Good morning. In 1987, after the infamous Black Monday crash, global exchanges introduced circuit breakers, automatic trading halts designed to prevent panic selling.

Because sometimes, the market needs a literal timeout.

-Jonathan Kibbler, Shaun A, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

The Currency Strength Flip You Can’t Ignore

I can always tell that the market has been volatile because the currency strength meter numbers flip dramatically.

On Friday just gone the VIX spiked its head above 20 for the first time since June, all down to the poor NFP numbers. In particular the revised figures which saw the 3 month average plunge to just 36k.

The market didn’t see it coming.

The VIX rallied, Stocks plunged and the USD nosedived.

But that’s in the past.

What now?

More Data?

This week we see the release of the ISM Services PMI as well as the Unemployment claims out of the U.S. Both data points are now becoming very important.

The ISM Services PMI is one of those reports you can’t ignore. If it’s above 50, it means the services sector (the backbone of the U.S. economy) is growing. Drop below 50, and we’re talking contraction. This survey taps into around 300 purchasing managers who have their finger on the pulse of business conditions like hiring, new orders, and prices. These people can’t afford to be wrong; their jobs depend on reading the economy right. If this number disappoints, it could be bad news for stocks and hit the U.S. dollar hard.

Unemployment claims could also add further pressure considering the market's sensitivity around the latest revised figures from the Non-Farm Payroll report.

It’s all about the cuts

Jerome Powell last week told the market that a cut would have been too soon considering the sticky levels of inflation. Two members of the Federal Reserve dissented wanting cuts to come. Since that meeting the jobs numbers through a spanner in the works.

Now the market is pricing in cuts again for September.

Let’s highlight some numbers and put them into context. Before the NFP data the market probability of a rate cut by the Federal Reserve in the September meeting stood at 63.1%. After, well it rose to 96.1%.

The market believes this data will push the Federal Reserve into cutting interest rates in the September 17th meeting.

Now we have lots more data between now and then including another NFP, so this ‘flippin’ back and forth could become a new norm in the short term.

Cutting rates could be bearish USD and positive for stocks, so the rebound we are seeing today makes sense.

Currency Strength Meter Out of Whack

When dealing with high volatility markets, the currency strength meter can become a little skewed. Let’s have a look at the latest figures:

As we can see the USD moved from -1 to +7 because many of the majors made new highs or new lows in favour of the greenback.

The EURO and CHF seem to have come off the worst with both currencies falling.

The JPY however seems to be the big winner swinging from -5 to +5 in just one week, showing that it gained strength.

This was all down to the swings in volatility.

However, I still feel that this can be valuable. It shows that in the short term it may be ok to follow the strong vs weak. But we should also do this with caution. Reduce risk perhaps or trade on a lower time frame.

One consistent throughout this though is the GBP weakness. Now moving down to -5 the GBP is the weakest currency and it’s being backed up by the data. The Bank of England is forecast to lower rates on Thursday 7th August which could fuel further selling for now.

Keep in mind

Volatility swinging could be normal considering we are in the summer months of trading where moves can be notorious. Remember that when the VIX spikes it could lead to some interesting opportunities. GBP weakness seems to be the only stable of the currency strength meter and has a fundamental driver behind it.

Stay safe out there traders!

