Good morning. The Nonfarm Payrolls (NFP) report tracks employment across about 80% of the U.S. economy, but it doesn’t include farmers, military personnel, or household workers.

So despite the name, it’s really measuring most of the workforce, just not the ones who grow your food, fight your wars, or clean your house.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

This Is the First Real Crack in the U.S. Labor Story

The market finally got a glimpse of weakness in the U.S. labor market and it didn’t need the official NFP report to see it.

With government data on pause during the shutdown, many turned to private surveys and corporate layoff announcements to read the trend. What came through is subtle but meaningful: hiring is slowing, job cuts are rising, and businesses are tightening costs.

The dollar is easing, not because confidence collapsed, but because the story just shifted.

Let’s keep it simple and look at what matters.

Here’s What You Need to Know:

1. Dollar Pulls Back as Labor Weakness Shows

The dollar index slid toward 99.80, reversing recent gains. This isn’t a panic move, it’s the market adjusting to new information. When job data softens, rate expectations soften with it, and the dollar responds.

2. Layoffs Are Picking Up and Not Just Seasonal

Private data showed job losses in government and retail sectors, alongside a surge in announced layoffs driven by cost-cutting and automation. The trend here is the key: companies aren’t preparing for expansion, they’re preparing for efficiency.

3. Markets Are Pricing in a December Rate Cut

The probability of a Fed rate cut at the December 10 meeting climbed to 68% from 62% just yesterday. Even Fed officials are sounding cautious. When policymakers start using words like “slow down” and “careful,” the market listens.

4. Major FX Pairs Are Quiet Waiting for Confirmation

USD/JPY still holds near 154.

AUD, NZD, EUR are barely moving.

GBP is steady after the BoE hold.

This is not a volatility day, it’s a positioning day.

My Takeaway

This is the first meaningful signal that the U.S. labor market may be shifting and the market is responding responsibly, not emotionally.

We don’t chase this move. We observe it.

If labor softness continues, the dollar trend could change more noticeably.

But until we get official NFP data, the market trades in shadows and tone.

Today, our job is simple:

Watch. Listen. and don’t force early entries.

The real trade sets up after confirmation, not during the first crack.

As always patience remains the edge.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to find the coverage you actually need.

FOREX

Trade Recap. 150+ Pips Banked.

