Good morning. The longest-ever bull market in U.S. history lasted 11 years, from 2009 to 2020, turning $10,000 in the S&P 500 into nearly $40,000.

Then 2020 reminded everyone: even the strongest bulls eventually need a break.t their platforms were broken. Turns out, it was just the algos having a meltdown.

-Jonathan Kibbler, Pat Lewis, Shaun A

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

FOREX

GBP Weak! The BoE Just Gave Us a Reason to Sell

The GBP strength is now falling and the currency strength meter is showing it as the worst performing currency of last week. Poor data combined with a central bank leader becoming more dovish has fueled the GBP bears.

UK’s Growth Remains a Struggle

Much like the day I got back from my stag do last week, the UK economy is running on fumes.

It’s no secret too.

When looking at the key data points, GDP growth remains in the negative for a conservative month. Industrial and Manufacturing production remains in the red. And now the Bank of England Governor has stated that rate cuts in August are likely.

The Guardian reported that Governor Bailey insisted that the path for rates is downward.

When a central bank becomes vocal about cutting interest rates then the market tends to sell that currency. I feel although we expected this GBP weakness to come, it’s only been reflected on the charts the past two to three weeks.

Backed By the Currency Strength Meter

The currency strength meter is telling us the GBP is in trouble. Across the board last week, it lost against all but the JPY. This is the technical feedback we can use when identifying the weakness which typically starts because of the macro economic shift.

Looking at the meter we can see that the GBP moved from +5 which is a strong but reversal zone, to 0, moving lower by 5 places. The stronger currencies include the CHF (Swiss Franc), AUD (Australian dollar) and CAD (Canadian dollar).

This means we could be looking at opportunities on GBPCHF, GBPAUD and GBPCAD.

Upcoming Data Could Add To Woes

On Wednesday, the UK will see the release of the latest consumer price index which is forecast to remain the same at 3.4%, with core also forecast to see no change.

This one metric could put doubt into the mind of traders looking to short the GBP.

However, if this number were to fall and head lower the chances of a rate cut from the Bank of England would increase substantially.

GBP/AUD Approaches Support

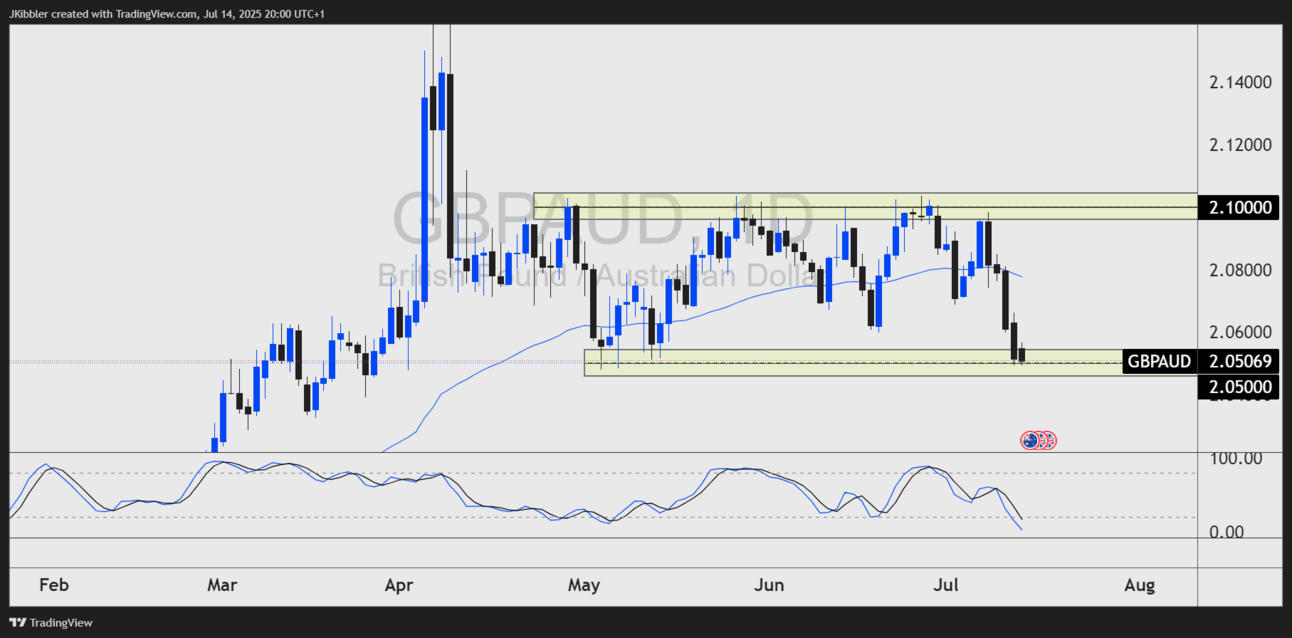

The price of GBP/AUD has reached a crucial support zone of 2.0500.

This is the key support of a range that has stemmed back from April of this year.

Shorts from the highs of the range have been fruitful over the past few weeks, but if the GBP weakness is going to continue a breakout of the range lows looks more likely.

