Good morning. Gold isn’t just a shiny metal, it’s officially a currency with the ISO code XAU. That means XAUUSD trades like a true FX pair, not just a commodity.

It moves 24/5 with the dollar and yields, just like EURUSD… only with a little more sparkle.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

The $3,500 Breakout: Gold’s Next Big Test

If you only looked at the headlines, you might think gold is stalling. But zoom out, and the picture changes, this metal just ripped through $3,500 and printed a fresh all-time high at $3,537 this week.

Traders are now debating whether it’s too late to join, or if this breakout has more room to run.

Here’s what you need to know:

1. The Fed Factor Keeps Bulls in Control

source: cmegroup/FedWatch

Markets are pricing in a September rate cut with 91.7% certainty. Lower rates mean less support for the dollar and more demand for non-yielding assets like gold.

As long as the Fed leans dovish, dips in XAU/USD will keep finding buyers.

2. Politics Add an Extra Layer of Risk

Pressure from the White House on Fed independence, plus ongoing tariff disputes headed toward the Supreme Court, has traders uneasy. Political noise rarely helps confidence, but it does keep safe-haven demand alive, and gold is reaping the benefits.

3. The Breakout Structure Is Clear

I’ve been watching that $3,300–$3,450 consolidation for months, and every time gold tapped the ceiling at $3,426 it got slapped back down. This week, that changed, the breakout was clean, and now that old wall has flipped into a strong floor.

The fresh all-time high at $3,537 tells me bulls aren’t just testing levels, they’re in control. The next hurdle sits at $3,546–$3,550, and if momentum holds, $3,600 is the obvious magnet. That’s where I expect the next real battle.

If we do pull back, I’ll be watching $3,500 and $3,426 for dip-buying. As long as we stay above the $3,360 zone, the breakout structure holds, and the bias stays higher.

4. Short-Term Risks: Overbought but Supported

Momentum indicators are stretched, hinting that gold may cool off before its next leg up. The $3,500 level is the first line of defense, followed by $3,426 from the old range top. A deeper floor sits around $3,360–$3,342 where moving averages align.

5. Three-Month Outlook: Higher Into Year-End

If the Fed cuts twice before 2026, gold has scope to test $3,700–$3,800 over the next quarter. Even if the dollar rebounds, global uncertainty and fiscal stress leave gold well supported as a hedge.

My Takeaway

Gold isn’t just a safe-haven story anymore, it’s a clean breakout backed by fundamentals, politics, and technicals.

Sure, it’s overbought in the short term, but the structure favors higher levels as long as $3,500 holds. Ignore gold here, and you’re ignoring the silent mover that’s telling the real story about confidence, risk, and the Fed’s next step.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

FOREX

Will This Forex Pair Finally Breakout?

If you’ve been watching the GBPAUD forex pair you’ll know that it’s trading in a range. But looking ahead at the fundamentals and sentiment, this pair is on my radar for a break.

AUD Side of the Story

The Aussie dollar has been caught up in a bit of back and forth. On one hand GDP is forecasted to show growth in Q2 to 0.5% vs 0.2% in Q1 which is positive. On the other hand, the RBA has already cut rates to 3.60%, with implied rates showing a decline to 3.30% by November.

