Good morning. Studies show that dopamine spikes in traders’ brains when they enter a trade, similar to what happens in gamblers at a casino.

That’s why clicking “buy” can feel like a win, even before the market moves. The real game isn’t the entry… it’s managing the rush.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

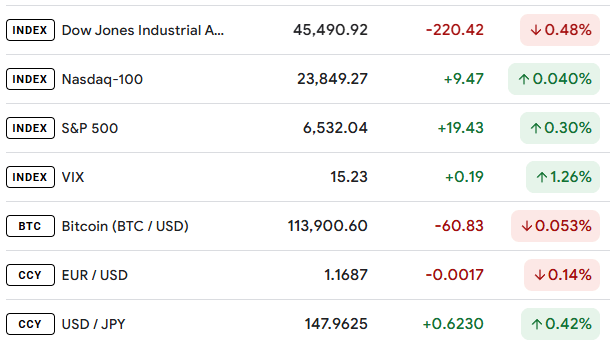

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MINDSET

The Myth of the Perfect Entry

Every trader dreams of catching the market at the exact turning point, the perfect entry that makes the chart look like it was drawn for them. But in reality, this obsession is one of the most costly distractions in trading.

Data shows that timing the entry is far less important to long-term performance than what happens afterward: how the trade is managed, where stops are placed, and how exits are executed.

Here’s what you need to know:

1. Entries Don’t Predict Profitability

Studies on hedge funds and retail performance show that entry timing contributes little to overall returns compared to trade management. A well-managed trade with a slightly late entry can still deliver strong results, while a poorly managed “perfect entry” can still end in loss.

Traders who obsess over precision often miss bigger moves waiting for the ideal price. Quantified Strategies’ backtests confirm the same: traders put too much weight on entry signals, but exits and risk rules explain the majority of performance outcomes

2. Risk Management Is the Real Edge

As Kahneman and Tversky showed in their Prospect Theory research (1979), losses weigh about twice as much as gains. This means the true battleground isn’t entry but how much you’re willing to risk.

Position sizing and stop placement consistently matter more to equity curves than whether you were five pips early or late.

3. Exits Drive the P&L

Performance data across active traders shows exits carry more weight than entries. A trade entered late but held through the right risk-to-reward framework will often outperform a perfect entry that’s exited prematurely out of fear.

The discipline to let trades run or cut them when invalidated creates the bulk of long-term returns.

4. The Illusion of Control

The fixation on entries often comes from psychology, the feeling that precision equals control. But markets are probabilistic, not precise.

By waiting endlessly for perfect alignment, traders fall into analysis paralysis, missing opportunities that didn’t fit the “picture-perfect” entry. The edge is not found in control, but in consistency.

My Takeaway

The perfect entry is a myth.

What separates professionals from amateurs isn’t their ability to nail the first tick but their consistency in managing trades once they’re in. Risk limits, position sizing, and disciplined exits are what build accounts over time. Focus less on being the trader who “bought the bottom” and more on being the one who stayed solvent long enough to compound gains.

AI You’ll Actually Understand

Cut through the noise. The AI Report makes AI clear, practical, and useful—without needing a technical background.

Join 400,000+ professionals mastering AI in minutes a day.

Stay informed. Stay ahead.

No fluff—just results.

TRADER INSIGHTS

What even is GDP?

When you hear traders or economists talk about GDP, they’re talking about the backbone of an economy. But what does it actually mean and why should forex traders care, especially this week with UK GDP data around the corner?

What is GDP?

GDP stands for Gross Domestic Product. In simple terms, it’s the total value of all goods and services produced in a country over a certain period, usually quarterly or yearly.

It matters because it’s the broadest measure of economic health.

A strong GDP growth can signal a healthy economy which is growing, which can be bullish for a currency.

A weak or falling GDP can signal trouble prompting support from the government or a central bank, which can lead to a weaker currency.

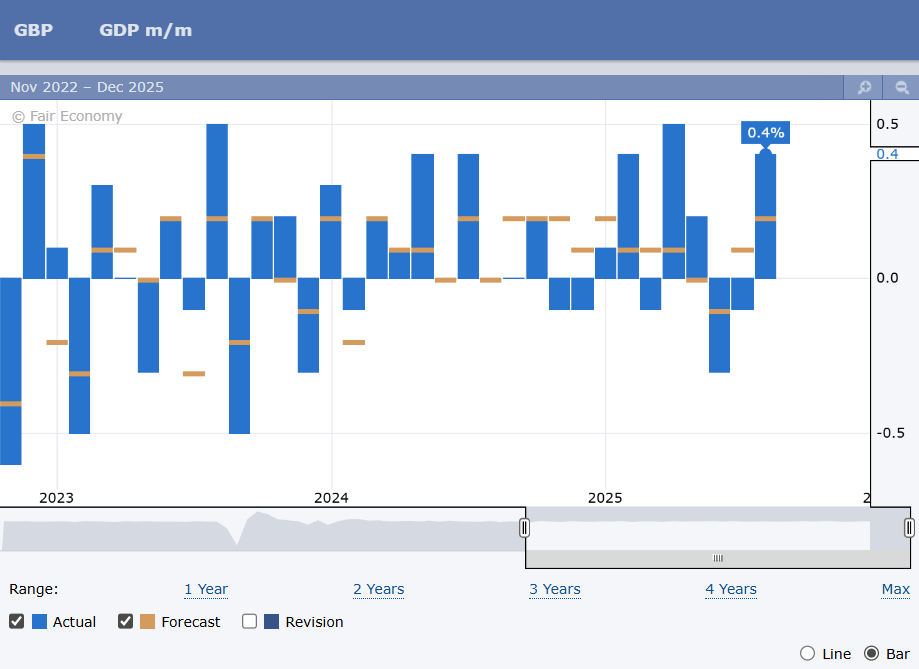

UK GDP Upcoming

The UK releases its latest GDP figures this Friday and the forecast isn’t great.

In August GDP rose to 0.4% up from the previous -0.1%, which triggered talks about the Bank of England's future rate path. This month its forecast to be weaker at 0.0%.

If this happens it could raise doubts about the UK economy's resilience, especially with inflation still running hot.

What scenarios could play out

A weaker than expected print (below 0.0%) could trigger GBP selling, as it suggests the economy is stalling while the government still faces tough fiscal challenges.The price of GBP/USD is trading up at the 1.3575 resistance, this level could hold in this scenario.

An inline or stronger print (0.1% or more) could give GBP a short-term lift, especially since hedge funds are already holding heavy short positions in the pound as seen in the Commitment of Traders report. A break of the 1.3575 level could see the price trade up to 1.3750.

GAMES

Trading Brain Training

I whisper “don’t miss it” when charts look right,

Pushing entries late into the night.

I fuel impatience, I cloud your plan—

Control me, and trade like a pro can.

What Am I?

GET TO IT

🦖 Check out these recommended trading tools.

🦖 Understand how Market Makers work.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: FOMO (Fear of Missing Out)