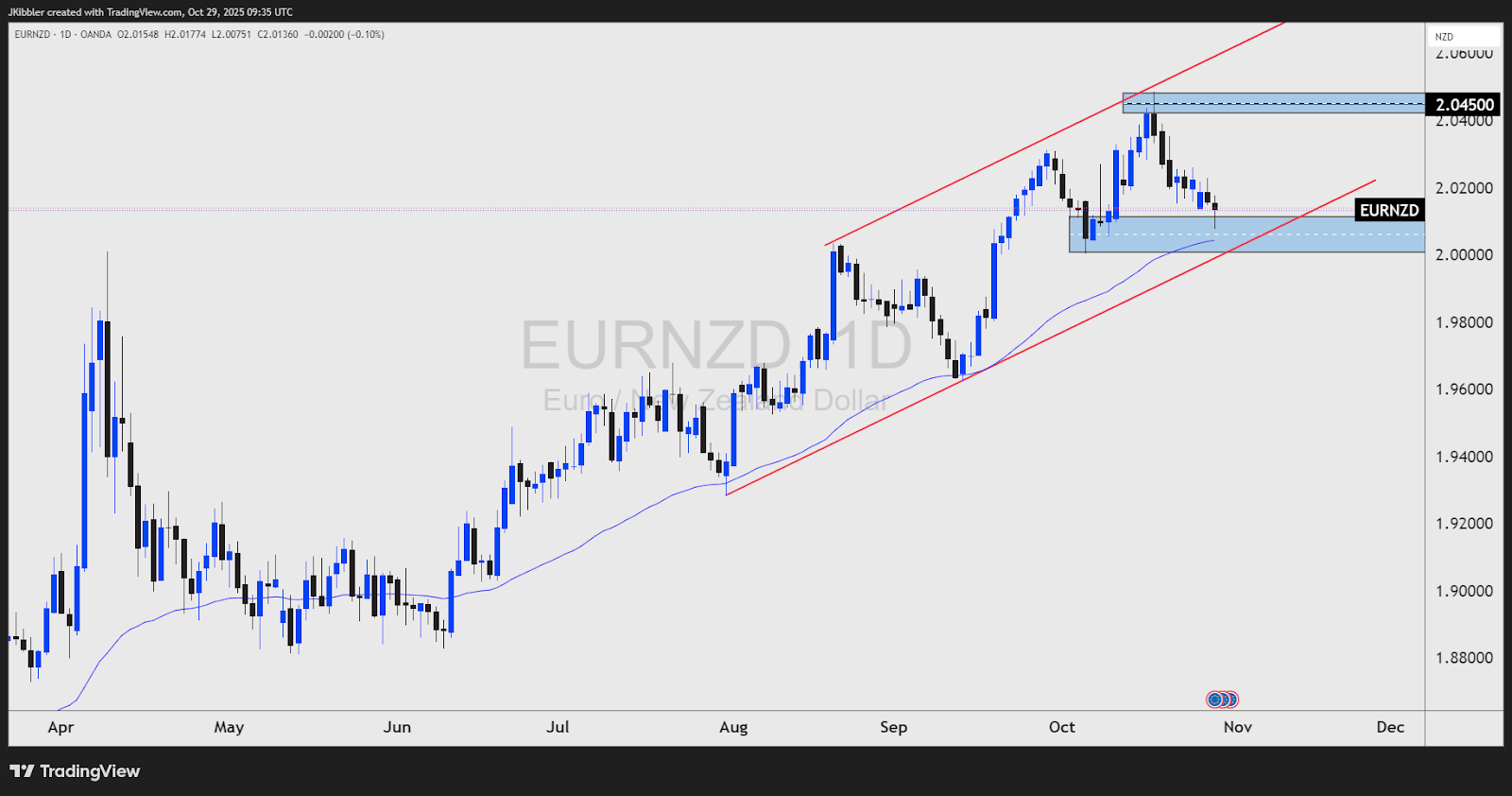

On October 29th I discussed my trading plan for EUR/NZD long.

Using my W.C.S method I identified why the trend could continue, the conditions around the market and the strategy I would use to enter.

I had to wait a while to implement the strategy. But yesterday I had a signal.

Over the course of the past couple of days, price moved in line with expectations and hit target.

Let’s recap what the trade was, and how it played out.

First, Why?

There were a few reasons why I saw this market continuing higher. They included:

The currency strength meter showed EURO as strong and NZD as weak.

ECB policy is steady, and NZD unemployment has been rising, causing the RNZ to look to cut rates.

The interest rate differentials showed EU02Y - NZ02Y in an upward trend.

Next, Conditions

This was the EUR/NZD chart we showed in the previous newsletter. We saw that the price was in a strong upward trend and testing supporting lows. The price was also above the daily 50 moving average.

One of my swing trading strategies includes a moving average crossover and retest combined with an oversold stochastic.

Yes, it’s that simple.

Once the 1HR chart showed the change in trend and the moving averages crossed, I watched this chart every day.

When the market tested the moving averages with the stochastic in oversold conditions, all I had to do was wait for a close back above the 50MA.

This occurred, and I entered the market.

I placed my stop loss below the 200MA and set my target at 2.0450 the middle of the previous daily swing high, which netted over 150 pips in profit.

Stick to your plan

I am showing you this because it shows that a plan was made and followed through.

It can be so easy to get distracted and miss opportunities like this.

It’s why I built my method. To help me identify the trending markets.

I am also in a CHF/JPY short, so we will see how that one plays out.

CHART BREAKDOWN OF THE DAY (XAU/USD)

Gold is trading near $3,994, moving sideways after pulling back from the $4,380 peak. Price is still holding above the $3,925 support zone, but upside remains capped near $4,135. A break below $3,925 opens the door toward $3,635, while a reclaim above $4,135 would signal recovery.

DAILY TRADING PSYCHOLOGY NUGGET

“Your first loss is your best loss.” Closing a losing trade early protects your capital and your clarity. Holding on out of hope only makes the damage harder to repair. In trading, small controlled losses are a sign of discipline, not defeat.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 07, 2025)

credits: REUTERS/Nelson Bocanegra

Oil prices hit their second straight weekly loss as rising global supply and fading demand in the U.S. weighed heavily on the market. A larger-than-expected U.S. crude inventory build added to the pressure, while a firm dollar and fears of a sluggish economy dampened energy sentiment. (source:reuters)

GAMES

Trading Brain Training

I don’t predict, I confirm the play,

I swell when trends decide to stay.

Rallies love me, crashes too

I show the strength behind the move.

What Am I?

GET TO IT

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

ANSWER

Answer: Trading Volume