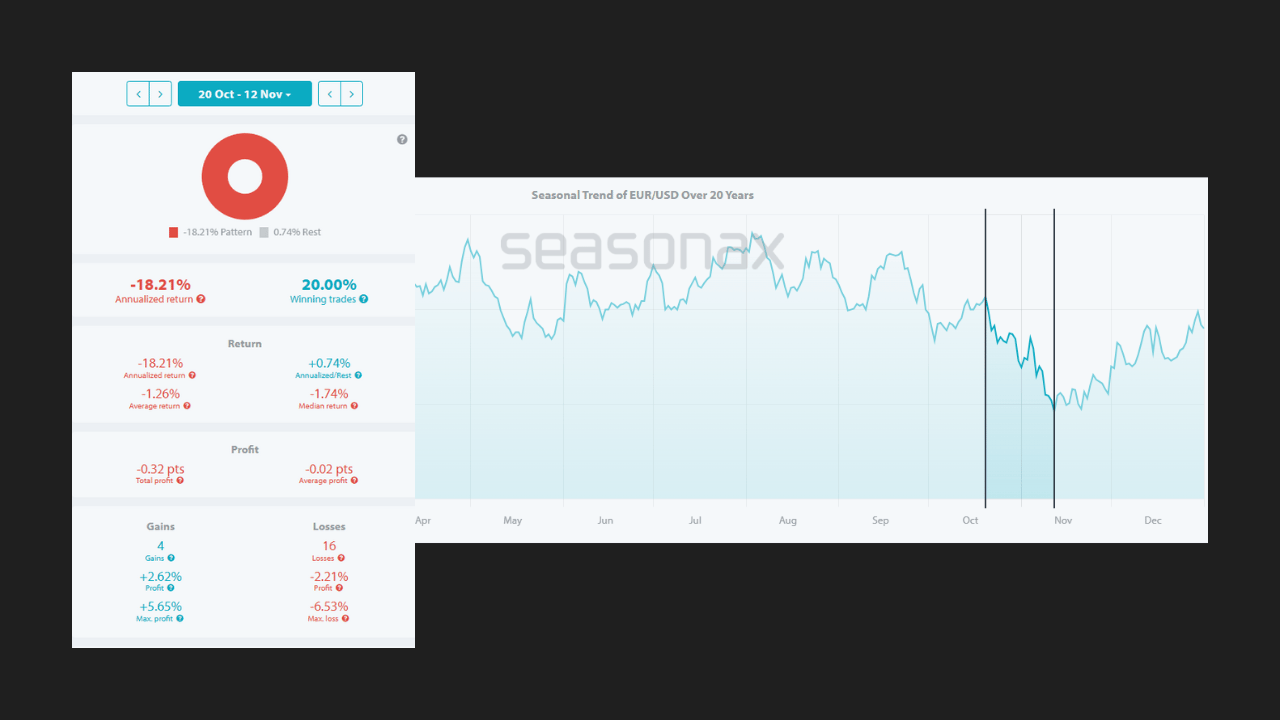

This 20-Year Pattern Could Spell Trouble for EUR/USD

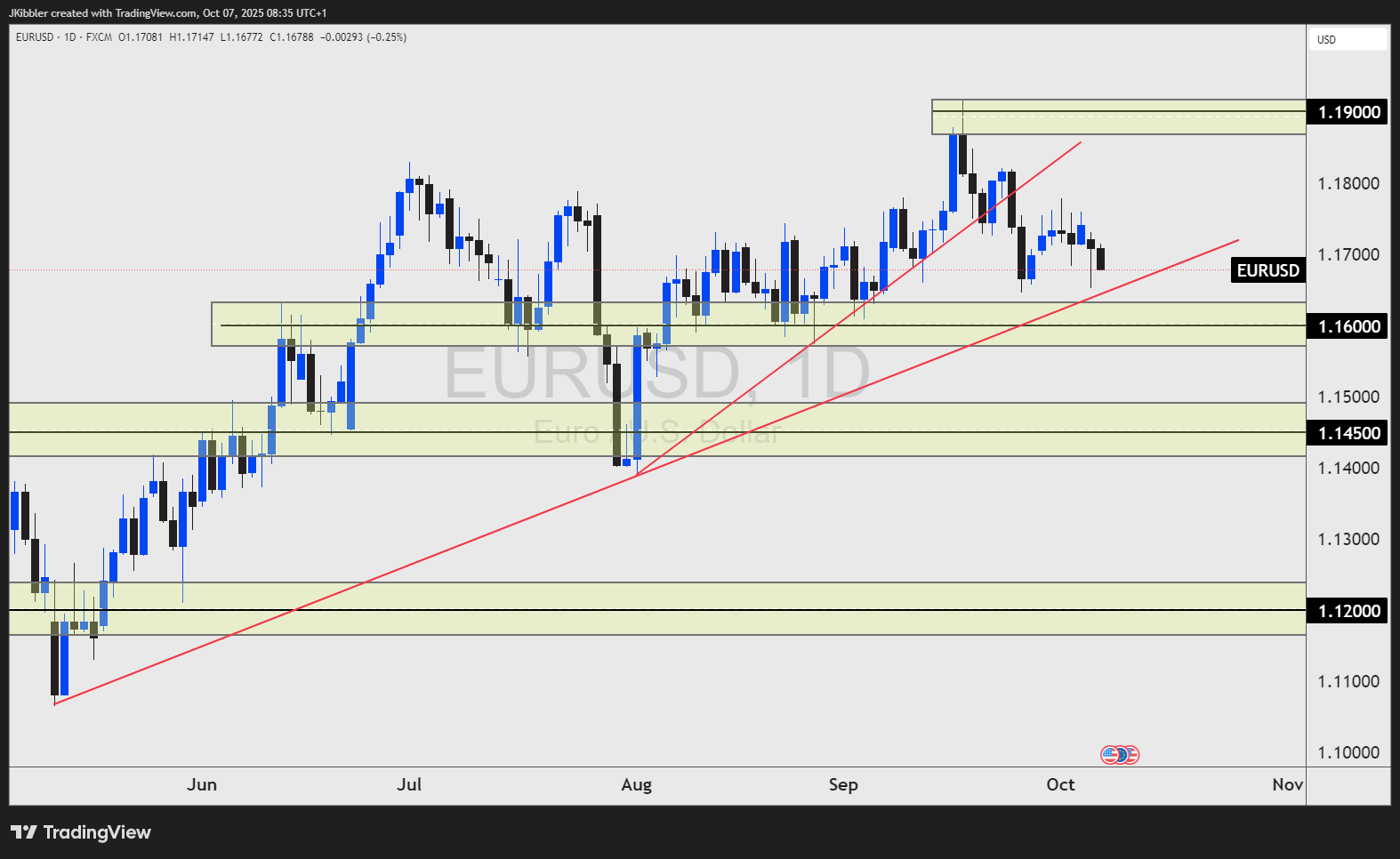

The EUR/USD price has been slowly grinding higher since August up until recently. A reversal from the 1.1900 handle could show underlying pressures for the forex pair.

EUR/USD Lower?

The USD Index shows the USD is gaining strength against the basket of currencies.Why?

Before the US government shutdown some data was beating forecasts in a positive way. Mainly talking about GDP, Unemployment Claims and New Home Sales.

US10Y has been on the rise tightenging the interest rate differentials between the US and Europe.

CoT positioning on EUR futures before the shutdown show extreme long positioning from the non-commercials, this can often see the price reverse in the short term.

Seasonal Bias

Historically, EUR/USD struggles between October 20th and November 12th. Over the last 20 years, this pattern has played out 80% of the time making it one of the more reliable seasonal trades on the board.

It doesn’t guarantee anything, but it does give you context that many traders skip.

The Technicals (Weekly trend)

EUR/USD remains technically in a weekly uptrend, but it's moved into a secondary phase, meaning momentum has stalled, and structure is starting to shift.

The big level 1.1600 is one to watch, if we break this level with conviction, that could signal the trend is turning, and open up downside continuation.

