Good morning. Ever noticed how you check your P&L way more when you’re down? That’s called negativity bias, the brain gives more weight to bad news than good.

It’s why a tiny red candle feels like disaster, while a giant green one just feels… “okay.” Your brain’s wired bearish by default.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MINDSET

I Tried to Trade My Way Out of Anger

The trade everyone thought was safe… until it wasn’t.

I’ve been there more times than I’d like to admit. I had this experience, it was two years ago, staring at the CPI release. I had a 7-trade winstreak going, confidence through the roof. Then I hit two losses in a row. My rule said shut it down after two losses. But the setup was still flashing, and my emotions were boiling. I told myself I’d trade a bigger lot size just to breakeven. That’s when everything unraveled.

It was traumatic and the lesson was learned the hard way.

That sting doesn’t go away quickly. But over the years, I’ve built a set of habits that keep me from turning one bad trade into a pain trade spiral.

Here’s what I learned from that experience:

1. Anger Was the Trigger

Losing twice in a row wasn’t the end of the world. What killed me was the anger that followed. I felt cheated, like the market “owed” me. That mindset flipped me from patient trader into reckless gambler. Once I clicked that oversized order, I wasn’t trading the setup anymore, I was trading my frustration.

2. Greed Made It Worse

I convinced myself bigger lot sizing would erase the pain. “Just one win and I’m back even,” I thought. But greed doesn’t fix mistakes, it compounds them. When slippage hit during that CPI print, my risk wasn’t just doubled,it was blown out of proportion.

3. A Streak Doesn’t Protect You

That 7-trade winstreak gave me a false sense of invincibility. I thought I’d “earned” the right to push harder. But markets don’t care about streaks. One bad decision can wipe out weeks of progress. That night, all seven wins vanished in one ugly red trade.

4. The Emotional Spiral Is Real

In a matter of minutes I cycled through every trader emotion: anger, greed, desperation, denial. It was a roller coaster, and none of it helped me think clearly. By the time the position closed, I wasn’t even reacting to price action anymore, just raw emotion.

My Takeaway

That night taught me the hard way: rules matter most when you least want to follow them. Two losses should’ve meant I walked away. Instead, I let emotions steer, and the cost wasn’t just money, it was confidence, discipline, and weeks of progress.

The pain trade isn’t just about one bad setup. It’s about the moment you let anger and greed drive your decisions. I learned the lesson the hardest way possible: if I don’t shut down after two losses, the market will do it for me.

Used by Execs at Google and OpenAI

Join 400,000+ professionals who rely on The AI Report to work smarter with AI.

Delivered daily, it breaks down tools, prompts, and real use cases—so you can implement AI without wasting time.

If they’re reading it, why aren’t you?

TRADER INSIGHTS

Is Friday the Day GBP Cracks?

I have been a bit of a bear on the GBP even though it is still strong on the currency strength meter. But Friday could be the day this comes to fruition.

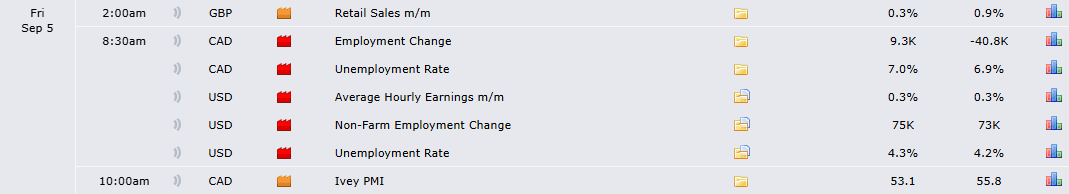

What’s happening Friday?

The British pound hasn’t had it’s best of weeks, and this week’s retail sales print on Friday could be the catalyst that adds some extra pressure.

Forecasts show a slowdown from 0.9% to 0.3%, suggesting there is weak consumer spending herding into the Autumn Budget. That’s not what the government would be wanting to see starting at a £35 billion fiscal hole.

Some Positives

Better than expected data: CPI came in above expectations again and Services PMI were revised higher. Which in theory will support the GBP.

Bond markets are fruity: Long dated gilt yields ripped higher not because of optimism, in fact quite the opposite. Markets are demanding higher risk premiums for holding UK debt.

BoE is kind of stuck: The Bank of England’s recent hawkish cut hasn’t really convinced markets that it can tame inflation. Although tax rises or spending cuts by the government could strangle peoples pockets, this isn’t happening today.

Hedge Funds Selling

The Commitment of Trader reports data show hedge funds are adding to their short positions and decreasing their long positions. This tells us that institutional money doesn’t really buy into the GBP recovery story.

How is this useful?

In my experience this tells me two things:

If retail sales disappoint, GBP upside could be limited. I am interested in selling GBPJPY and GBPAUD so those are the markets I will be watching.

Institutions aren’t buying into the GBP and they do typically follow the trend, so any upside here could see institutions increase their short positions.

Keep an eye out for the data drop and let’s see what happens.

WATCH

Here’s How Much I Spent traveling to Perth as a Day Trader!

GAMES

Trading Brain Training

I strike after loss, a dangerous chase,

Logic fades, emotions take place.

I promise revenge, but drain your stack—

Break my grip, and you’ll get back.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Check out these recommended trading tools.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Understand how Market Makers work.

ANSWER

Answer: Revenge Trading