Being short at these levels doesn’t make sense, I need to wait for the price to bound higher and reach resistance or break and retest the lows first.

Key Takeaways

GBP is the weakest major currency last week, confirmed by the currency strength meter.

UK data remains soft: negative growth, weak production, and slowing consumer momentum.

BoE turning dovish — Governor Bailey signals rate cuts likely in August.

GBP underperforms across the board, especially vs CHF, AUD, and CAD.

GBP/AUD nearing key support (2.0500) — watching for breakout or bounce setup.

This week’s UK CPI could trigger the next move — a softer print may accelerate GBP selling.

CRYPTO

XRP Surges 30%. Whales Buy Up $2.2B

These are the highest levels XRP has seen in months. At current prices, XRP has delivered staggering 400% returns over the past twelve months, but on-chain data suggests this rally might just be getting started as multiple fundamental and technical factors converge to create a perfect storm for the embattled cryptocurrency.

Behind the scenes, crypto whales have been accumulating XRP at a breathtaking pace that has market analysts buzzing. Blockchain analytics firm Santiment reveals that large holders controlling between 100 million and 1 billion XRP have added a staggering 2.2 billion coins to their portfolios since July 1, a $6.6 billion accumulation spree that's pushed their collective holdings to 9.8 billion tokens. Even more telling, the number of wallets holding at least 1 million XRP just reached a record 2,743 addresses, collectively controlling over 47 billion tokens (nearly half of the total circulating supply).

This aggressive accumulation pattern mirrors behavior seen in previous crypto bull markets where institutional players positioned themselves before major price breakouts. The timing is particularly noteworthy as it coincides with several fundamental developments that suggest XRP may finally be shaking off its regulatory overhang and technical stagnation that plagued it for years.

The buying frenzy comes as several fundamental factors align in XRP's favor. The regulatory clouds that long hung over Ripple's cryptocurrency have begun parting, with U.S. "Crypto Week" policy discussions potentially bringing clearer rules for the industry. Multiple bills currently under consideration could provide the regulatory clarity that institutional investors have been waiting for, particularly regarding XRP's classification as a non-security following Ripple's partial legal victory against the SEC last year.

Meanwhile, derivatives markets show traders betting big on continued upside, open interest has rebounded dramatically from April's $3 billion low to reach $7.2 billion, nearing January's all-time high of $8.3 billion. The options market is seeing particularly heavy activity, with traders loading up on short-dated call options at strike prices between $3.50 and $4.00, suggesting strong conviction that this rally has further room to run.

The surge appears partially fueled by explosive trading activity in South Korea, where Upbit exchange has reportedly seen unprecedented XRP volumes accounting for nearly 40% of global trading activity. With over 7 million South Koreans (15% of the population) now registered on crypto platforms, the country's retail traders are becoming an increasingly powerful market force. Local analysts note that XRP has consistently been one of the top three traded assets on Korean exchanges during this bull run, benefiting from its low transaction fees and fast settlement times that appeal to day traders.

This Korean premium effect has created interesting arbitrage opportunities, with XRP prices on Upbit regularly trading at a 2-3% premium compared to other global exchanges. The phenomenon has caught the attention of quantitative trading firms who have begun deploying sophisticated cross-exchange arbitrage strategies to capitalize on the price discrepancies.

Beyond speculative trading, real-world adoption is accelerating at a pace not seen since 2017. UK-based cloud mining platform XY Miner just launched an XRP-focused passive income program offering institutional-grade yield products, while London's GoldenMining completely overhauled its infrastructure to integrate XRP's blockchain. "This move enhances our cross-chain capabilities and increases the speed at which users can receive, manage, and reinvest earnings," said GoldenMining CTO Daniel Gray, highlighting XRP's settlement advantages that make it ideal for financial applications.

Perhaps most significantly, several Asian banks have begun pilot programs using XRP for cross-border settlements, though most have yet to publicly announce these initiatives due to regulatory sensitivities. Industry insiders suggest that if these pilots prove successful, we could see formal announcements in Q3 that would provide another major catalyst for XRP adoption.

But for all the optimism, XRP's rally exists within cryptocurrency's famously volatile context. While whale accumulation suggests strong conviction, it also raises questions about potential future sell pressure from these large holders taking profits. And though regulatory winds appear favorable, the U.S. policy discussions this week could still deliver surprises that might temporarily derail the rally.

As Bitcoin continues setting records above $123,000, the entire crypto market appears buoyant. But XRP's unique position,bridging traditional finance and blockchain, with growing enterprise use cases,gives it distinct momentum that could see it outperform even Bitcoin in the coming months. The combination of clearing regulatory hurdles, increasing institutional adoption, and favorable technical positioning creates a rare confluence of bullish factors.

GAMES

Trading Brain Training

I’m born from hype, but I’m not a fad.

No earnings, no board—yet traders go mad.

My value’s a joke, my mascot a meme,

Still, I’ve made millionaires in a dream.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Check out these recommended trading tools.

ANSWER

Answer: Dogecoin $DOGE.X ( ▲ 9.17% )