Good morning. On January 21, 1980, gold hit $850/oz, a price so extreme for its time that, adjusted for inflation, it remains one of the metal’s most explosive rallies ever.

It was fueled by runaway inflation, geopolitical tension, and pure panic buying, proving that gold’s biggest moves often happen when the world feels most unstable.

-Jonathan Kibbler, Shaun A, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

GOLD CHART BREAKDOWN OF THE DAY

Gold is showing signs of life again after last week’s flush, but the market hasn’t fully flipped bullish yet. Price is trying to build a base around the $4,080–$4,090 zone, which is exactly where the 15-min and 1-hour charts keep reacting.

FOREX

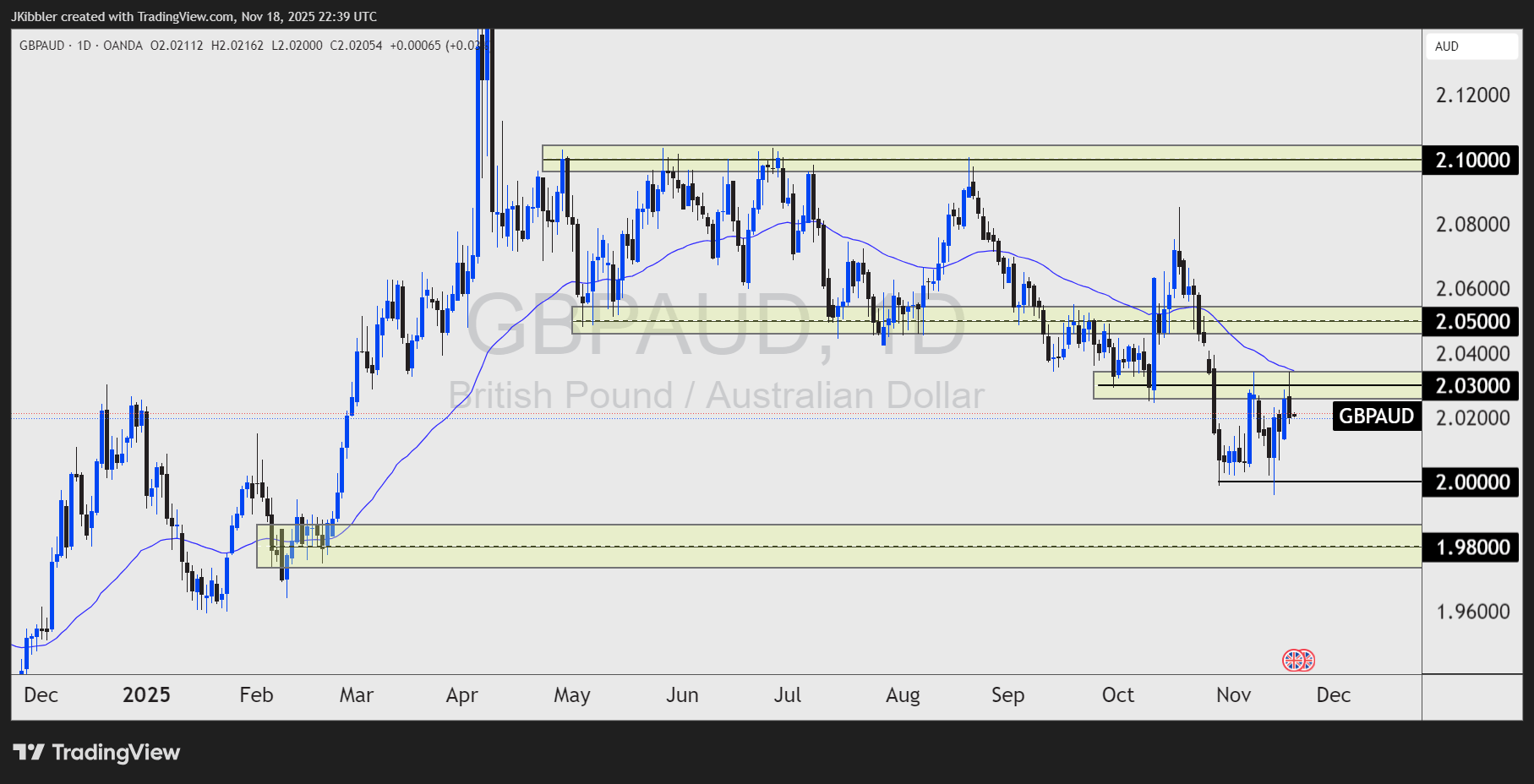

Why I Am Still Short GBP/AUD

The Australian dollar has been quietly building strength, and this week’s price action plus central bank messaging gives us a clearer direction. If you’ve been waiting for AUD to show its hand, this might be the moment.