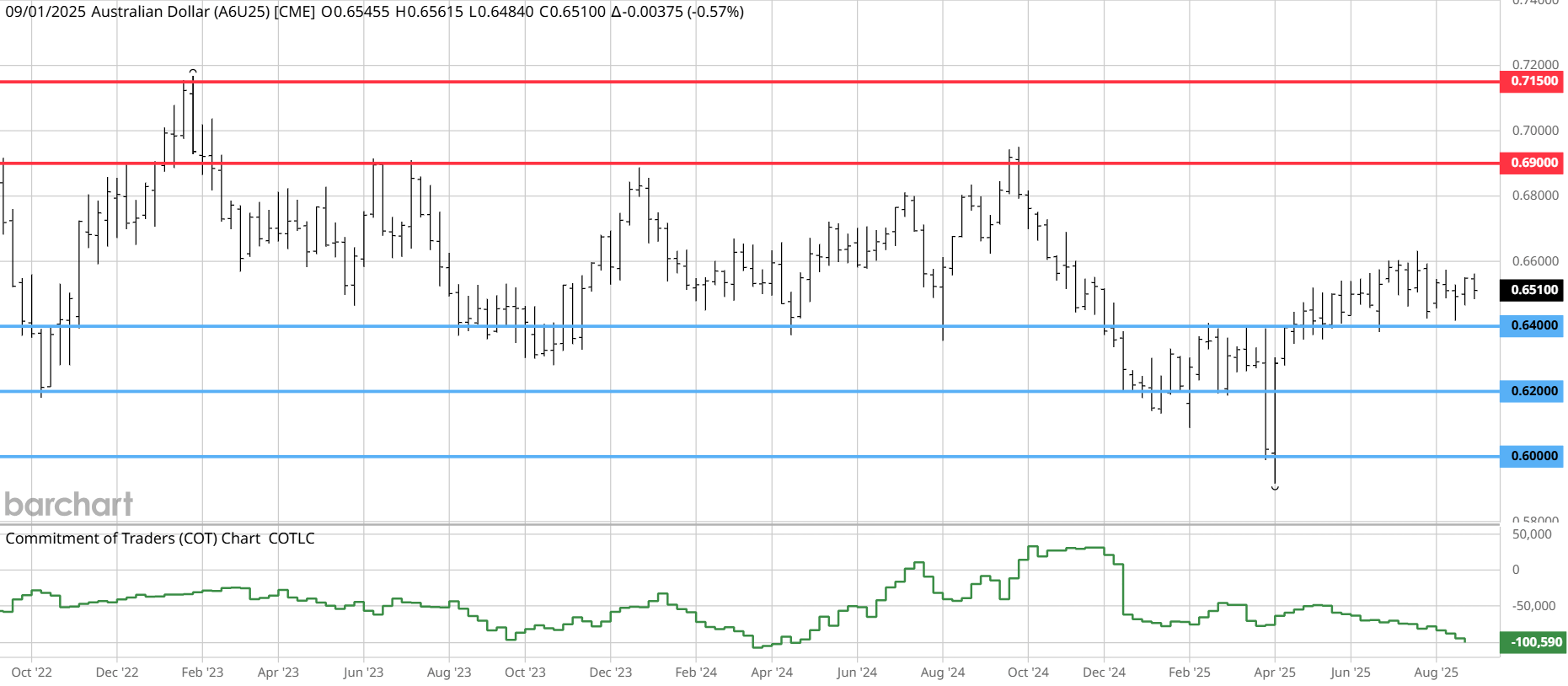

But that being said, sentiment analysis shows something interesting. The Commitment of Traders reports show non-commercials are holding extreme short positions in AUD futures. This overcrowding or extreme positioning can often see sharp reversals. Upside surprises in data could be a catalyst for a strong AUD.

GBP’s Turn

The GBPUSD price fell sharply after UK bond markets ripped higher. The 30-year gilt yields hit its highest level since 1998. Normally, higher yields would support a currency, but in this case it’s all about fiscal stress, not optimism.

Investors are uncertain about the latest plans to raise tax or cut spending by the UK government and are voicing their concerns by sending yields higher.

Uncertainty = Weakness and this could be the path for the GBP in the coming weeks.

Breakout Opportunity?

The price of GBPAUD is in a trading range, and this may remain in the near term. But there are two scenarios I am watching.

Breakout: If the price breaks through the range lows, then I will be looking for a retest and to short lower in line with the fundamental and sentiment view.

Short from range highs: If the price however remains within the range, then I favour shorts instead of longs. So a rejection of the resistance highs would be ideal for a short for me.

Traders, this is one I am keeping an eye on this one once again, will the breakout happen this time?

GAMES

Trading Brain Training

I’m borrowed to trade, but I’m not a loan.

Used with care, or accounts get blown.

I amplify gains, but losses too—

Handle me wrong, I’ll ruin you.

What Am I?

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Get funded as a trader with up to $4,000,000.

🦖 Check out these recommended trading tools.

🦖 Understand how Market Makers work.

ANSWER

Answer: Leverage