WATCH

Traded My Way from Australia’s Worst to Best Hotel!

CHART BREAKDOWN OF THE DAY (NZD/USD)

NZD/USD is trading around 0.5807 after failing to hold above the 0.5850 resistance zone. The pair remains below both the 50-day and 200-day SMAs, signaling continued bearish pressure. Immediate support lies near 0.5780, and a break below it could extend losses toward 0.5720 or even 0.5690. On the upside, buyers need a clear move above 0.5850 to challenge 0.5885 and shift short-term momentum back to neutral.

DAILY TRADING PSYCHOLOGY NUGGET

“Your job isn’t to predict the market, it’s to react correctly to what it does.” The best traders don’t try to be fortune tellers; they read the market’s behavior and adjust with discipline. Prediction feeds ego, but reaction protects capital.

TODAY’S MOST TRENDING MARKET NEWS (OCTOBER 7, 2025)

credits: REUTERS/Issei Kato

Japan’s Finance Minister warned against excessive forex volatility as the yen tumbled to a two-month low (~¥150.62 per USD), citing expectations of more fiscal stimulus under the new political leadership and emphasizing that currency moves should reflect economic fundamentals. (source: reuters)

GAMES

Trading Brain Training

I’m not a compass, but I point the way,

Momentum shows where prices may stay.

Cross me up or cross me down,

Traders watch me flip the crown.

What Am I?

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Moving Average Crossover