Let’s break down what’s driving the aussie… and where the best opportunities may sit.

Why AUD Strength Is Back on the Table

The Reserve Bank of Australia’s latest communications lean hawkish, and that’s the big story behind the aussie stabilising and starting to push higher.

Here’s the key points:

The RBA held rates at 3.60%, but made it crystal clear inflation is still a problem.

Core inflation in Q3 came in materially hotter than expected.

Housing costs, services inflation, and private demand are all picking back up.

The Bank even labelled monetary policy as only “a little restrictive” central bank code for: “We’re not cutting anytime soon.”

Markets agree. Rate-cut odds for December have collapsed to under 5%, meaning traders now think the RBA has finished easing.

Where This Really Gets Interesting: GBPAUD Shorts

If you’re looking for a directional play, GBPAUD is ticking the boxes for me.

AUD is getting stronger and GBP is getting weaker.

The GBP is struggling to gain any traction as markets are now pricing a 78% chance of a December rate cut from the Bank of England.

Weak growth, rising unemployment and sticky inflation is making the GBP unattractive to investors.

GBP/AUD Technicals

The price is below the 50 day moving average.

A rejection of the current levels could see the price move back to the lows of 2.000. A break of this level will see the price trade towards 1.9800.

This will be invalidated if the price forms new highs above 2.0300.

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

TRADER INSIGHTS

The Setup on Gold Is Too Clean to Ignore

Gold has been moving in a way that almost feels like it’s hinting at something. You know that moment when a chart looks too clean, too respected, too well-behaved and you feel the market is gearing up for a bigger move? That’s exactly where XAU/USD is sitting right now.

We bounced off the $4,000 area almost perfectly, buyers stepped in where they should have stepped in, and now the market is just waiting for one thing: the FOMC minutes

No hype, no guessing. Just reading the flow.

Here’s What You Need to Know:

1. Risk Sentiment Is Fragile and Gold Feeds on That

The overnight slump in U.S. equities reminded traders that the economy isn’t as stable as the headlines suggest. That weakness has kept the dollar soft during Asian hours, helping gold hold above the $4,070 area. Add ongoing geopolitical risks, and safe-haven demand quietly supports the metal underneath.

2. But Reduced Fed Rate-Cut Bets Are Capping the Upside

The Fed isn’t as dovish as the market hoped. Several officials are signaling, “Don’t expect too much easing yet.” That’s keeping the dollar from fully breaking down and it’s the main reason gold hasn’t exploded higher. The market wants more clarity before committing.

3. Traders Are Waiting for FOMC Minutes and NFP

This is the real driver. Us gold traders aren’t confused, we are patient. With the delayed NFP report coming Thursday and the FOMC minutes dropping today, nobody wants to get caught on the wrong side.

The next leg on gold will be based on tone: if the Fed sounds cautious, gold lifts. If they sound confident, the upside slows.

4. The Technical Setup Is Too Clean

Gold respected the 200 MA on the H4 almost perfectly and that’s rare in a market this emotional.

– Immediate support sits at $4,037–$4,036 and the 4-hour 200 MA ($4,000) – A break under $4,000 opens the door to $3,931, $3,900 and $3,886 – Resistance sits at $4,100, and a clean break could squeeze shorts toward $4,152–$4,155, then $4,200

This is why the setup feels “too clean to ignore” because both bulls and bears are defending their zones perfectly.

My Takeaway

Gold isn’t running away yet, but it’s winding up. This is the kind of structure that gives you confidence after the catalyst, not before.

The levels are clear. The reaction zones are obvious. And the timing lines up with major Fed releases.

My advice today: Let’s trade reaction, not prediction.

Let the minutes drop. Let the market choose its direction. Then ride the clean side of the move.

DAILY TRADING PSYCHOLOGY NUGGET

“Trade what you see, not what you hope for.” Hope is comforting, but it has no place in execution. The moment you wait for the market to ‘prove you right,’ you’ve already surrendered control. Stick to the chart, follow the evidence, and let the setup not emotion, decide your next move.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 19, 2025)

credits: REUTERS/Jeenah Moon

Global markets are drifting in a cautious holding pattern as investors await Nvidia’s earnings and pore over a flood of upcoming data, especially UK inflation, euro-zone figures and Federal Reserve meeting minutes. Risk assets remain muted, with a slide in AI & tech momentum and the dollar holding firm at multi-month highs. (source:reuters)

GAMES

Trading Brain Training

“I’m watched by every trader,

Yet no one can agree where I ‘should’ be.

Too high and risk assets choke,

Too low and bubbles grow.

I’m just one number, but I move the world.

What am I?”

GET TO IT

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Understand how Market Makers work

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: The interest rate