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

TRADING INSIGHTS

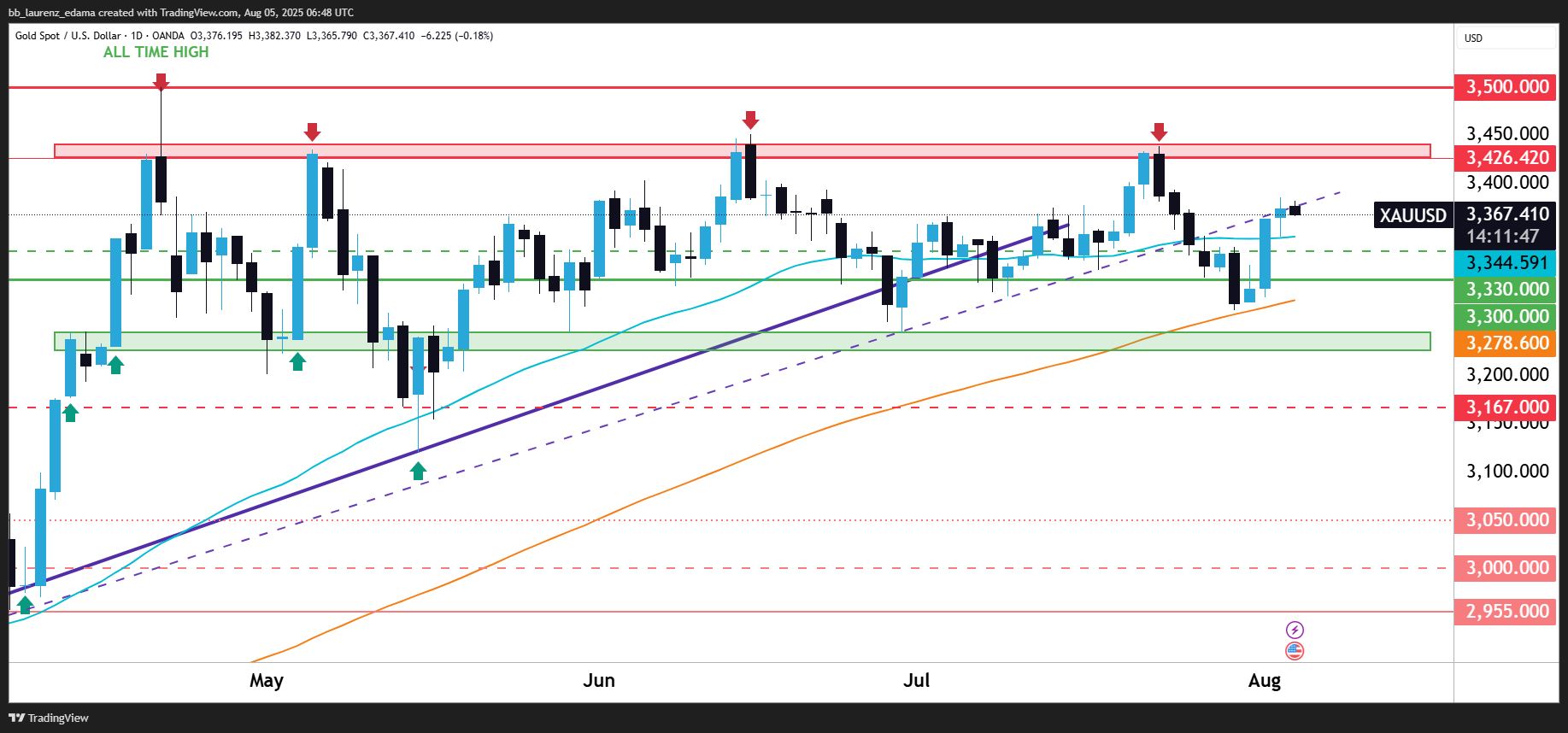

Will $3,370 Hold for Gold or Break Higher?

Gold is taking a breather after testing a near two-week high. While Friday’s weaker NFP report sparked a fresh wave of rate cut bets for September, the yellow metal hasn’t pushed higher just yet. That’s partly due to modest USD strength and a risk-on mood that’s keeping a lid on bullish momentum. But don’t count gold out. With tariffs heating up and Fed expectations rising, any dip could be seen as a buying opportunity.

Here’s what you need to know and why it matters.

1. Gold Finds Support After Weak NFP

Gold bulls got a shot of momentum after U.S. jobs data missed the mark. July’s NFP report pointed to a cooling labor market, reinforcing expectations that the Fed will cut rates in September. This sent U.S. Treasury yields lower and gave gold a lift above $3,380 on Monday, though buyers have since stepped back.

The yellow metal now trades near $3,370, with the $3,385 swing high acting as short-term resistance. Despite the pause, the fundamental backdrop remains supportive.

2. Trump Tariffs Keep Safe-Haven Demand Alive

Last week, President Trump signed an executive order imposing sweeping tariffs on dozens of countries, set to take effect August 7. The uncertainty around global trade, especially U.S.-China talks, continues to underpin demand for safe-haven assets like gold.

With U.S. Treasury Secretary Scott Bessent noting that any extension of the tariff truce with China is still undecided, traders remain on edge. The geopolitical risk is another layer of support for gold amid broader market noise.

3. Fed Cut Odds Climb Above 90%

According to the CME FedWatch Tool, markets are now pricing in over a 90% chance of a 25-basis-point rate cut in September. Combine that with recent weak factory orders data (-4.8% in June), and the case for easing grows stronger.

Rate cuts typically weigh on the dollar and support gold. But for now, the dollar has stabilized after slipping post-NFP, creating a short-term tug-of-war.

4. Technical Setup Favors Dip Buying

Gold remains in bullish territory after bouncing off the 200-day SMA and reclaiming trendline support. The $3,344–$3,330 zone held firm, making it the key dip-buying area. Price is hovering near the $3,366 pivot, a hold above could drive a push toward $3,385 and $3,426.

If bulls lose grip, watch the $3,300–$3,278 zone for renewed demand. As long as support holds, the bias leans toward buying dips, with the all-time high near $3,500 still in sight.

Here’s the Takeaway:

Gold is holding steady below its recent highs, caught between rate cut optimism and modest dollar strength. With geopolitical tensions rising and the Fed likely to cut in September, the dips are increasingly looking like buying opportunities, not breakdowns.

GAMES

Trading Brain Training

I’m not a trader, but I never sleep,

Across all time zones, my rhythm runs deep.

News, charts, and leverage too—

24/5, I challenge you.

What Am I?

GET TO IT

🦖 Understand how Market Makers work.

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Forex Market